Jane Fraser and other top Citigroup executives spent Wednesday delivering a message that contained both humility and confidence: The global bank has not lived up to its full potential, but it’s charting a game-changing path that will reap rewards for patient stakeholders.

At the firm’s first investor day in five years, executives in charge of Citi’s core businesses offered sometimes blunt assessments of where the $2.3 trillion-asset company has erred in the past, how it will leverage its current strengths and what needs to happen to improve profitability.

They described Citi as intent on creating a simpler version of itself, and on concentrating on high-growth-potential businesses to deliver larger shareholder returns.

Citi wants to lean into growth opportunities in services, commercial banking and wealth management; capture more share in the markets, banking and U.S. personal banking businesses; digitize and automate its operating model; improve its risk controls; and become a leaner, flatter organization, which it plans to accomplish partly by exiting certain markets.

The end goal: to increase its return on tangible common equity by nearly 50% by the year 2027.

But, executives warned, it’s going to be a multiyear endeavor, and one that’s pricey, at least in the near-term. Citi forecast a 5%-6% uptick in expenses this year.

Part of the increase will be tied to increased hiring in areas such as wealth management. That hiring burst is expected to help push expenses up 10%-12% in the first quarter, excluding any impact from the divestitures of certain consumer businesses, Citi said.

“We know there is a clear-cut case for change at Citi … and we are tackling issues that have held us back head on,” Fraser, the CEO, told investors. “It is going to take time, but I am fully committed to doing hard work to get this bank to where it needs to be, and my team is, too.”

The heavily anticipated investor day — which was scheduled to be held in person but

The day gave members of Fraser’s executive team — who spoke one by one at the six-plus-hour event — an opportunity to highlight all of the moving parts in Citi’s new strategy, which now revolves around five “core, interconnected” businesses.

Those five businesses are: services, which includes the highly profitable treasury and trade solutions segment; markets, which includes fixed income and equities; banking, which involves investment, corporate and commercial banking; global wealth management; and U.S. personal banking, which covers branded credit cards, retail services and Citi’s retail banking network.

Fraser and her team said that all five units can draw business from one another.

“They are interconnected [and] they are synergistic,” she said.

The company also laid out its expectations for key profitability metrics, and how specifically the company plans to achieve those targets. Within the next three to five years, Citi is aiming to achieve a return on tangible common equity of 11%-12%.

It could be a heavy lift. During the fourth quarter, the New York company reported an ROTCE of 7.4%. Big-bank peers JPMorgan Chase and Bank of America reported 19% and 17%, respectively.

In research notes previewing Citi’s investor day, some analysts noted that Citi’s ROTCE has exceeded 10% just twice in the last decade.

But Citi executives made the case that the 11%-12% range is achievable. In a pre-recorded presentation, Mason said that the efficiencies and investments being undertaken now will start to pay off in the next few years.

“In the next three to five years, we expect revenue growth to accelerate” across the five core businesses that Citi now operates and “to grow 4-5% for the firm overall,” Mason said.

“I realize these are meaningful growth expectations,” he added.

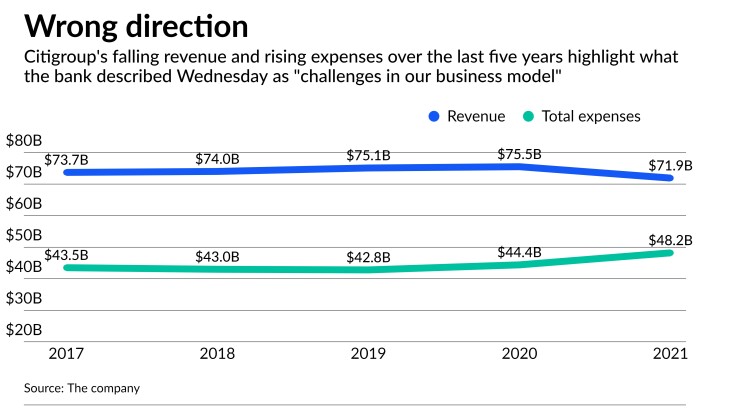

Between 2017 and 2021, Citi’s annual revenues fell from $73.7 billion to $71.9 billion, while its total expenses rose from $43.5 billion to $48.2 billion.

The investor day capped what has been a supremely busy first year for Fraser as CEO. She has integrated Citi’s wealth businesses

She has also put 13 overseas retail franchises up for sale in areas where Citi has deemed itself too small to compete effectively, and so far found buyers for about half of them. In January, Fraser announced the

She has also realigned business units, including “personal banking and wealth management,” which used to be known as “global consumer banking,” and created a newly formed unit that will house all of the business that Citi plans to leave.

Retail banking veteran Titi Cole

In terms of investments, Citi is focusing on areas where it thinks that it can build scale. One example is Citi Alliance, a new wealth management segment that was announced Wednesday.

Housed within Citi’s global wealth management unit, Citi Alliance will provide banking and lending services for clients of registered investment advisors, technology providers, broker-dealers and custodians. Citi has already signed contracts with several wealth management firms to use the service and there’s a “very strong pipeline” of other potential users, said Jim O’Donnell, head of the global wealth unit, which has client assets totaling $814 billion.

“We see this as a great opportunity in the months and years ahead,” O’Donnell said.

Citi executives also spoke about the firm’s ongoing overhaul of its internal controls and risk management efforts, which they called central to achieving the company’s business objectives. Those efforts were spurred in part by

The orders included a $400 million civil penalty.

Karen Peetz, the former president of Bank of New York Mellon who came out of retirement in mid-2020 to join Citi as chief administrative officer, is leading the overhaul. On Wednesday, she offered “a peek under the hood” at how Citi is tackling the challenge of updating its systems.

A “significant portion” of the new hires are working on data efforts, while others are simplifying “end-to-end processes” and making sure there are enough controls in play, Peetz said. Citi is “refining and executing” on the consent order remediation plans “with urgency,” she added.

Mason, who answered investor questions at the end of the day, was frank about the work ahead.

“We need to make up for the past underinvestment in our businesses,” he said.

In her closing remarks, Fraser indicated that she understands the frustrations of investors regarding Citi’s historical financial performance.

“We know we have something to prove, and we welcome the opportunity to do it," she said. "We know it won’t be easy. We know it will take time.”