Financial services companies are paying closer attention to places like Albany, N.Y., and Toledo as they try to reach a growing population of underbanked Hispanic immigrants living in and around smaller U.S. cities.

Competition for immigrant dollars in big cities like Los Angeles and New York, where national companies have established themselves in the Hispanic market, is already much tougher than it was a few years ago, executives and observers said.

KeyCorp, for example, has targeted its efforts toward cities including Denver and Albany and has plans to expand into Buffalo, Syracuse, N.Y., Seattle, and Portland, Ore.

"There is a higher concentration [of national banks] in big cities, so I have less competition to play in that space" in second-tier cities, Thomas R. Hawn, the Cleveland company's senior vice president of consumer segment management, said in an interview Tuesday. "If you are doing it right and you are the new entrant, you have a huge advantage in those places."

He spoke to a reporter at the second annual Underbanked Financial Services Forum in Dallas. SourceMedia Inc., the parent company of American Banker, organized the conference.

Executives at the conference also identified opportunities in cities that are not necessarily small but are not typically considered immigrant hubs.

"In these emerging markets like Cleveland and Washington, D.C., our competition has not recognized … [the underbanked] as much," said Daniel A. Weiss, the senior vice president of Microfinance International Corp., which offers check-cashing services, remittances, and consumer loans through storefronts in the Washington area under the Alante Financial name. "Surely they're there, but they are not as dense as they would be in traditional markets like California, Texas, and Florida, where you have Western Union, MoneyGram, and check cashers everywhere."

Drew Edwards, the president and chief executive of Banuestra Financial Corp., which offers check-cashing, remittance, and other services to Hispanics through 12 storefronts in Atlanta, said it hopes to open locations in cities like Seattle, Las Vegas, and Denver.

Some of the largest Hispanic populations served by U.S. Bancorp are found in Iowa and its home state of Minnesota, even though the Minneapolis company also operates in Hispanic hubs like Phoenix.

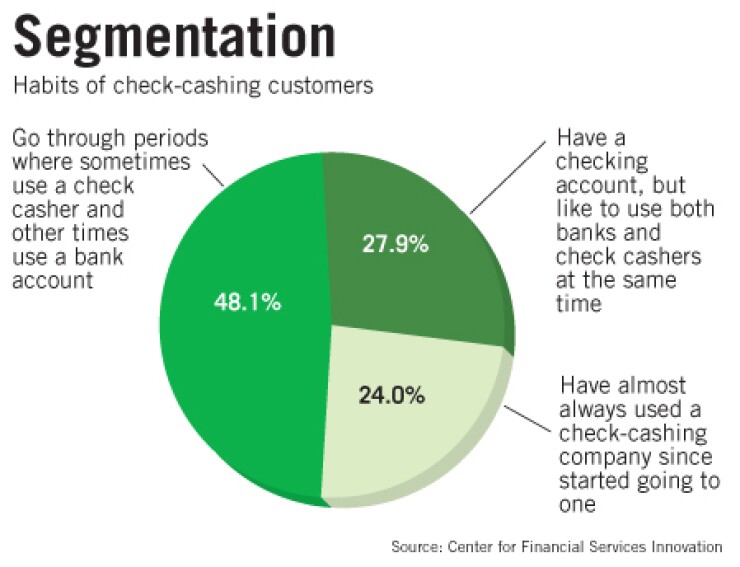

"Looking at these second tier cities may be a gateway" and a "first move" strategy for banks looking to serve underbanked Hispanics, said Jennifer Tescher, the director of the Center for Financial Services Innovation, a nonprofit affiliate of Chicago's ShoreBank Corp. "The retail banking explosion primarily happened in larger cities, and competition in smaller cities is more likely to be from smaller community banks."

However, Ms. Tescher cautioned those looking at smaller cities not to underestimate the competition. "I don't think second-tier cities are underserved."

During the 1990s, Hispanic population growth in the United States was strongest in the Midwest and the Southeast, where it at least tripled, according to the Census Bureau.

At the same time, the slowest growth — as low as 7.8% — came in states like California, Texas, and New Mexico.

About half of Hispanic households make $36,000 a year or less, according to the Pew Hispanic Center, a division of the Pew Research Center.

Gwen K. Dalton, a program manager for Fiserv Inc.'s Information Technology Inc., said there is "a huge growth opportunity" in smaller cities. "Bankers simply can't ignore to afford that [Hispanic] consumer base."

Experts at the conference also said that to reach the underbanked, companies may have to abandon some traditional notions about financial services.

Trent Spurgeon, the senior vice president for product and segment management at U.S. Bank, said that banks should not brand themselves as traditional "marble-based" institutions with Hispanic immigrants, who may feel more comfortable managing their money in places like check-cashing outlets.

"As traditional bankers, we hope we can retrofit [underbanked services] to traditional infrastructure … but I am not sure that is a true or hopeful outcome," Mr. Spurgeon said.

U.S. Bank, which launched a remittance program with MoneyGram International Inc. in 2004, was "very well positioned" to serve the Hispanic market with a "full product suite" of custom tailored debit, deposit, and remittance products and services, he said.

Mr. Hawn explained KeyBank's use of the idea of "culturgration," — a measure of an immigrant's integration in a local culture — in determining which Hispanic consumers it could best serve.

KeyBank is targeting immigrants who spoke English as a second language and had established tax identification numbers allowing them to work in the country, he said.

Migrant workers paid in cash, along with the children of immigrants, were less likely customers for KeyBank products like checking services and debit cards.

Ms. Dalton agreed with Mr. Spurgeon that banks must establish new best practices and products instead of trying to fit the needs of Hispanic consumers into their current operating models.

Banks must establish trust and provide incentives for consumers to use an institution's services, she said.

"It goes so far beyond translating marketing brochures."

Mr. Edwards said Banuestra, which once was partly owned by SunTrust Banks Inc., can help immigrants apply for individual tax identification numbers with the Internal Revenue Service — a critical step to entering the U.S. financial mainstream.

Banuestra is in talks with private-equity groups to help fuel future growth, Mr. Edwards said. He hopes to raise the number of consumers it serves by tenfold, to 240,000, with the help of additional capital.

He also suggests that companies interested in the sector commit themselves fully from the start. "If you tiptoe into the space, you are going to get burned."