-

The banking industry earned $35.3 billion in the third quarter, a nearly 50% increase from the same point last year and the highest level for profits since the second quarter of 2007, according to a report released Tuesday by the Federal Deposit Insurance Corp.

November 22

WASHINGTON — Banks earned a post-crisis earnings record in the third quarter, proving once again that there are profits to be made from cleaner balance sheets.

But regulators also cited signs of concern in the most recent bank industry data, warning that such earnings are unsustainable without sharper loan growth.

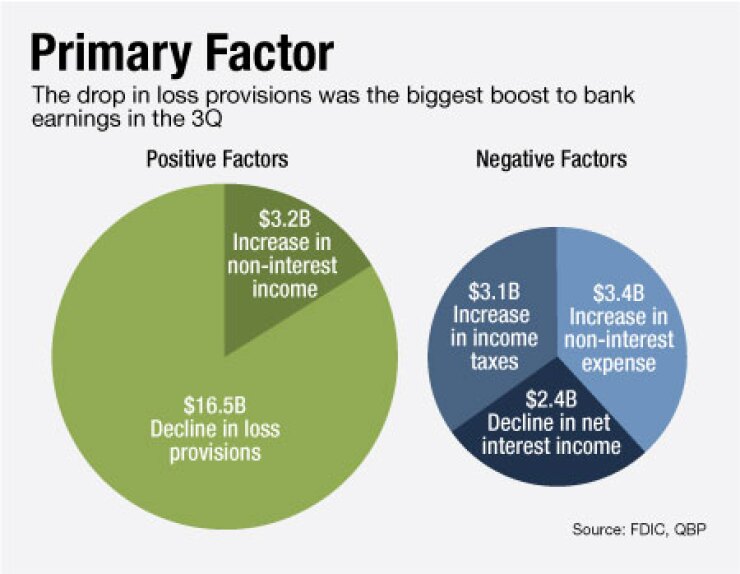

"Improvement in industry earnings has been almost entirely dependent on reduced loss provisions," acting Federal Deposit Insurance Corp. Chairman Martin Gruenberg said Tuesday. "The traditional banking business of taking deposits and making loans accounts for almost two-thirds of net operating revenue. Future revenue growth will likely depend on increased lending."

The industry earned $35.3 billion in the third quarter, a nearly 50% increase from a year earlier, but like the eight previous consecutive quarters, much of its gains were due to lower loss provisions.

In the third quarter, 63% of institutions had higher quarterly profit than a year earlier, while just over 14% reported a quarterly loss - the lowest level since early 2008.

The industry set aside $18.6 billion to cover losses. While only 2.6% less than the second-quarter, the provision was 47% less than in the third quarter of 2010 and was the lowest amount set aside since the third quarter of 2007.

Banks were also boosted by fewer problem loans. Noncurrent loans declined for the sixth straight quarter, falling 3.3% to $309.6 billion. To illustrate how far banks have come since the crisis, the list of "Problem" institutions declined by 21 to 844, and for the third straight quarter the FDIC took money away from a separate fund to pay for future failures.

"Bank balance sheets are stronger in a number of ways, and the industry is generally profitable," Gruenberg said.

But with the sluggish economy holding back credit demands, the industry's growth was modest. Although there was noticeable strength in commercial lending, banking industry assets increased during the quarter by 1.5% to $13.8 trillion, and total loans rose by just 0.3% to $7.33 trillion. (Loan growth would have essentially matched the 0.9% increase achieved in the second quarter, but the consolidation of charters at one large banking company meant loans between banks fell sharply by 25% to $109.5 billion.)

The industry enjoyed a 0.5% bump in net operating revenue — to $164.7 billion — compared with a year earlier, thanks to a $3.2 billion increase — or 5.8% — rise in noninterest income to $59.5 billion. Even though it was the first year-over-year increase in noninterest income in seven quarters, the agency said a good chunk of that was due to a few large banks booking accounting gains from debt that had declined in value. Without those gains, the FDIC said, "net operating revenue would have posted a year-over-year decline for a third consecutive quarter."

Gruenberg said the lower loss provisions and improving credit quality "are in a sense reflections of greater strength in the industry, so it's a positive development."

He added, however, that the reliance on those positive indicators for earnings growth "can't go on indefinitely." The pace of improvement in the overall economy "is probably the key issue in terms of loan growth," he said.

"After three years of shrinking loan portfolios, any loan growth is positive news for the industry and the economy, but the lending growth we see remains well below normal levels," Gruenberg said.

A bright spot for loan growth was the rise in commercial and industrial loans, which rose 3.6% during the quarter to $1.28 trillion. Yet the FDIC attributed the overall increase in assets to higher amounts in securities portfolios and trading accounts. Mortgage-backed securities increased 3.5% in the quarter to $1.6 trillion, and Treasury securities held by banks increased 6.4% to $173 billion.

Also increasing were residential mortgage loans, which rose by $23.7 billion — to $1.8 trillion, though FDIC officials said that was likely due in large part to increased refinancings and the amount of resources available through federal housing programs.

"The mortgage market is primarily a government-backed market right now," Richard Brown, the FDIC's chief economist, said in a staff briefing about the report.

Assets in other categories declined. Balances of real estate construction loans decreased for the 14th straight quarter, falling 7.4% to $254.6 billion.

Yet officials indicated the slow loan growth is more a function of problems in the broader economy than fundamentals in the banking industry, which are strong.

"These institutions are ready to lend," Brown said. "By and large," the banking industry is "one of the positives in the U.S. economic outlook."

Meanwhile, institutions continued to clean out their bad assets. Compared to the end of the second quarter, noncurrent loans were lower in every major category. Noncurrent construction loans declined 10% to $37.1 billion, and noncurrent commercial and industrial loans fell 7.6% to $19 billion. Net charge-offs of $26.7 billion — a 39% drop from a year earlier — was the lowest total since the second quarter of 2008.

The FDIC said trading revenue rose nearly 200% from a year earlier — totaling $13.2 billion — while servicing income was $4.6 billion less than in the third quarter of 2010. However, the FDIC said, both figures affecting revenue changes "were limited to a few of the largest banks."

Net interest income declined for the third straight quarter; $105 billion in total net interest income was 2.2% less than a year earlier. Yet the lower interest income stemmed from declines at large banks, as more than 60% of institutions actually had year-over-year increases in net interest income. The average net interest margin of 3.56% was 19 basis points lower than in the third quarter of 2010.

The FDIC's negative-$763 million loss provision for its Deposit Insurance Fund, as well $3.6 billion earned from deposit insurance assessments, helped boost the DIF's balance by nearly $4 billion to $7.8 billion — the fund's second straight quarterly balance in positive territory. The ratio of insurance reserves to estimated insured deposits rose 6 basis points to 0.12%.