On a recent business trip through Europe, the entrepreneur David Mondrus paid his way entirely with bitcoin.

Mondrus was looking to raise money for his new venture, Trive, a startup that aims to combat fake news by empowering and incentivizing researchers all over the world to check facts. The idea is to pay them in cryptocurrency to score the "truth" of news stories, after which Trive's web browser plug-in will be able to filter out any stories falling below a certain threshold.

Armed with a prepaid Visa debit card linked to his Coinbase account, Mondrus was able to finance his trip with cryptocurrency. Whenever he made a purchase, he'd swipe his card and the requisite amount of bitcoin in his Coinbase wallet was converted into local currency at the moment of sale. As far as merchants were concerned, he was simply swiping a normal piece of plastic. The card is accepted everywhere Visa is accepted.

"It works really well: Italy, Romania, Switzerland, Germany, France," Mondrus said.

Bitcoin is borderless money, but it has suffered from a lack of merchant acceptance and consumer adoption alike. While mobile apps exist to facilitate cryptocurrency payments, they have yet to catch on with most consumers. But an increasingly popular tool, the cryptocurrency debit card, has the potential to bridge the gap between this new form of money and existing payments infrastructure, making it a breeze for average people to spend bitcoin and for businesses to serve them. It may even give banks a compelling reason one day to store digital currency for customers.

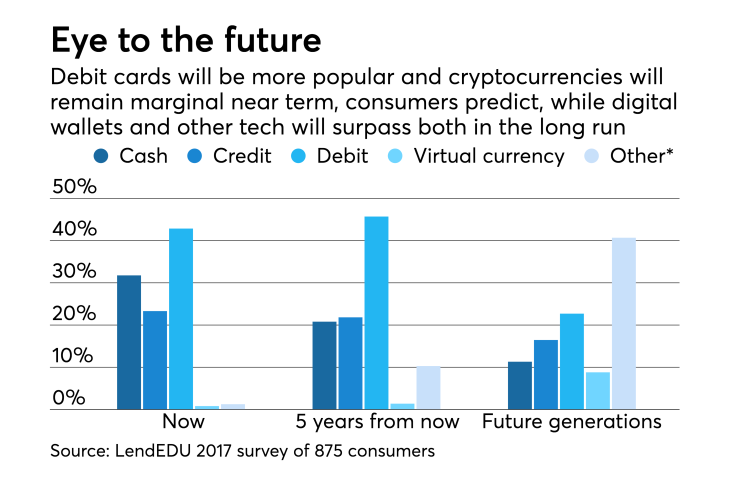

While cryptocurrency payments aren't yet mainstream, debit cards are. In a recent LendEDU poll of American consumers, nearly 43% of respondents said their primary form of payment is a debit card. Only 0.8% of respondents said the same about digital currency.

Asked to predict what their main payment method will be in five years, nearly 46% of respondents said it would be a debit card, while only 1.4% said they thought it would be something like bitcoin.

A chicken-and-egg problem

A self-proclaimed "bitcoin believer," Mondrus has converted his finances as much as possible to cryptocurrency — putting him in the extreme minority, to say the least. One of the chief benefits of doing so, in his view, is the ability to escape the progressive devaluation of fiat currency such as the U.S. dollar.

"I ask people, 'Do you think the government will ever stop printing money?' The answer is no," he said. "How much would a millionaire pay to protect his assets from devaluation? I'd say it's a lot. So the value of bitcoin will continue to skyrocket."

Why, then, haven't American merchants and consumers caught on?

The main reason is that "most of them don't know much, or anything, about cryptocurrencies or the potential benefits they could have," said Ryan Taylor, CEO of the team behind Dash, a newer digital coin that has gained tremendously in value this year. "The industry has a great deal of education to do."

Fundamentally, it's a chicken-and-egg problem. Merchants don't want to support a payment method that most of their customers aren't going to use.

Even Mondrus stopped accepting bitcoin payments at his sideline business, an online specialty jewelry store. He ships internationally, so bitcoin seemed an ideal payment method at first, he says. He was paying between $1,000 and $1,200 a month in merchant fees, and bitcoin transactions involve no merchant fees at all—a clear benefit. But none of his customers ever paid him in cryptocurrency, and it wasn't worth keeping his system updated to accept it.

Prepaid debit cards could be the key to unlocking mass consumer adoption of cryptocurrency. If people can spend their bitcoin—or Dash or ether—using a familiar piece of plastic, then this new form of money might not seem so weird or scary after all.

"It's exactly the same as a normal debit card," Mondrus said of his card, which was created by the payments company Shift. "I have a debit card connected to my bank account and a debit card connected to my Coinbase account. I use them interchangeably."

Moving money

Bitcoin debit cards have been around for years, at least in theory. Xapo

But it is the explosion of interest in bitcoin and other digital assets this year, and the concomitant multiplying of their market value, that makes cryptocurrency debit cards newly attractive. For one thing, a lot of people who have seen their cryptocurrency holdings appreciate are now looking for a way to spend their digital money.

The combination of cryptocurrency and prepaid plastic can do things that a normal debit card can't, says Taylor. Let's say that a business needs to pay an overseas contractor or employee—an increasingly common scenario in our wired world. International wire transfers are expensive, time-consuming and unreliable.

"It's crazy how difficult it can be to make international payments," Taylor said. "About two in 10 [wire transfers] that we send out get lost in the Swift system."

A better option might be to mail the contractor a crypto debit card denominated in local currency. On pay day, the employer can simply top up the card with the appropriate amount of digital currency, which will be converted to a form of money the cardholder can spend just about anywhere.

"It's a very convenient way, and a fast way, to get funds between countries," Taylor said.

Like cryptocurrency itself, these debit cards are an international phenomenon. Dash announced Monday that it is on the verge of integrating with Wirex, a London company whose cryptobanking platform serves 800,000 customers across 130 countries. Like Mondrus' card, each Wirex prepaid debit card is linked to a digital wallet where its user holds digital currency, which is converted to fiat currency whenever a purchase is made. The card can even be used to withdraw cash at ATMs around the world. To date, Wirex users have accounted for more than $1 billion in transactions.

The prepaid Visa card offered by Atlanta-based BitPay works differently. (It's common for digital-currency startups

Since launching the U.S. card in May 2016, BitPay has sold more than 33,000 of them, exceeding the company's expectations. (An international version became available in Europe about four months ago.) The number of monthly active users grew 1,583% between August 2016 and August 2017, according to BitPay.

The companies behind cryptocurrency debit cards have a few ways to profit from them. BitPay sells its card in the U.S. for $9.95—payable only in bitcoin—and for as little as $15 in Europe. The company also earns revenue through interchange fees.

And, finally, it makes a profit by selling the bitcoins it receives from customers, "while still giving the user a good price for their coins," said Stephen Pair, BitPay's CEO.

An opportunity for banks

It remains to be seen whether banks will begin offering cryptocurrency debit cards themselves. BitPay partners with Metropolitan Commercial Bank in New York to issue its card, but it is conceivable that one day financial institutions may decide to cut out the middleman.

"I think they would have an easier time issuing them than someone who is not already in banking and doesn't have a banking license," Taylor said. "There is a market and a set of consumers who value this service, and [it could work] much like free checking accounts that they use to entice customers and to create a relationship and be able to cross-sell other products. … I'll tell you, if there were a [financial institution] in the United States that was doing it, I would sign up for that card. And it would establish a relationship with that bank. So I think there's a real business case there, regardless of whether these end up being high-usage cards or ones that are used occasionally."

Cryptocurrency users, Taylor added, "tend to be more well-educated, more wealthy" than the average consumer. "This is an attractive consumer set [for banks]."

BitPay's competitive advantage against any new entrants is that it is a long-established player in the bitcoin industry and has already developed a mobile app that integrates with its card.

"A bank would have to build that software" in order to compete, Pair said. "Banks historically have not been good software companies."

But, as Mondrus points out, a bank could simply do what banks do best when it comes to keeping up with new technology: acquire a smaller, nimbler company.

Regardless of who issues them, cryptocurrency debit cards may prove to be a mere stepping stone in the evolution of payments, like beepers in the days before mobile phones became ubiquitous. In LendEDU's poll, 8.8% of respondents predicted that their children would rely on digital currencies as their main form of payment, while only 22.7% said they believed future generations would primarily use debit cards.

As the science fiction author William Gibson has said, the future is already here — it's just not evenly distributed. BitPay's employees in Argentina today receive 100% of their salary in bitcoin, according to Pair. That fits with the way in which bitcoin is used in countries such as Argentina, whose national currencies can't be trusted to retain their purchasing power even in the short term.

Outside of the U.S., Pair said, "bitcoin is much more of a transactional medium than a speculative asset."