The banking industry ended 2016 on a high note, but in a way that creates more uncertainty about the state of consolidation.

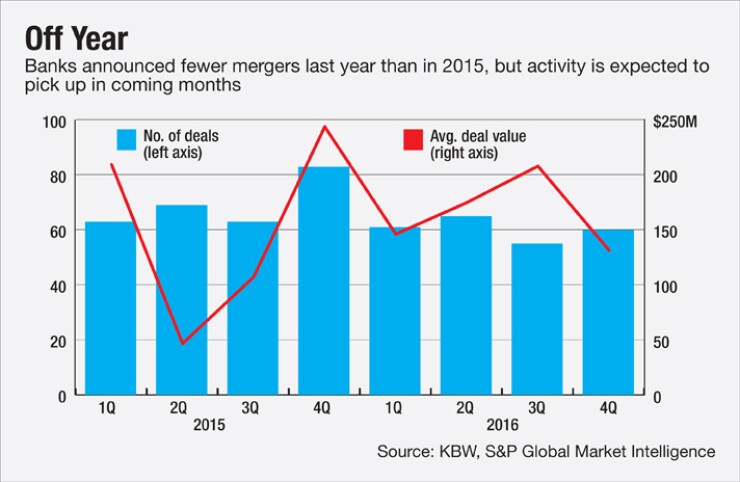

Overall activity was off for much of last year as the presidential election and low energy prices created reasons to take pause. The number of mergers fell 13% from a year earlier, with 241 bank deals announced, according to Keefe, Bruyette & Woods and S&P Global Market Intelligence.

There were some positive signs in the second half of the year. Average deal values rose 9%, largely due to several big mergers announced in the third quarter. A recent surge in bank stocks, fueled in part by expectations of relaxed regulation and more interest rate increases, spurred a number of historical acquirers

Still, there are plenty of questions entering 2017. Will optimism get more aspiring buyers off the sidelines, or will it encourage more banks to remain independent, at least in the short term? What will pricing look like? How will concerns about asset concentrations and bubbles, such as commercial real estate, influence consolidation?

American Banker recently posed those questions to three dealmakers: Charles Crowley, a managing director at Boenning & Scattergood; Matt Veneri, co-head of investment banking at FIG Partners; and Rory McKinney, D.A. Davidson's head of investment banking.

The following is an edited transcript of their responses.

What are your expectations for bank M&A this year?

CHARLES CROWLEY: In recent years, it seems that about 4% of the existing charters are going away through mergers. That's probably a reasonable estimate for 2017. Some deals in 2016 were

MATT VENERI: Activity should increase modestly. With the rise in valuations for most publicly traded banks since the Trump rally, transaction pricing will increase going forward. Higher stock prices will lead to more banks considering a sale. Over the past month, bankers who were earlier considering M&A have been talking to us about potential deals in 2017.

RORY MCKINNEY: We anticipate a pick-up in activity as the momentum and optimism in late 2016 carries into the new year. As we've seen in recent deals, the post-election run-up in bank stocks has given public acquirers strong currencies to aid in strategic M&A. While we expect more banks will be inclined to sell as a result of higher takeout values, some banks may decide to take a wait-and-see approach given the expectations of a more favorable operating environment and higher trading valuations. There are a lot of banks at or near 52-week highs.

The number of deals was off in 2016. Why was that?

CROWLEY: At the start of the year, bank stocks were down, and that probably slowed down some discussions and momentum. When the year-to-date pricing medians were down compared to the previous year, it made some potential sellers less likely to pursue discussions. Also, a number of previously active buyers were digesting the most recent crop of deals, so they were out of the market for a while.

VENERI: The regulatory approval process slowed the pace of deals. It simply took longer in many cases for buyers to get deals approved. The regulatory focus on [commercial real estate] concentrations also impacted the decision-making ability of bank management. Many companies began to focus on the pro forma make-up of their balance sheet in the face of heightened regulatory scrutiny.

MCKINNEY: Periodic market turbulence in 2016 — China, energy, [Federal Reserve] monetary policy and the presidential election all contributed to volatility in bank stocks during the year. That resulted in buyers being less inclined to use their currency and sellers being less inclined to take it, especially if they thought that the headline deal value at announcement was too low.

What role could CRE concerns play?

CROWLEY: Buyers will have to be careful conducting diligence to make sure that they're not taking on problems. Some banks may have been stretching a bit on credit quality or interest rate risk, and that could come back to bite them in an M&A context or as an independent.

Some smaller community banks have not necessarily been able to strongly compete in [commercial-and-industrial] or consumer lending. To the extent that they might be overly concentrated in CRE and getting some regulatory pressure about it, those banks may just decide to sell to another bank as opposed to raising capital or changing their business plan.

VENERI: Acquirers were more focused on the resulting CRE concentration levels than in the past. That concern may have impacted some transactions, but with the expansion of the bank subordinated debt market and other capital alternatives, I don't think it stopped a deal from happening when both sides wanted it done. If anything, the focus on CRE has fostered M&A for banks that don't want to dilute existing ownership through a capital raise to address concentration issues.

MCKINNEY: It is a factor acquirers are considering as they look to buy, especially in CRE-centric markets that we have here along the West Coast. In most situations, given relatively high capital levels, pro forma CRE concentrations aren't going to break a deal. But there are situations where a transaction simply won't be pursued because of it.

Banks faced with CRE concentrations could opt to sell as their organic growth prospects are limited by concentration concerns. On the buy-side, acquirers that already have high CRE concentrations could be forced out of deals if the seller's CRE concentration is too high or [they might] back away given regulatory concerns.

Do you expect more consolidation in specific geographic regions?

VENERI: The Southeast will see an increase in activity as concerns about asset quality move further in the rearview mirror. Additionally, the increase in bank valuations has helped banks in the Southeast more than most other geographies. We have already seen a significant increase in Florida and Georgia, states that were hit the hardest during the credit crisis. The mid-Atlantic will remain strong in markets around New York, Philadelphia and Washington. Texas should be more active as energy prices continue to stabilize.

MCKINNEY: The Western U.S. was active in 2016 and we expect that momentum will carry into 2017. We feel activity in the larger Western metro markets will outpace smaller rural markets as they gain interest from a broader buyer universe. We also believe M&A activity in the Midwest will remain robust given the significant number of banks in the region.

CROWLEY: Not necessarily. The motivations for prospective buyers and sellers will be pretty much the same across geographic boundaries. Of course the number of banks in a state and a region will have an impact. We would certainly expect to see more M&A activity in Illinois than in Arizona, simply because of the number of banks in the respective states.

Since the presidential election, people have been talking about tax reform and scaled-back regulation. Will those encourage or inhibit M&A?

CROWLEY: Some sellers in recent years have opted to go that route because they felt that the regulatory deck was stacked against them, and that the cost and burden of regulation were falling disproportionately on the community banks, as well as the money center banks. If some of those community banks have a new sense of optimism in the boardroom, they may elect to stay independent and grow.

From a tax standpoint, this tends to be an industry with a fairly high effective tax rate. If corporate tax rates were reduced, we would see an increase in earnings, and we have already seen a sharp increase in stock prices. Depending on the viewpoint of CEOs and directors from bank to bank, that could lead to differing views on whether to participate as a buyer or seller in M&A transactions.

VENERI: A relaxed regulatory environment, if it comes to pass, most definitely will stimulate M&A. The regulatory approval process became extended during the credit crisis. Buyers were limited in the number or size of targets. The $10 billion threshold also gave some buyers pause as they approached that level. I see the easing of regulations related to the M&A approval process, capital requirements and concentration limits as the one area that could have a significantly positive impact on deal activity. For its part, tax reform will help drive up valuations, making it easier for acquirers to do deals. However, it is all relative because tax reform will also drive up the value of the target institutions as well.

MCKINNEY: In general, the outlook for lower taxes, a steeper yield curve, and less regulation is driving the increase in bank stocks. In turn, the greater a buyer's ability to pay means stronger takeout pricing which should drive more M&A. While stronger earnings and a more positive outlook may entice some potential sellers to stay independent, it's not like the regulatory burdens facing community banks are going to evaporate or [net interest margins] are going to rise dramatically in [the first half of 2017]. While we don't believe tax reform and potential regulatory easing will open the flood gates for M&A, the increased optimism and potential bottom-line improvement should at least provide a boost to deal activity.

What does the recent run-up in stock prices mean for capital raising and M&A?

CROWLEY: From a capital raising standpoint, even banks that don't need capital are taking advantage of the opportunity to do so. For large banks with liquid stocks, it is relatively easy to do so at a slight discount from current market values. Some community banks that may not have had the opportunity to raise capital are also considering it, and we have seen that there is investor appetite, even for relatively small banks.

On the M&A front, there has always been a correlation between the valuation level of bank stocks and prices. To the extent that buyers want to use their newfound purchasing power, it should mean an increase in price to tangible book and [price-to-earnings] levels in bank deals, which would generally bring more potential sellers into the arena, assuming that these bank stocks hold up at current levels. Of course, a prospective seller has to be careful about the stock it chooses to swap into, as the value at day one may not be the value at closing.

VENERI: Since mid-November, banks have been more active in the capital markets for common equity [compared to] the previous 10 months. This surge has spurred many more M&A conversations. Deals that had been put on the backburner have resurfaced. Many banks have become much more proactive taking advantage of the increase in their stock prices. This trend should continue and drive activity in the first and second quarter. If the new administration makes good on its pre-election promises, this upward trend in bank stocks should continue throughout the rest of the year.

MCKINNEY: With the run up in bank stock prices we expect more public banks will see this as the right time to tap the markets and raise additional capital. It also means that banks that have contemplated [initial public offerings] will be more inclined to pursue them. As most banks are well capitalized we expect the proceeds will be used to support new organic growth opportunities or growth through M&A.

Many bank have raised capital. What effect will that have on M&A?

CROWLEY: One of the things that can hold back bank buyers from time to time is a concern about their pro forma capital levels. Most banks do not — and should not — building a war chest of capital in anticipation of deals that may never materialize. Nevertheless, to the extent that they are more confident in their ability to get capital, it can lower the inhibition to stretch their pro forma ratios a bit.

On the other hand, some smaller banks believe that they have to grow in order to deliver solid returns to shareholders and justify continued independence. To the extent that those banks are able to raise capital more easily, it may make their long-term plan extend a while longer as an independent organization.

VENERI: Recent capital raises, including our own at [FIG Partners], will definitely help. However, given that most transactions are all-stock or cash-and-stock combinations, the recent equity raises are more internally focused. Banks are taking advantage of higher valuations to reduce CRE concentrations or strengthen core capital to accelerate organic growth. For now, this is war-chest building, but over time, as a company strengthens its own balance sheet, it may then use its stock currency for M&A. Given the current pricing dynamics and investor expectations, all-cash deals are hard to pull off unless the target is small relative to the buyer or in a market that is not that competitive from a pricing perspective.

MCKINNEY: It should help drive M&A as acquirers look to put the capital to work in conjunction with their higher valuations. On the other hand, some banks that may have been considering a sale will raise less dilutive capital and see how they do in the Trump economy.

What will higher interest rates mean for deposit-rich franchises?

CROWLEY: When loan growth wasn't particularly robust for some banks and funding was cheap — both borrowings and deposits — there was probably a relative lack of appreciation for good deposit franchises. Now we are seeing some banks have had strong loan growth which has boosted their loan-to-deposit ratios considerably. Some of those banks would welcome the opportunity to acquire a bank that is more deposit-rich, even if that bank is in a relatively less demographically appealing market. Banks of all sizes will be anxious to see what shifts occur within their deposit base, from checking and money markets to CDs.

VENERI: A bank's deposit franchise is its greatest asset. As rates continue to rise, banks that have built a strong core deposit base will see their value increase. Buyers have and will continue to pay higher premiums for sticky, low-cost deposits. The price gap will likely widen between banks that have an attractive deposit base and those that don't. Banks with excess liquidity on their balance sheets, as demonstrated by low loans-to-deposits ratios, also have become attractive targets for higher growth banks that are experiencing loan growth.

MCKINNEY: In the current low rate environment the value of a strong core deposit franchise has been muted. We believe an increasing rate environment will highlight banks that have built a strong deposit base as their earnings show stronger improvement with loans repricing at a faster rate than their low cost deposits.

How could shareholder activism influence M&A?

CROWLEY: Unfortunately, shareholder activism is here to stay, and not just in the banking sector. Inevitably, some of the activist funds think that they can make a quick strike by filing a 13-D and pressuring a board into selling. Some of the banks targeted have not always had the shareholders' best interests in mind, but most have. We always tell our clients that the best defense is a good offense. Banks need to strongly encourage more insider buying so that the insiders have their interests aligned with the other shareholders. Also, bank boards need to challenge themselves and their officers to drive for stronger performance so that they are not vulnerable to attacks by those with a strictly short-term perspective.

VENERI: The impact will be modest. Privately held banks and those that do not trade on major exchanges could face pressure from activist shareholders more than larger publicly traded banks. Many banks still have institutional investors or private-equity shareholders that will be looking for a liquidity event. Depending on size, a public offering isn't always available. This will lead shareholder activists to push these banks toward a sale, particularly if pricing metrics are appealing.

MCKINNEY: We believe shareholder activism should remain on the rise in 2017. In an effort to capitalize on their investments and realize gains from the recent run-up in bank stocks, we believe activist shareholders will continue to push boards to pursue strategic alternatives. Some investors may be concerned about the longevity of the rally and the overall economic outlook should the Trump honeymoon subside so they may look to take some chips off the table.