Don't let recent approvals fool you; regulatory scrutiny is still holding back bank M&A.

Increased oversight is keeping some would-be acquirers on the sidelines. In other instances, compliance issues in areas such as money laundering prevention or the Community Reinvestment Act are complicating matters.

Fifth Third Bancorp, for instance, recently revealed that it had received a

-

The $140 billion-asset company disclosed Thursday in a regulatory filing that the Federal Reserve Board downgraded its Community Reinvestment Act rating to "needs to improve."

July 14 -

Recent speculation that Comerica is on the block has sparked a conversation about how regulators would vet the sale of a SIFI.

May 12 -

The long-delayed approval of the merger of M&T and Hudson City should have been a bright spot in postcrisis M&A, but a small footnote from the Fed quickly reminded bankers that dealmaking will remain a demanding process.

October 1

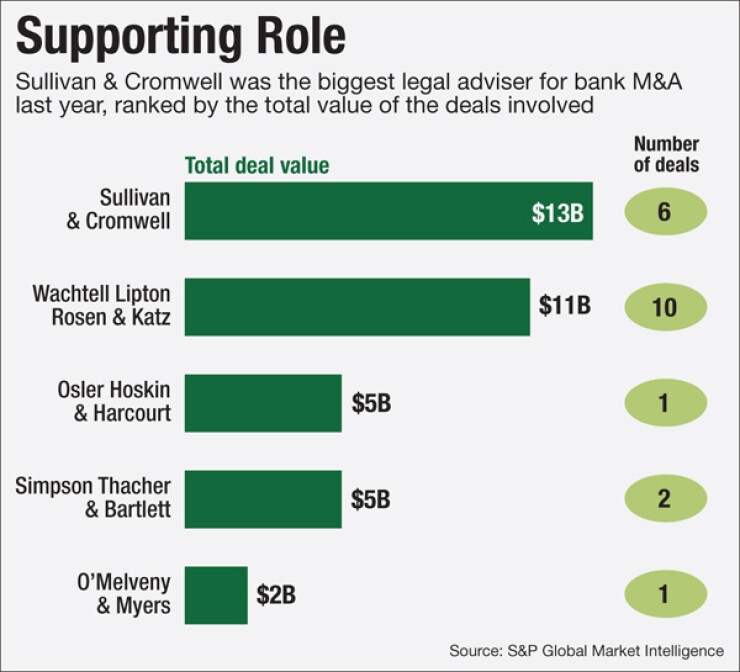

M&A will pick up as more banks adjust to current regulatory conditions, said H. Rodgin Cohen, senior chairman of Sullivan & Cromwell. He is also betting that larger institutions, which for the most part have sat idle since the financial crisis, will again become active acquirers.

"I think we will see an increase in deals when banks learn to accommodate regulatory expectations," Cohen said.

"If not direct, but indirectly, the banking industry has paid tremendously for the financial crisis with this low rate environment," Cohen added. "That may be good for the economy, but it is certainly bad for banks."

Cohen, who was also heavily involved in negotiating the release of Americans during the Iran hostage crisis, has had a long and storied career focusing on banking regulation and securities law, while also helping banks navigate some of the largest acquisitions in recent history. Two of his favorite deals — First Union's $13 billion purchase of Wachovia 2001 and Bank of New York's deal for Irving Trust in the 1980s — stand out because he ultimately viewed them as true success stories.

Cohen, 72, said he would retire "someday" and focus on philanthropy and stamp collecting. Until then, expect to see him advising bankers on regulatory issues and consolidation.

The following is an edited transcript of a recent conversation with Cohen.

Why has bank M&A been slower this year?

H. RODGIN COHEN: I think several factors are responsible. One is that larger institutions are out of the M&A game for the most part. Second, there are a number of banks that continue to get [Camels] ratings that take them out of the game. There are a number of banks under investigation by various government agencies and, for practical purposes, that takes them out of the game either because their regulators are saying don't do acquisitions or sellers would be very reluctant to sell into an ongoing investigation.

In fairness, another key factor that is mystifying to me is an investor fixation on tangible book value dilution and the payback period. The problem is new. It is really hard to pay the premiums sellers typically demand and not have a tangible book value dilution and keep that within what some investors seem to think is the 11th Commandment, which is thou shall not have a more than five-year payback period. There is a tremendous amount of confusion about how you calculate the dilution and how you calculate the payback period, so no matter what an institution puts up someone will say that isn't calculated correctly.

What kind of regulatory orders are banks facing?

If you get a 3 on management [for Camels ratings] you shouldn't be doing deals, regulators say. A "needs to improve" on the [CRA] takes you out as well. Beyond that, if you're under an active investigation by the [Consumer Financial Protection Bureau] or law enforcement authority, the regulators would be very discouraging of a deal.

Bank Secrecy Act and anti-money-laundering concerns have been some of the biggest hot buttons in M&A. What is going to be the next big issue?

I think it's already happening with the CFPB investigating what they believe are a variety of consumer issues. A particular one on the CRA is they're looking at what I call the doughnut theory. If a bank has lots of branches in the suburbs ringing the city then none in the core, so you have the hole, then that's a problem. These are issues — right or wrong, you could argue it — but the bottom line is that if you have these problems you won't get deals approved.

Big-bank M&A has been slow since the crisis. Do you anticipate that changing?

It's hard for me to believe that the superregionals and the next level of regionals won't return to substantial acquisitions. We've seen Key, Huntington and New York Community announce deals. We've seen BB&T doing a number of deals and that leaves some very skilled dealmakers out there.

When these banks do return to M&A, what will those deals look like?

I tend to believe that deals are seller-driven rather than buyer-driven. To an extent, it will depend on what is available, but for the most part I think you would rather do larger deals than a series of smaller deals because the risk is greater. If you start a series of smaller deals, you never know if you will complete it.

There were some rumblings Comerica may sell, though

The Federal Reserve has taken what has become known as the financial stability factor, which was added by Dodd-Frank, and used it as a test. [The Fed] applies it quite religiously in larger deals. I don't think it would be off limits for a super regional or a large foreign bank that had an interest in doing [a deal for Comerica]. I also would be shocked if [such a sale would be] anything other than totally consensual. If [Comerica's CEO and Chairman] Ralph Babb and his board decides to stay independent, I'd be surprised if it turned out any differently.

What is the regulatory environment like right now for foreign banks?

I think you can divide them into four groups. The first two are foreign banks which have a substantial presence here, or they don't. The others are [divided by] whether or not they are a [global systemically important financial institution]. You have the most flexibility if you're not a GSIFI and you have very little presence here. You have the least with the reverse. I'm not sure if there's a single foreign bank that would be precluded from doing a fairly significant transaction in the U.S.

The Fed is requiring foreign banks with a significant presence here to form intermediate holding companies over their U.S. operations. Will that deter them from doing acquisitions?

The IHC is a dilemma because it is as new for the regulators as it is for the banks. But I think that's the necessity of dedicating so much in the way of resources and time [such that it] has actually curtailed the appetite of foreign banks. You only have so many resources. A number are going through [the Comprehensive Capital Analysis and Review] for the first time, or they are in the first stage of CCAR. I think they will get this under their belts. You look at someone like Toronto-Dominion, which has done a great job with acquisitions. MUFG has had fewer deals but has managed to handle them very well. Those are just two. RBC just did a deal for City National. I think that's working out hopefully well for both sides. I think there are very skilled acquirers that understand the U.S. market. Until the last 10 or 15 years this country was littered with failed foreign banks. But it's now come down to those that understand and appreciate the U.S. market.

What separated those that failed and those that succeeded?

I think those who failed usually did for two reasons. No. 1, they picked up properties that were very troubled and it's very hard to fix a troubled bank. I'm not necessarily talking about near failure but there were a number that were purchased that were in really bad shape. Second, they couldn't figure out how to coordinate control from outside the U.S.

Some bigger deals have drawn a lot of scrutiny. Any tips on how to avoid unwanted attention?

It begins with anticipating what's going to happen. You know that there are very effective community groups that are going to get interested in a deal of a certain size. You have two ways to go. You can sit around and put a blindfold on and hope they will not come, then start negotiating [with them] months into the deal. Or you can engage in outreach. In large deals or in small deals, I think the most successful institutions engage in that outreach. You should anticipate that political leaders will be concerned when there are job losses or other adverse impacts. Part of your preplanning is how you will counter concerns, and then I will strongly urge outreach virtually simultaneously with the announcement of the transaction to the individuals who are most likely to be concerned.

What advice do you have for small banks looking to do their first deal?

I think the most important thing they could do is talk to their principal federal and state regulators to make sure they understand that the bank is interested in expanding by acquisition. They need to make sure the regulators know they have thought through an acquisition strategy and they are well prepared to take the action.