-

Although bankers are likely to have significant concerns about the risk retention proposal due next week, they appear to have won at least one victory already: a choice over how to structure risk that must be retained.

March 24 -

Forthcoming regulations could make conventional mortgages more expensive to the wide swath of homebuyers and owners who can't put 20% down, depressing originations and potentially undermining the housing recovery.

March 21 -

Investors were spooked about what exactly two top administration officials meant last week when they said the GSEs would not be exempted from pending risk-retention requirements.

March 21 -

Two top Obama administration officials said Tuesday that the GSEs would not be exempted from a pending proposal to help standardize mortgages sold into the secondary market.

March 15

WASHINGTON — One of the most important pieces of the Dodd-Frank Act is set to start falling into place Tuesday as regulators offer a plan that would establish stringent underwriting standards for most mortgages, provide limited new rules for servicers, and detail how institutions must retain some risk of loans they intend to sell to the secondary market.

The risk retention proposal is likely to draw protests from the banking industry and concern from lawmakers because it is so sweeping and may reshape the entire lending business.

According to a

Under the Dodd-Frank law, lenders are required to hold 5% of the risk of a loan unless it is considered a qualifying mortgage. But lawmakers left it up to the regulators to determine how that risk was structured, what types of securities may be exempt and what was defined as QRM. Following is a guide to the regulators' plan, which is expected to top 300 pages.

Qualifying Residential Mortgages (QRM)

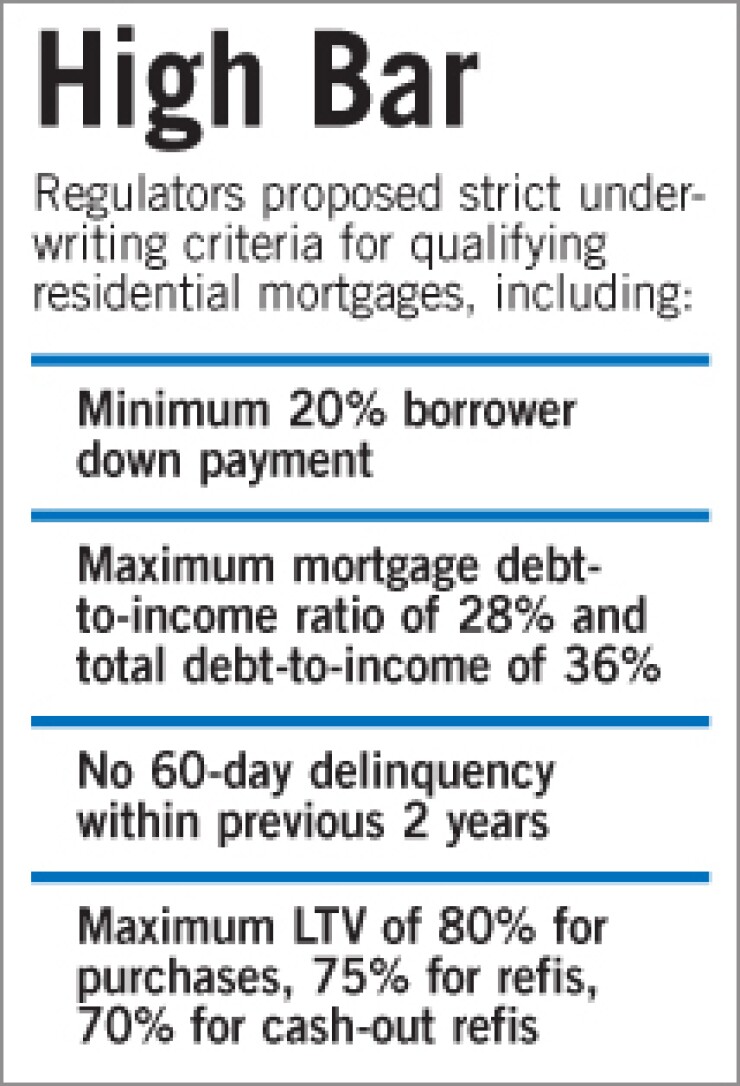

Lawmakers intended certain loans that met "traditional" underwriting standards to be exempt from any risk retention requirements. But regulators have offered a conservative definition that would exclude many mortgages currently made in the market. Regulators acknowledged as much in the summary, saying they want to ensure QRM loans are "very high credit quality."

To meet the definition, a borrower would have to make a 20% downpayment and could not have a 60-day delinquency on any debt obligation within the past two years. Lenders must also ensure that the borrower's mortgage bill should not consume more than 28% of their income, and their total debts could not eat up more than 36% of their pay. A maximum loan-to-value ratio of 80% under a purchase transaction would be required for a home purchase, while a 75% combined LTV would be needed for refinance transactions (or 70% for cash-out refinancings).

Loans deemed QRM could not have certain product features such as negative amortization, interest-only payments, or significant interest rate increases that add risk to mortgage loans.

Regulators said the LTV ratio would be calculated without including mortgage insurance. While they acknowledged that such insurance typically protects investors from losses when borrowers default, they requested further comment to assess whether loans with mortgage insurance would be less likely to default than other mortgages.

Servicing Rules and QRM Options

The proposal would also include a limited set of servicing requirements that could lower the risk on default of residential mortgages as part of its QRM criteria.

For example, an originator of a QRM would be required to incorporate certain requirements regarding servicing policies, like loss mitigation actions and procedures for dealing with second liens when a first one is modified.

Regulators were quick to note that any servicing requirements included in the proposal will not replace ongoing interagency efforts to develop national mortgage servicing standards. According to the summary, the interagency effort is considering a number of factors not included in the QRM, including the quality of customer services provided throughout the life of the mortgage, foreclosure processing, and servicer compensation and payment obligations.

It also left open to comment whether a national approach would be a more effective in addressing servicing problems over its proposed QRM criteria.

Importantly, regulators appear to be considering possible alternatives to QRM. According to sources, the proposal will ask whether the proposed definition is too narrow and suggest at least two alternatives. Under one plan, regulators would create a second-class of loans that are exempt from a 5% risk retention requirement, but include at least some risk retention amount between 0% and 5%. Under another plan, regulators could broaden QRM criteria to capture more loans but enforce a tougher risk retention requirement for loans that fall outside that status.

Exempt Asset Classes

Qualified assets such as auto loans, commercial loans, commercial real estate, and residential mortgage would not be required to retain any part of the credit risk if they meet the underwriting standards included in the proposal.

Regulators said auto loans, for example given its depreciable nature, should focus primarily on the borrower's ability to repay the loan. In the case of commercial loans, underwriting standards should be designed to ensure that the borrower's business would remain in sound financial condition and would have the ability to repay the loan.

The agencies did not propose a different set of residential mortgage underwriting than the QRM standards at this time.

The agencies can develop underwriting rules for more asset classes, but chose not to do so at this time.

As a backstop measure, two provisions have been included in the proposed rule to guard against abuse of the QRM, or possible exemptions. Under the first, the sponsor would be required to provide a self-certification to ensure that loans were underwritten in accordance with the rule. In the second, for loans which are later deemed as not having the proper underwriting standards, the sponsors must buy them back within 90 days.

As expected, federal and state guarantees are exempted, as are single class re-securitizations.

Risk Retention Structure

Regulators also detailed which entities must retain risk and provided options for how it could be structured.

According to the summary, the "sponsor" of the securitization, which takes the loan from the originator before it is packaged for the secondary market, is required to "hold the required risk retention." But the proposal would allow the sponsor to assign a "proportional" share of the risk to the originator of the loan.

"This would have to be voluntary on the originator's part, however, through a contractual agreement with the sponsor," the summary said.

How the risk retention is structured is designed to be flexible "to allow the securitization markets for non-qualified assets to function in a manner that both facilitates the flow of credit to consumers and businesses on economically viable terms and is consistent with the protection of investors," regulators said.

The summary lays out seven options for how a sponsor could structure risk retention. They include a so-called "vertical slice," in which a sponsor holds 5% of each tranche in the securitization. Alternatively, sponsors could hold a "horizontal" piece, in which their first-loss position would be on the whole securitization. A third option would involve sponsors taking an "L-shaped interest", in which the 5% interest would be split 50-50 between a vertical slice and horizontal loss position.

Further choices are tailored toward more specialized structures, including certain master trusts as well as asset-backed commercial paper conduits.

GSEs

In addition, the summary explicitly says that Fannie Mae and Freddie Mac would satisfy risk retention requirements because they retain 100% of the credit risk of loans they purchase. While not an exemption per se, the regulators said they would revisit the question after the GSEs are out of conservatorship and no longer receive direct Treasury Department support.

The issue of whether the GSEs would be captured under risk retention has been the source of considerable anxiety within the mortgage market. After media outlets said the GSEs would be exempt from the plan, Housing and Urban Development Secretary Shaun Donovan said an exemption was not under discussion. The proposal puts that argument to rest by clarifying the risk retention plan does not apply to the GSEs while under conservatorship but stipulating that it is not an exemption.

Other Requirements

According to the summary, sponsors would also face compensation restrictions barring them from being paid in advance for "excess spread income" that securitized assets earn over their duration.

The proposal would also take steps to limit securitizers from hedging their mandated risk retention or transferring it to other entities, only allowing it under certain scenarios. For example, they could hedge interest-rate risk.

The proposal, the summary said, would impose disclosure requirements "specifically tailored to each of the permissible forms of risk retention."