Corporate America has shed its aversion to bank loans, though most businesses remain reluctant to borrow.

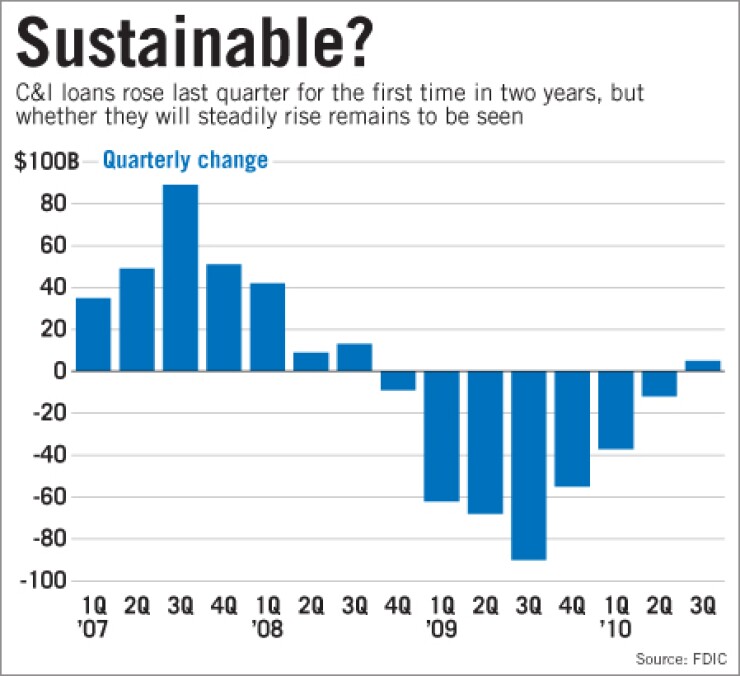

Banks last quarter added more working capital, equipment financing and other business credits to their books than they ran off for the first time in two years, the Federal Deposit Insurance Corp. reported last week. Commercial and industrial loans — or business credits not related to real estate — grew 0.4%, to $1.17 trillion, from the second quarter at the nation's 7,760 FDIC-insured banks.

That number confirms what bankers have been telling investors and analysts for months: Fewer business loans are going bad — so overall balances are stabilizing as existing customers pay off old loans and take out new ones. Relatively healthy companies in the health care, energy and other recession-resistant sectors are beginning to invest in growth after a long spell of belt-tightening. Banks also have been offering increasingly friendly rates and terms to the few healthy companies interested in borrowing.

Whether C&I lending is rebounding, bottoming out or only temporarily rising remains an open question, experts said. Though banks may be making more C&I loan commitments, few companies are tapping credit lines. Businesses have lots of cash and are operating at maximum efficiency; few need to borrow.

"Line utilization is still relatively low, and we haven't seen that pick up yet. So what we're seeing is basically more lines, more line commitments, more customers," Howard Atkins, Wells Fargo & Co.'s CFO, said this month. "We think we're picking up some market share in the commercial loan area, and [though] it's flattening out, I wouldn't … suggest that this is necessarily the start of a cyclical reemergence in loan demand."

Demand remains especially soft among the types of companies that banks need to see to end their lending drought: the largest companies and any business that relies on consumers for profits.

"If you're in consumer housing-related industries, construction, retail, restaurants, credit is still tough to get," Brian Moynihan, the chief executive of Bank of America Corp., said at a conference in November. "But credit is fully available to all other companies, and the competition is very strong across the industry."

Richard K. Davis, the chairman and CEO of U.S. Bancorp, said this month that the largest companies are looking to invest but do not need banks to help fund it. They can raise debt and equity from the capital markets. But growth-minded small and midsize companies need banks, he said. The problem is, there just aren't a whole lot of them.

"What's just starting to happen — call it a glimmer, if you will — is [that] the middle-market customers are starting to show an interest [in loans]. Their ability to wait any longer without investment is over," Davis said. "We're finding a great deal of growth in our own balance sheet because we're growing market share, but there isn't a lot of growth in small business. There aren't a lot of qualified customers based on the rules of the game today."

Borrowers that are qualified are limited to specific geographies or industries. Ralph Babb, the chairman and CEO of Comerica Inc., said this month that the Dallas-based lender is seeing C&I demand for working capital loans at energy businesses in northern Texas. Midsize entertainment and technology businesses in California "are getting things in position" to borrow more, he said. He is also bullish on lending prospects among Michigan automotive-related companies, given improving car sales.

The industry may be on the point of seeing an increase in loan demand, Babb said. "If people get confidence in the economy, … I think we'll see a very slow [loan] growth for a period," he said.

Large banks have been doing all they can to grease C&I demand. Loan officers at a handful of big commercial banks have told regulators that they have been easing C&I lending standards at least since spring. A handful of loan officers at big banks surveyed by the Federal Reserve in October said they have been relaxing loan covenants, tightening loan spreads and reducing prices because of intensifying competition. They also cited more confidence in the economy as a reason to relax standards. The Fed's July and April surveys reported similar results.

In the most recent survey, bankers said C&I demand was largely flat; they had indicated a modest increase in demand three months earlier. Companies were generating more capital internally while needing less funding for inventories, accounts receivable and plant investments, among other things, they said. Inquiries about new or increased lines of credit were up, however, indicating that demand could pick up.

Easing loans standards does not necessarily mean increasing risk, according to William Schwartz, senior vice president of financial institutions at the ratings agency DBRS Ltd. It was only a matter of time before banks started easing unusually tough post-recession lending criteria, he said. The criteria are still high, even at companies that have relaxed them.

And the few companies showing an appetite for loans are generally a safe bet, given that they have come through the recession.

"Look at how many quarters of tightening there were," he said. "We haven't seen anything right now that would concern us."