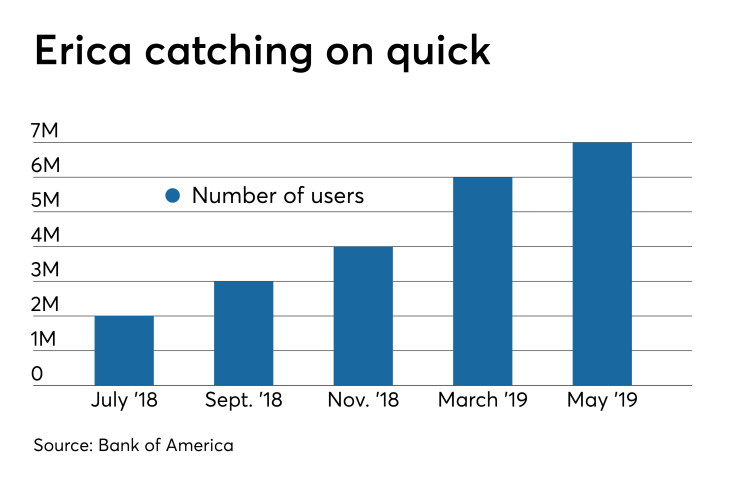

Bank of America’s Erica is growing on consumers.

Since the bank introduced what it calls ‘proactive insights’ to the artificial intelligence-driven virtual assistant late last year, it has added thousands of users willing to take advantage of its automated advice on day-to-day finances.

Marking its first anniversary this week, the service has processed more than 50 million requests to date. It now counts some 150,000 users per week, with overall users reaching 7 million, according to the bank.

The "insights were the first time Erica became proactive and started looking at clients’ situations and behaviors,” said Christian Kitchell, AI Solutions and Erica executive at Bank of America. “Erica is basically helping clients to stay on top of activity inside their accounts to make sure they avoid any surprises and to ensure they’re getting the most out of their banking relationship.”

To that end, the bank next month will launch a new Erica feature called Balance Watch, which will alert users when typical everyday spending has the potential to result in a negative balance. A user receives the notice only if a negative balance is possible in the next seven days.

The feature is “based on what we can derive analytically from typical spending month over month and what we can derive from typical deposit activity,” Kitchell said. “It gives us the ability to give you a heads-up that you have the potential to go below zero in that time frame."

The complexity involved in giving bank customers this kind of insight may be hampering other banks from launching their own virtual assistants.

To date, Bank of America is one of the few institutions to launch a first-party virtual assistant at scale that does not rely on another platform such as Facebook Messenger or Amazon’s Alexa to connect with bank customers.

Ally Bank in 2015 was one of the first banks to introduce a virtual assistant within its mobile banking app. Wells Fargo told American Banker earlier this year that it was testing a virtual assistant within its mobile banking app that aims to be as flexible as possible. Synchrony Financial works with 20 retailers that use the bank’s AI-powered assistant, Sydney.

Still, the industry’s enthusiasm for virtual assistants remains low.

“We’re not really seeing any other bank go all in on virtual assistants the way Bank of America has done,” said Emmett Higdon, director of digital banking at Javelin Strategy & Research. “A lot of it has to do with the complexity in providing the type of proactive, predictive insights the bank wants to provide.”

“That requires an incredible amount of data integration, so it’s not a small undertaking for a bank."

Kitchell said the bank’s continued emphasis on Erica comes from a desire to provide customers a personalized experience.

“The way we look at it is, we’re very early in the game, but we think it’s a game we have to be in,” he said. “It’s not our goal to work on this for just one or two years. It’s a long-term effort."

That effort also speaks to the bank’s plan to put an increased emphasis on intertwining mobile and online banking with its physical branches.

Dean Athanasia, president of consumer and small-business banking at Bank of America, said Tuesday in a presentation at the Deutsche Bank Global Financial Services Conference that 17% of activity at the bank’s nearly 5,000 branches is “driven by someone making an appointment in the app.”

“The capabilities in the app and the connection to the physical world is what puts us out in front,” he said.

Athanasia said the bank will continue to invest in digital banking and noted that Erica plays into those efforts.

“Every single dollar we spend in tech goes into value-added services,” he said. “We are trying to disrupt the disruptors.”