Almost all U.S. challenger banks offer no-fee checking, savings accounts and enhanced personal financial management tools. Now some of the most popular have taken, or are poised to take, their next step: making loans.

Personal loans and credit cards are lucrative but inherently risky, and these young companies — like MoneyLion, Varo and others — will have to prove to regulators, investors and the public that they have the wherewithal to weather downturns in the credit cycle.

“When you look at [challenger-bank] strategy, it seems fairly clear their goal is to try to fill in all the unmet needs of their current customer base,” said Alex Johnson, director of solution marketing at FICO. “Lending does come with different challenges, and a change in the credit cycle will make them more challenging.”

MoneyLion’s approach to credit risk management is lending primarily to customers of its investment service. The majority of its loans are secured because users have the ability to borrow from their investment account, CEO Dee Choubey said.

“We found members that want to invest for the long term exhibit positive behavior,” Choubey said. “Therefore, we’re able to take a higher level of risk from day one than many credit card companies and lenders that don’t have that behavior comfort to take that risk.”

Choubey said most users request secured loans to cover small and temporary shortfalls in their finances.

“Consumers are always stressed about the two or three months out of the year when things might go bad and they need that credit line,” he said. “Knowing that these options exist is a very powerful insurance mindset that our consumers have.”

When asked about the possibility of MoneyLion offering a credit card, Choubey said the challenger would use a similar approach.

“When we build our credit card, we’re going to want to innovate a bit and make sure it’s tailor-made for members that invest with us,” he said. “It’ll play on that thesis that if you invest with us, we’ll give you a larger credit line than what you would get from an unsecured credit card provider.”

Like MoneyLion, Varo Money also has sought to build long-lasting relationships with users through lending while mitigating risks.

Varo is hoping the structure of its business will help gird it for economic downturns and credit cycle fluctuations. The San Francisco company

“You have to structure loans and credit facilities in ways that are helpful to consumers but are also not going to expose you to a lot of loss,” Varo CEO Colin Walsh said. “In your underwriting, you have to really sort of trigger some of those stress conditions. And it's not something for novices.”

FICO’s Johnson said that in addition to a thorough underwriting process, challengers will need to make sure their collections efforts are sufficient. In an all-digital business, that will not be easy.

“What is your approach to collections going to be when most of the interactions that you have with your customers are through a mobile app or text message rather than over the phone?” he asked. “There’s a whole set of customer service and portfolio management problems that you need to be able to solve and be ready to solve, if you’re going to jump into lending."

Walsh said Varo will issue credit cards once it is fully licensed and acknowledged the challenges associated with such a product.

“You have to understand how to get paid back when you’re extending credit,” he said. “It’s an art and a science, and it’s an area where experience really matters.”

Choubey and Walsh said they are not overly concerned about how a recession could affect their ability to offer credit, but consumer debt is at its highest point since the last financial crisis.

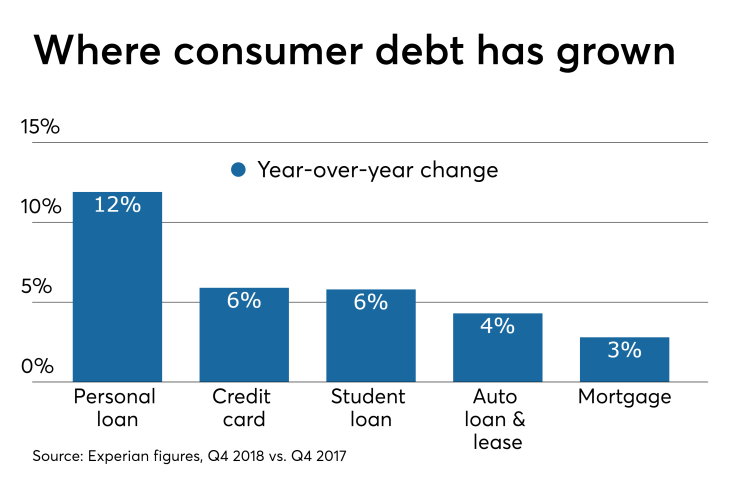

Personal loan debt also is on the rise, according to Experian. Existing personal loan debit reached $291 billion in the fourth quarter of 2018. That figure was up 11.9% from the same period in 2017. Experian says personal loan debt is growing at a faster rate than auto, mortgage and student loan debt.

Walsh said that if a challenger is offering credit as part of the overall relationship with the user rather than just viewing it as a feature, the company is more likely to be repaid during a difficult economic cycle.

“Consumers don’t want to put that relationship at risk, so you’re much more likely to get repaid if you have that relationship,” he said. “If you treat credit as just another feature, the consumer is going to treat it like that as well.”