-

A lot of bank boards have a big knowledge gap when it comes to technology. A recent Accenture study found that, of 109 large banks globally, more than 40% did not have a single board member with a technology background. And the situation is even more worrisome at small banks.

January 4 -

Relations between banks and fintech companies are starting to thaw as the two sides begin to acknowledge the advantages of scale that exist when they join forces.

December 14 -

Banks are being "unbundled" by challengers in numerous business lines, but they can recapture the relationship with the help of technology and the right mindset.

October 13 -

Among other reasons for seeking their own charters, the U.K.'s so-called challenger banks say they need to avoid being beholden to older institutions that can slow down the creative process.

September 16 -

The relevant question is no longer whether new regulations will come for the fast-growing industry, but what form they should take.

November 5

To borrow from Jack Nicholson's character in "A Few Good Men," can your bank handle the truth?

Suppose the management of a large bank promises to achieve a goal — say, hit a market share target, slash expenses by a certain amount, or upgrade core processing systems without going over budget.

How can the bank's investors, the board or even others in the C-suite know if the projections are realistic? Middle managers or rank-and-file employees may have a sense of whether the claims are plausible, but they don't necessarily have an incentive to say anything that contradicts the boss.

Enter

A prediction market is like "a socially ignorant nerd who blathers the truth all the time, whether people want to hear it or not," says Hanson, an associate professor of economics at George Mason University and a research associate at Oxford University's Future of Humanity Institute.

He doesn't claim that the predictions are infallible, just that they're more reliable, than, say, an "independent" consultant who has an incentive to tell the people who hired him what they want to hear. It's a way to "get more accurate estimates than through other channels," Hanson says. Think the opposite of a "yes man."

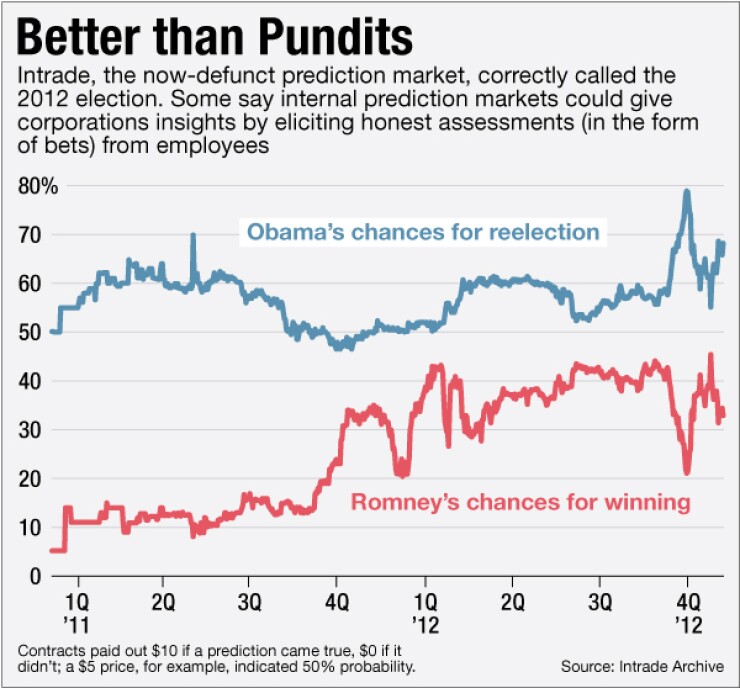

Perhaps the most famous prediction market was Intrade, where speculators made bets on election results, weather and the outcome of wars. Some corporations (Microsoft, Google, Hewlett-Packard, and Starwood among them) have

Maybe large banks, among the most siloed, opaque and politicized organizations around, could use this mechanism to get at the truth about everything from the prospects for a large technology project to

In the latter scenario, Hanson describes an imaginary corporation that amends its charter to make the CEO's tenure depend on prices in "dump" or "keep" markets. Some people would agree to buy or sell the company's stock if the CEO is dumped by the end of a certain quarter. Others would make similar agreements to trade the stock only if the CEO is kept. The value of these agreements would vary depending on the market's view of the CEO's abilities. For example, an unpoplular CEO would make the "dump" agreements more valuable and the "keep" agreements less valuable. If, during the last week of the quarter, the "dump price" exceeds the "keep price," the market is recommending that the board cut the CEO.

You might think that a company's stock price itself is a referendum on the CEO, but Hanson points out that many other factors can influence equity markets. "Markets are saying thousands of things that are hard to disentangle," he says. A prediction market is a "more direct" message.

Bets don't have to involve stock. Neither do they need to focus on major issues. Prediction markets can help provide clarity on more granular outcomes within a corporation. Employees could be given the opportunity to (anonymously) buy a contract that pays out $1 if a certain outcome happens, such as a deadline being met for bringing a product to market. If the contract is trading for pennies, it's a signal to management that confidence is low. Options might be to delay the marketing for the product, change who's in charge of it or kill it.

Prediction markets are strictly advisory, and management is under no mandate to act on the feedback. But if more such markets were created, the track records of companies that followed their advice could be compared to those that didn't. If those that heeded their internal markets generated higher returns, it would shame the others, Hanson says. At the very least, a company or its managers would no longer have the excuse that a problem "came out of left field and nobody could see it coming."

One objection to prediction markets is that, like other markets, they can be rigged, but to Hanson, attempts to manipulate them can only help by adding liquidity. In his view, traders in financial markets fall into two categories: wolves and sheep. Wolves are those who trade because they have good information. Sheep are those who trade for any other reason — "if you trade against them, you're likely to win," Hanson says. A manipulator, then, makes a "nice tasty sheep," and the more people try to manipulate prices, the more wolves will come in to bet against them, resulting in more accurate prices.

But Hanson admits that there are some big impediments to widespread adoption, not least of all legal issues. Prediction markets can run afoul of insider trading and gambling laws. Intrade suspended operations in 2012 after the Commodity Futures Trading Commission sued.

The biggest barrier to corporate adoption, however, is the very thing that makes prediction markets valuable: they speak the truth. "An honest, accurate forecast might not be welcome," Hanson says. Often, when a market predicts that a project will fail, it "embarrasses the person in charge."

Even if corporate America remains lukewarm to prediction markets, they might sprout up anyway. Hivemind is a software project to create decentralized prediction markets using the technology underlying (what else?) bitcoin. "No one wants to open Pandora's Box of truth," says Hivemind founder Paul Sztorc. "My project aims to open the box and keep it jammed open!"