-

Fidelity Southern (LION) in Atlanta is planning to raise $60 million in a public offering and use the proceeds, along with cash on hand, to exit the Treasury Department's Troubled Asset Relief Program.

June 4 -

Porter Bancorp (PBIB) in Louisville, Ky., has turned to Sandler O'Neill to help it recapitalize after another quarterly loss.

January 30 -

C&F Financial (CFFI) has agreed to acquire Central Virginia Bankshares. Both are in the Richmond, Va., area.

June 11

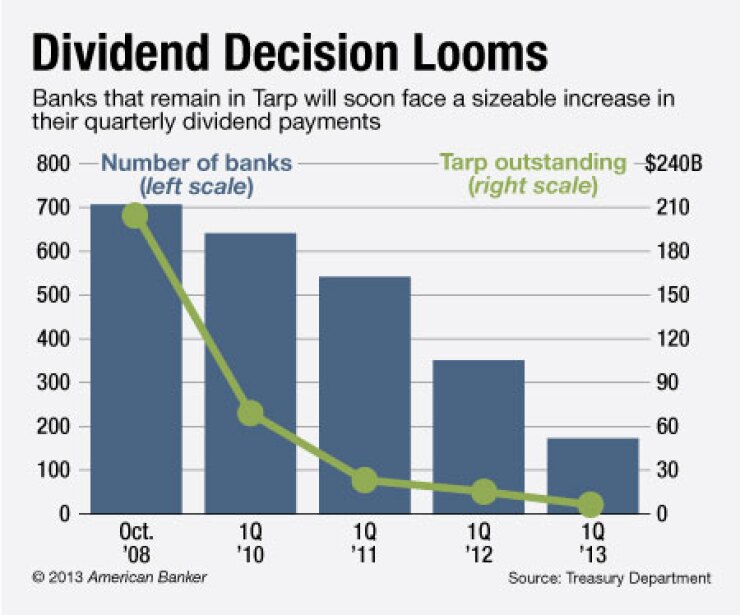

Dozens of community banks with capital from the Troubled Asset Relief Program are bracing for higher costs tied to continued participation.

Banks that hit their fifth anniversaries in the 2008 program face a mandatory hike in dividend payments on the preferred stock, which are scheduled to jump to 9% from 5%. At some banks, higher dividends would kick in during the fourth quarter.

The higher rate would catch up with other banks next year. Meanwhile, Tarp's special inspector general has unsuccessfully lobbied the Treasury Department to renegotiate dividend rates.

"It is a big motive to get out before that jump," says Roger Dick, president and chief executive of Uwharrie Capital (UWHR) in Albemarle, N.C. The $547 million-asset company calculated that, including tax considerations, its rate would be closer to 14%.

Uwharrie has received regulatory approval to begin a private placement to redeem the $2.8 million in preferred stock still held by the Treasury Department. The company, which is current on its dividend payments, originally received $10 million in Tarp funds.

The placement "will be in the local community," Dick says. "The appetite for it is good. We're putting it out at 5.6% and people are hungry for yield."

Other banks are making plans to exit Tarp as their deadlines near, including Fidelity Southern (LION) in Atlanta. The $2.5 billion-asset company

A number of banks will not be as lucky, says Christy Romero, special inspector general for Tarp. She says many banks with Tarp funds remain saddled with problem assets and cannot realistically raise the capital necessary to repay the Treasury Department.

"The community bank industry has just started in the last year getting its feet back on stable ground," Romero says. "Capital is starting to become available, but it's slow and sluggish. Hopefully this is just a matter of buying time."

For some banks, a higher dividend could serve as motivation to stop making those quarterly payments. It could also spur more bank sales.

C&F Financial (CFFI) in West Point, Va., plans to

Banks that owe Tarp funds "unfortunately, with some exceptions, tend to be the weaker banks," says Daniel Wheeler, a lawyer at Bryan Cave. He adds that banks that are "on the edge already may decide to forgo" the higher payments.

A number of Tarp participants are already skipping the 5% payouts. For instance, Porter Bancorp (PBIB) in Louisville, Ky., which will hit its fifth anniversary in November, stopped paying Tarp dividends in late 2011. The $1.1 billion-asset company said in a May 15 regulatory filing that it has accrued $3 million of unpaid dividends. Porter

John Taylor, Porter's president, did not return a call seeking comment.

The dividend hike could also prompt directors of some community banks to "come up with money out of their own pockets" to pay off their bank's Tarp investment, Wheeler says.

The prospect of a 9% dividend payment places unneeded pressure on struggling banks, Romero says. Instead, she says the Treasury Department should renegotiate its contracts with those banks and their regulators in a way that would postpone a dividend hike.

"If they're not able to pay the 5% dividend, they're not going to be able to pay the 9%," Romero says.

Romero says she pitched the idea of negotiating the dividend rates to the Treasury Department, but it was rejected. She declined to discuss the reasons behind the rejection, referring those questions to the Treasury.

"Lowering the dividend rate would not be consistent with our responsibility to wind down the program in a way that maximizes the value the taxpayer's investment while attracting new capital interest in the program," says Adam Hodge, a Treasury spokesman.

The government is unlikely to go along with renegotiated contracts, even for banks that lack the cash inflows to pay a 9% rate, says Rob Carothers, a lawyer at Jones Walker. "It's going to be pretty difficult to negotiate an extension," he says.

"I don't think Treasury would be willing to do that," Carothers adds. "They're going to say to these banks, 'you need to raise capital, or pay the higher dividend.'"