-

Community Trust Financial of Ruston, La., has received a $45 million investment from Pine Brook, a New York private-equity firm, the two firms announced Monday.

December 17 -

Executives at a number of smaller banks see an opportunity in lending to peers despite lingering risks that are driving large and midsize lenders out of the business.

September 10 -

Green Bancorp CEO Geoff Greenwade wants to buy more banks, which he hopes will ultimately make the Houston bank more attractive to buyers.

July 17 -

PacWest Bancorp in Los Angeles is attempting a hostile takeover just days after unseating Umpqua Holdings to buy American Perspective Bank. Industry observers say the company's newfound buying aggression might make it a better seller someday and give its PE investors a tidy exit.

May 9 -

Community Trust Financial Corp. in Ruston, La., is expanding into Mississippi. The $1.2 billion-asset company has a deal to buy the $65 million-asset Madison Financial Corp., which would add three branches in the neighboring state.

September 15

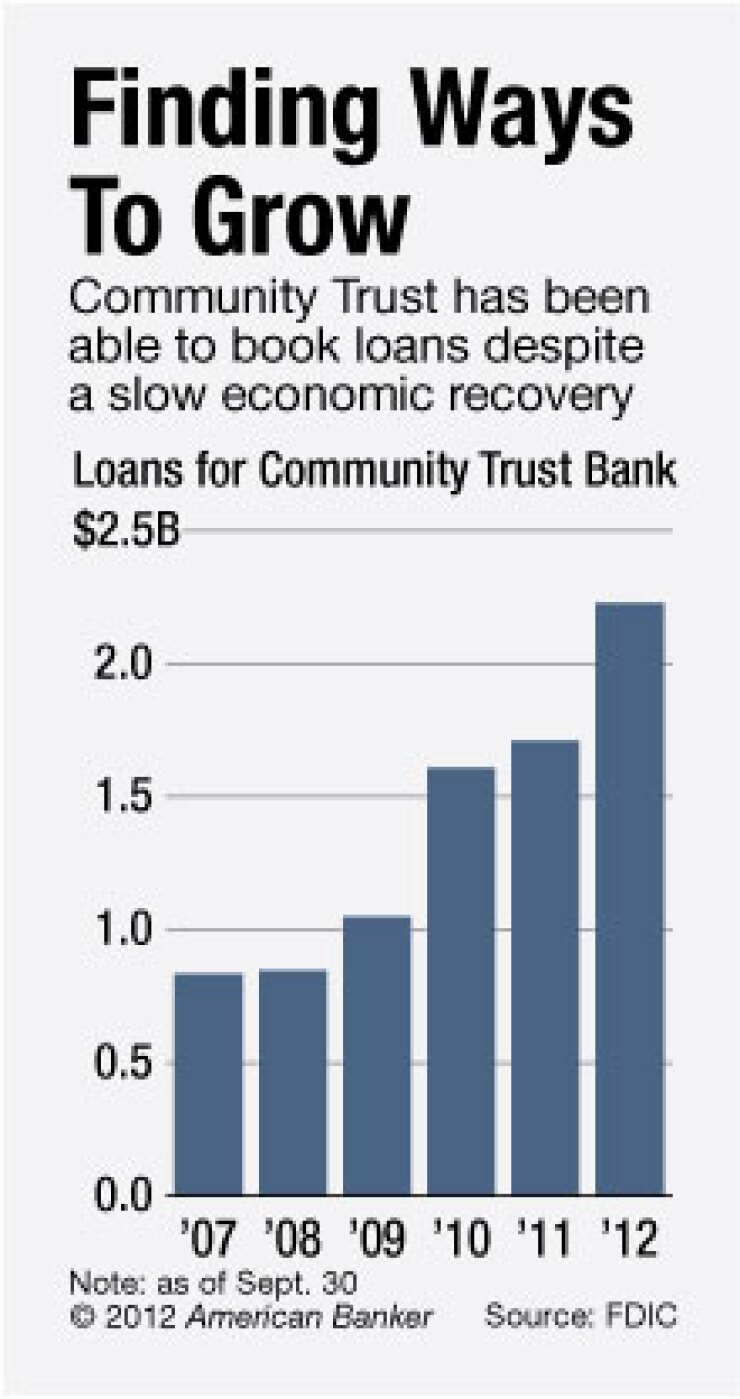

Community Trust Financial has a simple secret to luring private equity. The company nearly tripled the size of its loan portfolio at a time when other banks were in a tailspin.

It certainly helped that the Ruston, La., company also elbowed its way into Texas.

Community Trust announced Monday that it

"Our growth was outpacing our ability to raise capital, so we decided to look into" private equity, says Drake Mills, Community Trust's president and chief executive. "After we made our presentations, we ended up having levels of interest for up to $140 million. That gave us the ability to pick our partners. … We quickly understood which ones were in it for the long term."

Community Trust settled on three private-equity groups. Pine Brook in New York invested $45 million. Castle Creek in Rancho Santa Fe, Calif., placed $30 million, and an unnamed Chicago firm chipped in $10 million.

Pine Brook looks for banks that have exceptional management teams, exemplary profit growth and are doing business in robust areas, says Oliver Goldstein, one of the firm's managing directors. The company has also invested in Green Bank in Houston and

Plenty of private-equity firms, including Pine Brook and

At Sept. 30, Community Trust's loan portfolio had grown by 30% from a year earlier and more than doubled from the end of the third quarter of 2009, to $2.2 billion in loans. Mills says the company has benefited from operating in markets that emerged from the economic downturn relatively unscathed. Still, he says it has also been able to hire teams from banks that were struggling to make commercial-and-industrial loans, which make up about 40% of the company's loan book. Mills says there is another $250 million in the pipeline.

Attracting talent has been the key to the Texas operations, which account for $800 million in assets, mostly around Dallas-Fort Worth. The hiring continues; Mills says Preston Moore, a former Encore Bancshares CEO, was just recruited to lead an expansion into Houston. Encore was sold to Cadence Bancorp this year.

That's a good sign, says Dan Bass, a managing director of investment banking for Performance Trust Capital Partners. Moore "is obviously very well known in the marketplace," he says.

Although Community Trust's growth has mostly come from its own hard work, it has completed two small acquisitions. It bought the $140 million-asset First Louisiana Bancshares in 2009 and

Acquisitions will continue to complement organic growth, Mills says. As he looks to roughly double the bank's size over the next few years, he sees acquisitions contributing to 30% of the growth. Mills says he is interested in banks with assets of $250 million to $750 million between Dallas and Jackson, Miss. Targets must have strong asset quality and a deep commercial book.

"We want banks with proven track records and succession in their teams," he says. "There has to be an opportunity to continue to grow" the C&I book.

Mills says he is somewhat concerned about the company's ability to grow in Texas through acquisitions, given the rich premiums that banks are fetching. Bass says there is reason to be concerned.

"There should be a lot of acquisitions, but the deals we are seeing are the exceptions," Bass says. "A lot of the banks that would be sellers want to consider themselves to be buyers, also."