Competition for deposits is tight, the outlook for loan demand is uncertain, and regulatory relief is yet to be much of a relief — so what explains the upswing in banker optimism in a recent survey of community banks?

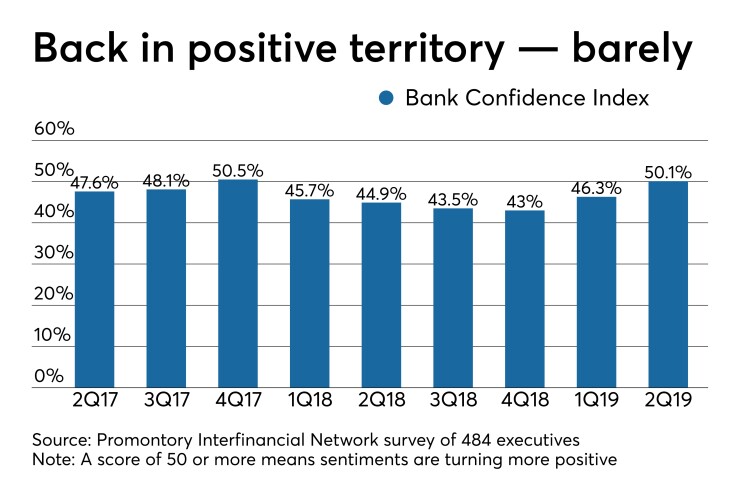

Promontory Interfinancial Network, in a report released late Monday, said its Bank Confidence Index rose 3.8 points in the second quarter to 50.1 points on a scale of 100. That was the first time it had passed the 50-point threshold since the end of 2017. The deposit placement provider’s quarterly index seeks to quantify bankers’ expectations for the next 12 months based on their responses to questions about access to capital, loan demand, funding costs and deposit competition; a score of 50 or more means that banker sentiments are turning more positive than negative.

It’s tough to parse out exactly why bankers’ attitudes improved, but Paul Weinstein, a senior policy adviser for Promontory, said timing may be part of it. Promontory conducted the survey from July 1 – 12, when anticipation was running high for an interest rate cut by the Federal Reserve. On July 31, the Fed lowered the federal funds rate by 25 basis points.

“I think that basically, the hope in their minds was that a Fed action would help the economy,” he said. “We’re setting a new record for a period of economic expansion, and there’s just a sense that a recession has to hit at some point. I think the hope that the Fed would cut rates and that would help continue the expansion, that may have carried over.”

The results provide an interesting backdrop ahead of Fed Chairman’s Jerome Powell’s highly anticipated remarks scheduled for Friday at the central bank's symposium in Jackson Hole, Wyo. Bankers and investors will be looking for hints about the Fed’s next steps; the markets are believed to have priced in one more rate cut of 25 basis points by the end of the year.

Promontory surveyed 484 CEOs, presidents and chief financial officers primarily from banks with under $10 billion in assets. It was the largest sample size Promontory has had since it began the survey in the beginning of 2015, and this latest analysis reveals sharp divisions among banks on issues ranging from trade to regulatory reform.

For instance, bankers are split when asked about the impact of U.S. trade policy on their business, with 48% saying it had a negative impact and 47% saying it had no impact. Just 6% said it had had a positive impact.

The question of trade also split bankers among geographical lines, with negative opinions of trade policy highest among banks in the West (67%) and Midwest (61%). That may be because Midwestern farmers have been hurt by ongoing trade tensions with China, and because tech firms on the West Coast rely on imports and exports, Weinstein said.

Bankers in the South and Northeast were more confident than bankers in the West and Midwest.

Promontory also queried bankers on whether the regulatory reform law enacted last year had reduced the burden and cost of compliance over the past year, finding that 54% said it had not. Of that group, though, 27% were still hopeful they would eventually see some cost savings.

Bankers’ attitudes toward loan demand in the 12 months ahead is mixed: 41% say they expect it to improve, 23% say they expect it to worsen, and 36% expect it to remain stable.

A majority, or 74%, said that deposit competition had worsened over the past 12 months, and 61% said they expected deposit competition to worsen in the 12 months ahead. However, this latter figure represented a decline of 11 points from the previous quarter and 28 points from the year-ago quarter. In other words, most bankers expected worsening deposit competition, but fewer held that view.

That may be because bankers are expecting that further rate cuts by the Fed will loosen funding costs and ease competition for deposits.

While 87% said that funding costs had worsened over the prior 12 months, the outlook for the 12 months ahead was somewhat sunnier. Forty-one percent of bankers said they expect funding costs to improve, while 28% said they expected them to stay the same, and 31% said they expected funding costs to worsen.