Though the recent U.S. market turmoil has made it harder to save, investors continue to open 529 college savings plans.

Experts say that growing public awareness of the tax-friendly investment option has offset difficult market conditions.

In spite of the weaker housing market and the stock market's plunge, people have continued opening 529 accounts.

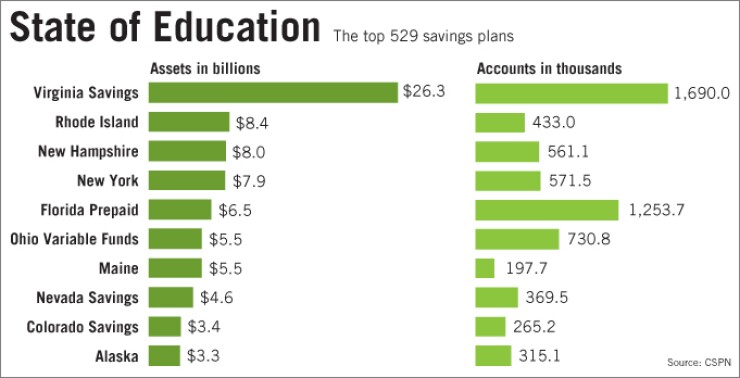

Sponsors had 10.54 million accounts holding $129.83 billion of assets as of Dec. 31 (for 48 states and the District of Columbia) or Sept. 30 (for Nevada, which had 12,388 accounts holding $106.21 million), according to the nonprofit College Savings Plan Network. In contrast, all 50 sponsors had 9.27 million accounts holding $105.69 billion at the end of 2006. Wyoming does not have a plan.

"People look at college savings as a mid- to longer-term savings vehicle, and a lot of folks have a systemic investment plan set up, so the market conditions don't have a huge impact," said Bruce Harrington, a managing director at Cogent Research LLC of Cambridge, Mass.

Despite the strong numbers, 529 plan providers said there has not been much of a drop in demand so far. "Really things look pretty much the same" as they did before the market turmoil, said Jeff Troutman, vice president of program management at Fidelity Investments. "It's been quiet surprising, given the degree of volatility" in the market.

In the year that ended Jan. 31, the number of new accounts at Fidelity increased 10% from the previous year, though the company did not say how many new accounts it had.

John Trader, the public relations and marketing manager with the nonprofit College Savings Plans of Maryland, said it is still too early to determine if the economic downtown has affected plan enrollment in his state. "It's hard to draw the conclusion that the market has had an adverse affect," Mr. Trader said.

Since the enrollment period for Maryland's plan lasts from the beginning of December through April 4, and most people sign up during the last couple of weeks, it will be difficult to get a strong indication of enrollment trends until April, he said.

However, Mr. Trader said that since the start of December there have been around 550, compared with 655 during the same period a year earlier. "That's a low drop in enrollments, considering the economic conditions."

Mary G. Morris, the executive director of the Virginia College Savings Plan, said its enrollment period runs from the beginning of December through the end of February. "We're running very close to what we were doing last year," she said, though she would not provide specific numbers. "Our programs are all strong, and we're adding new accounts all the time."

Experts say they remain optimistic about the long-term outlook for 529 plans.

Brian Boswell, an analyst at the Boston research firm Financial Research Corp., said the plans are still in their infancy. "It's a rapidly growing product," given the novelty, he said. "As time goes on and the firms become better at reducing costs and fees decrease, you'll see continued steady growth."

According to Savingforcollege.com LLC's annual fee comparison study released last week, Ohio, Illinois, and North Carolina offer the least expensive direct-sold 529 plans. OFI Private Investments, Inc., a subsidiary of OppenheimerFunds Inc., manages Illinois' plan, and College Foundation Inc. manages North Carolina's, using certain administrative and record-keeping services provided by Upromise Investments Inc.

Regardless of market conditions, there is plenty of room for new customers in the fledgling market. According to Cogent Research, 529 plans remain unknown to half of the U.S. households that have not begun saving to pay for tuition in the years ahead.

Companies are getting the word out to more potential customers.

For example, Massachusetts Financial Services Co. is planning to begin marketing its plans soon through its advisory network, so it can educate individuals on issues such as how not saving for college appropriately can affect long-term retirement plans. Currently in the industry financial advisers typically encourage investors to prioritize retirement savings over college savings.

"I'd expect the 529s will continue to grow as people's awareness of college costs continues to evolve," said Bill Finnegan, a senior vice president and director of global retail marketing at Massachusetts Financial, which does business as MFS Investment Management and is majority owned by Sun Life Financial Inc.

However, that growth will not come "in the coming months," he said. "It'll take longer."