-

Judging from the questions executives fielded about everything from the slowdown in China to the bank's energy exposure to the potential for another 2008-style crisis, worries are running high.

January 15 -

The most international of the megabanks surprised analysts with a strong quarter Thursday, despite unrest in some of its distant markets. Citi execs see a slowdown coming in its emerging markets but say there is no reason to panic yet.

October 15

This is no time for a megabank to rest on its laurels.

Granted, Citigroup has been riding a wave of good news lately, after becoming the only big bank to pass its living will in the eyes of regulators and posting first-quarter earnings per share that beat analysts' predictions.

But it is continuing to slash jobs and look for other efficiency measures as it strives to be "simpler, smaller, safer and stronger" — a phrase Chief Financial Officer John Gerspach used twice Friday during a conference call with reporters. The same phrase was used earlier in the week by Michael Corbat, Citi's chief executive, in a statement about the bank passing its living will.

To that end, Citi racked up higher-than-expected restructuring charges for the quarter, $491 million as opposed to the $400 million that Gerspach had predicted last month. But while the one-time cost is "substantial," Gerspach said Friday that he expects it to yield enduring savings.

Indeed, the higher number is actually good news, an analyst said. "It's a sign that they're finding more opportunities to become more efficient," said Marty Mosby of Vining Sparks. Either that, or Citi is simply running through its checklist of cost-cutting measures more quickly than it had anticipated.

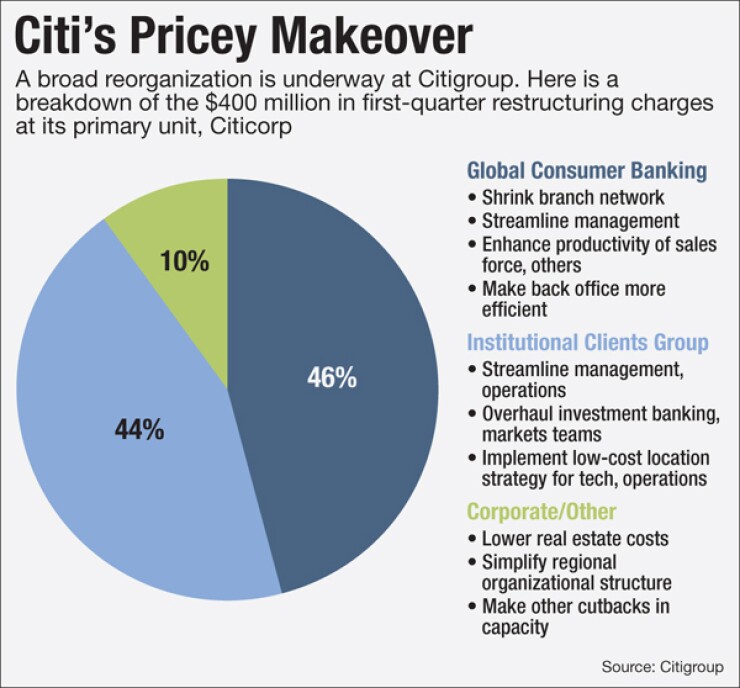

Citi recorded nearly $400 million of the restructuring charges at its main Citicorp unit and predicts that those could translate into roughly $500 million in annual savings. Most of the charges, some 46%, were made in Citi's consumer banking business, with another 44% affecting its institutional clients group.

"Over the next 12 months, it's more than going to pay for itself," Mosby said.

The majority of the charges is likely being used to pay severance to former employees whose jobs have been eliminated.

In the first quarter of 2015, Citi chalked up only $16 million in repositioning charges. Gerspach implied that that was a mistake, telling reporters that this year he wanted to take the hit earlier so the bank would enjoy the "full benefit" of the expense reductions throughout the remainder of 2016.

"This is the largest repositioning charge we would expect to take in any quarter this year," Gerspach said.

At the same time it was clear that the company has no intention of curtailing its hunt for efficiencies. "I don't think we ever stop repositioning," he said.

Cost-cutting, of course, is "not a panacea if you're in consistent revenue decline," said Stephen Biggar, an analyst at Argus Research. But there, too, Citi outperformed expectations, posting first-quarter revenue of $17.6 billion — an 11% slide from the previous year but still better than analysts' $17.5 billion estimate.

A lot of work remains to be done. Equity-market revenue for the first quarter was $706 million, down 19% from 2015. Gerspach said his near-term goal for the equities business is to have it reach a steady $800 million to $900 million in revenue.

Earnings per share were $1.10 on net income of $3.5 billion; the 24 analysts surveyed by Bloomberg had predicted $1.03. Its operating costs were also healthier than expected, dropping 3% to $10.5 billion. The average of analyst expectations was $10.8 billion.

One bright spot is Citi's continued progress in winding down Citi Holdings, once known as the company's "bad bank" because of the toxic assets it held. In 2009, these unwanted assets accounted for 30% of Citi's balance sheet and generated billions in losses. Now, having been profitable for seven consecutive quarters, Citi Holdings has shrunk to a mere 4% of the company's total assets. The portfolio is now so small, in fact, that Citi said from now on it will no longer break out results in its quarterly reports.

Citi's tangible book value is $62.58 per share, but it has been trading at a significant discount. Its shares closed Friday at $44.94, down 4 cents. The lower price reflects various concerns, including investor worries about growth prospects in emerging markets.

If the bank sees a greater rebound in its core revenues along with the benefit expected from its recent restructuring, that would justify its stock returning the level of its tangible book value, said Mosby. In a research note released today, Sandler O'Neill gave its 12-month price target for Citi stock as $57.

In the meantime, the bank's goal is to pass its Comprehensive Capital Analysis and Review this summer, which would allow it to buy back stock at the temporarily discounted price. If all three of those things come together — a big "if" — then, Mosby said, "they set up to be one of the best-performing stocks over the back part of this year."