Consumer banking

Consumer banking

-

Marcus Castilla was recently named director of the Oklahoma bank's digital banking unit for service members; he shares what Roger offers today and some plans for the future.

July 5 -

The OCC's new Vital Signs initiative gives bankers an important tool to help them assess the financial health and stability of their customers, and to help them build a strong foundation for the future.

July 4 -

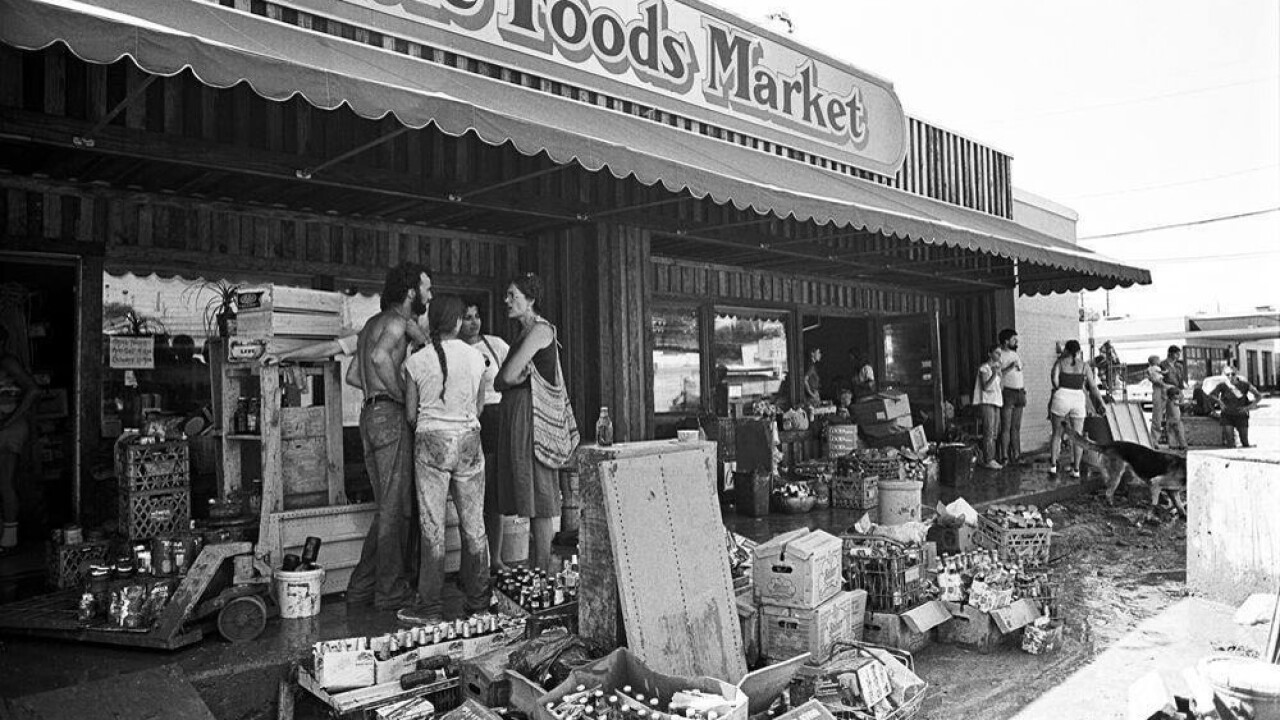

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

With the line between banks and fintechs growing ever blurrier, financial services supervisors ought to consider adjusting regulation to fit the kinds of activity an institution is engaged in.

July 3 -

During a panel discussion at American Banker's Digital Banking conference last week, experts from American Commerce Bank discussed the launch of its virtual banking platform and theorized why other executives might be slow adopters.

July 2 -

With the Federal Reserve holding interest rates at elevated levels through the first half of the year, analysts are sharpening their collective focus on possible fallout from high deposit and borrowing costs.

July 2 -

Old Glory Bank, which has ties to conservative political figures and touts itself as "pro-America," needs to raise more capital to meet its regulator's requirements. "Failure is not an option. We're going to figure this out," the bank's president and CEO said.

July 2 -

The top five community banks have more than $1.2 billion in combined farm loan portfolios as of March 31, 2024.

July 2 -

New top executives were lined up for lenders across the West and Midwest, including Bank of North Dakota.

June 28 -

VersaBank plans to use the one-branch Stearns Bank Holdingford in Minnesota as a platform to expand a lucrative niche business acquiring loan and lease receivables from point-of-sale lenders.

June 27