Depending on who is asked, a sophisticated land-fraud scheme that has ensnared several Southeast banks is either a sign that loan books are finally feeling the effects of a real estate downturn or an isolated event that will have little long-term impact on the banks involved.

At the very least, the discovery of the fraud calls into question the lenders' credit oversight practices.

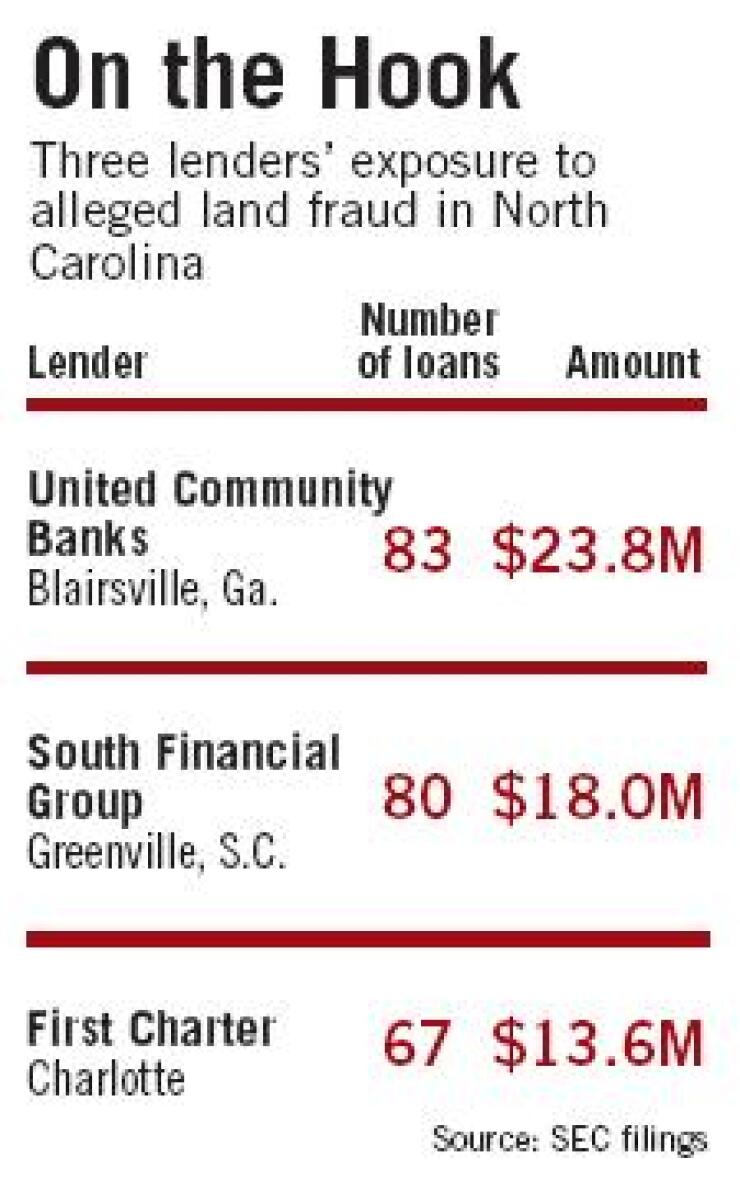

So far three banking companies - United Community Banks Inc. in Blairsville, Ga., South Financial Group Inc. in Greenville, S.C., and First Charter Corp. in Charlotte - have announced that they made 230 loans totaling $58 million to individuals buying lots on a single development in Spruce Pine, N.C.

The banks said they believe many of the loans could default, which has several analysts questioning why they would take on so much exposure to a single project.

North Carolina Attorney General Roy Cooper last week won a court order to stop work on the Spruce Pine project and another one nearby linked to the same developer, Peerless Development Group.

Mr. Cooper charged that the developers used "deceptive" practices to sell lots to individual buyers and used the proceeds to fund other projects and expensive vacations to Switzerland and the Greek islands instead of building homes on the lots as promised.

Other banks appear to be on the hook as well. The attorney general said Peerless received payments of about $100 million from individual buyers, meaning about $42 million is still not accounted for.

One company that might have exposure to the project is the $513 million-asset Mountain 1st Bank and Trust Co. in Hendersonville, N.C. Greg Gibson, its chief executive, said his team is reviewing its portfolio.

"We're working through the process of seeing what [exposure], if anything, we have," Mr. Gibson said. "We just don't know yet."

Court documents show that BB&T Corp. in Winston-Salem, N.C., is involved, but a spokesman said its exposure was immaterial and that the company does not comment on matters subject to litigation.

Peyton Green, an analyst at First Horizon National Corp.'s FTN Midwest Securities Corp., said the discovery of the fraud should be a concern for the entire banking industry.

"We've had almost zero losses associated with commercial real estate lending or real estate lending period," Mr. Green said Wednesday. "I think you're starting to see things bubble up to the surface - and the fraud stuff usually comes up first, before the real problems."

Jefferson Harralson, managing director of equity research at KBW Inc.'s Keefe, Bruyette & Woods Inc., who focuses on Southeast banks, said that the incident should be a "wake-up call" for the region's banks.

"I think you're seeing real estate pressures," he said. "You're seeing fraud occur at the end of a bull market for real estate."

So far investors seem to be taking the news in stride. South Financial's shares fell just a penny Thursday and First Charter's fell 2.6%. Shares of United Community, which revealed its exposure late Tuesday, fell about 6% Wednesday but rebounded slightly Thursday.

In an interview Tuesday, United chief executive Jimmy Tallent said that though the company is "embarrassed" by the situation, he pointed out that chargeoffs would likely amount to just a fraction of its annual earnings.

South Financial said in a news release that it expects to charge off about half of its $21 million exposure, which includes $3 million of loans on land secured by the developer made in 2001 and 2002 that it has already classified as nonperforming.

Jennifer Thompson, an analyst at Oppenheimer, lowered her earnings estimates for South Financial by 4 cents this year, to $1.27, and 5 cents next year.

"The positive thing out of all this is that it seems very much to be fraud-related and not necessarily indicative of deteriorating credit conditions in the market," she said.

But South Financial officials should review its exposure to certain developments, Ms. Thompson said.

"I think they should look into some issues like total exposure to a single project and how they could have maybe flagged this issue before it blew up," she said.

Kevin P. Fitzsimmons, managing director of equity research at Sandler O'Neill & Partners LP, agreed. "It definitely brings to light that [controls] could be improved," he said.

He said the recent troubles of Coast Financial Inc. in Florida "should have provided the catalyst to really dig deep into this stuff."

(Coast has lost more than 80% of its market value since disclosing in January that hundreds of construction loans it made were in danger of defaulting because a single developer had declared bankruptcy.)

But Lynn Harton, South Financial's chief risk and credit officer, said he does not believe there was a breakdown in internal controls.

"These projects didn't come in a flood, they came in one, two a month," he said. "It wasn't apparent from a control standpoint that they were aggregating."

Nonetheless, Mr. Harton said the company is conducting searches for loans by ZIP code to find unusual concentrations in lot loans. "We are scouring the portfolio as you can imagine just to make sure we don't have any other situations like this."

Bob James, the president and CEO at the $4.9 billion-asset First Charter, defended his company's failure to identify the problem sooner.

"None of our loans are past due," Mr. James said. "Unless you see some loans starting to go past due and they are all in the same development, I don't know that there would have been any red flags."

He said that First Charter is examining its entire lot loan portfolio for similar problems, and that it has just $80 million of lot loans in its $3.4 billion portfolio.

"We do not believe this reflects in any way upon our underlying credit quality of the rest of our portfolio," Mr. James said.