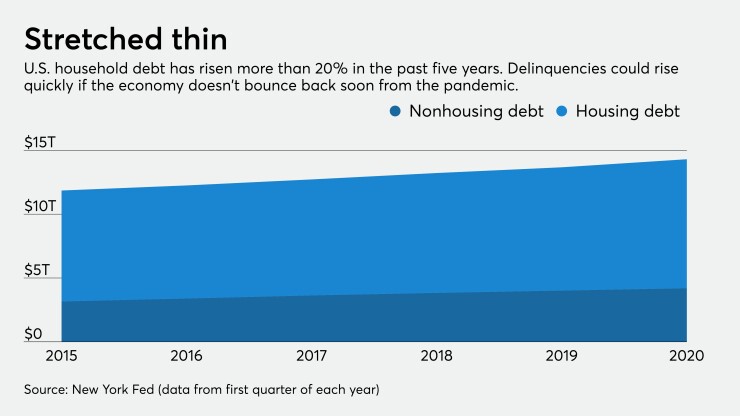

A tidal wave of consumer debt issues is bound to hit when government assistance ends and banks wind down their loan deferral and forbearance programs.

“A tremendous amount of liquidity assistance has been provided to customers,” said Brian Middleton, head of strategic execution and business transformation in Regions Bank’s operations and technology group. “It’s fair to say that that will run out at some point. My hope is that customers are back to being fully employed soon. Only time will tell.”

To prepare, banks are putting in place technology that helps streamline debt collection and make it more humane and conversational.

Where debt collectors of yore would have called people at home (and perhaps have badgered them), today some banks are setting up automated, gentle reminders of late payments; the ability to renegotiate a payment plan on a website or app; virtual assistants to communicate with borrowers; and robotic process automation to execute the changes customers request.

“We're seeing more financial institutions, lenders and others bracing for impact,” said Ohad Samet, founder and CEO of TrueAccord, a mostly digital collections agency used by several large banks. “Some are still in denial, but the vast majority are saying, we need to acknowledge this and we need to do something about it.”

Alan McIntyre, senior managing director for banking at Accenture, said that during the mortgage crisis, lenders’ answer to this problem was to have thousands of people in warehouses calling borrowers.

“This time, we’re seeing more banks thinking about creating systems and approaches that interact with the customer better, gather better information and make better decisions,” he said.

Banks have something they didn’t have in 2008: time to prepare.

“We have this calm before the storm,” McIntyre said. “The real impact is not going to start to be felt until the fall.”

Building a self-service portal at Key

Some banks, including

“We feel strongly about being a relationship bank and those relationships, just like marriage, aren't only for good times, they’re for good times and bad,” said Kimberly Snipes, consumer chief information officer at Cleveland-based Key. “We want our customers to say, I hate that I had that situation, but I felt like my bank was working with me, not against me.”

The bank partnered with several vendors, including Oracle, to build the portal.

“It allows our customers a frictionless way to engage with us around the ability to make a payment, to make a promise to pay, or to have some kind of workout,” Snipes said.

The anonymity of the technology “gives them a way to handle what I'm sure is a very stressful situation for them in a more dignified and maybe comfortable way,” she said.

KeyBank plans to guide customers to the portal through messages in its online banking site and through text alerts.

Legal, compliance and risk groups within the bank are figuring out what the policies to use to help customers out.

“There are compliance and regulatory restrictions around what you can and can't do, and how often you can do those things,” Snipes said.

Snipes hopes Key will roll out the portal in the current quarter.

The bank has also begun deploying robotic process automation whenever there is a clear case for forbearance or some other aid.

And KeyBank wants to be more proactive by analyzing data to see which borrowers are having trouble, reaching out to them and helping them before they fall behind on payments.

Early intervention at Regions

That kind of proactive stance and the use of robotics are both in play at Regions, of Birmingham, Ala.

Collections call volume increased to 15 times the usual volume from late March to late April as customers suffered pandemic-related hardships, the bank said; it would not share the exact numbers. Because of automation and process improvement the bank implemented, the collections team was able to handle the increased volume without adding personnel.

Automating collections has been a priority for the bank since early 2020, before COVID-19 appeared in the U.S., according to Middleton.

“We had the aim and the desire to enhance our customer experience when it comes to collections,” Middleton said.

Regions has worked hard to identify delinquent borrowers with the ability and the willingness to pay. Those kinds of customers often rely on lenders to notify them that they have missed a payment or have overdrawn, he said.

The bank has used texts and emails, rather than traditional phone calling, to warn customers that they have missed a payment. By using such alerts, the bank says, it has reduced outbound collections calls by 60%.

The alerts are rules-based, and the tone is supposed to be conciliatory.

“We're looking to come alongside our customers and help them through whatever hardship they're experiencing,” Middleton said. “So a lot of the texts are just a reminder, realizing that people are really busy and may have forgotten to make a payment, may not realize that their account is overdrawn or may not know how to get the help that they need.”

Another subset of customers is those who are willing to pay but can’t due to COVID-19 or other unforeseen circumstances in their lives, Middleton said.

Regions has added intelligence to its interactive voice response system to understand if the customer qualifies for a payment deferment and automatically set it up.

Customers always have the ability to speak to an agent, Middleton said.

“But we're seeing quite a few customers leverage that IVR technology,” he said.

Benefits of automated collections

Samet at TrueAccord, which has 5 million active monthly users, pointed out that with people working from home, call centers are not as effective as they used to be. Agents working from home can't maintain compliance with payment security standards and therefore can't take card payments. (So-called PCI compliance requires physical security that people working from home don't have.)

TrueAccord’s platform uses artificial intelligence to interact with consumers at the times and in the channels they prefer, mainly text and email. The system lets them tell their story and then helps them come up with a repayment plan. All available options are dictated by the lenders. The tone of communication adjusts according to consumers’ behavior — both what they say and what they do.

Samet said 96% of TrueAccord’s resolutions do not involve a human.

“Even when they communicate with a customer care agent, it's mostly around sending an email or text and getting a response that carries them forward and not getting into too much of a conversation,” Samet said. “People [in debt] don't want to talk to people. If they do, we're available.”

When TrueAccord added a feature to its service that lets users to move an upcoming recurring payment by up to seven days with a couple of taps on their smartphone, inbound calls to its call center dropped by 11%.

“Giving them that flexibility reduces stress, reduces friction and increases people’s ability to stay subscribed to the repayment plan that they chose,” Samet said. “If you can get as good results or even better results by being on the consumer’s side, then you have nothing to lose. The better the service you give consumers, the more flexibility you give them, the more people pay — it's directly correlated.”

The business process outsourcing and collections agency ERC, which also has several large bank customers that it can’t name, uses an AI-based virtual assistant named Eva from Interactions to converse with borrowers who are behind on payments.

The virtual assistant handles simple requests, such as address and phone number changes and taking payments.

Customers can speak their requests to Eva, which has natural language processing technology that converts spoken words to text the computer can understand.

“She might not be able to help you with everything that you say, but she'll understand everything you say,” said Marty Sarim, the chief executive of ERC, a collections and business process outsourcing company. Eva also responds in sentences and says things like, “I need more information to do this.”

With the use of the virtual agent, seven live agents can do work that formerly would have been done by 10, Sarim said.

“And those seven people are more efficient because they're only focusing on what they do best, which is handling complex calls,” Sarim said.

Customers have become more comfortable speaking and interacting with a virtual agent in the three years ERC has been using Eva, Sarim said.

“There's no longer that hesitation or concern that people will just zero out to try to speak directly to a human,” he said. “In the collections industry, we're seeing this phenomenon that people want to interact with a virtual agent because there's no embarrassment, there's no judging, they don't feel like they'll be harassed.”