Consumers’ use of mobile and online banking has skyrocketed during the coronavirus pandemic as banks have limited in-person visits to appointments or drive-through service, or completely closed branches.

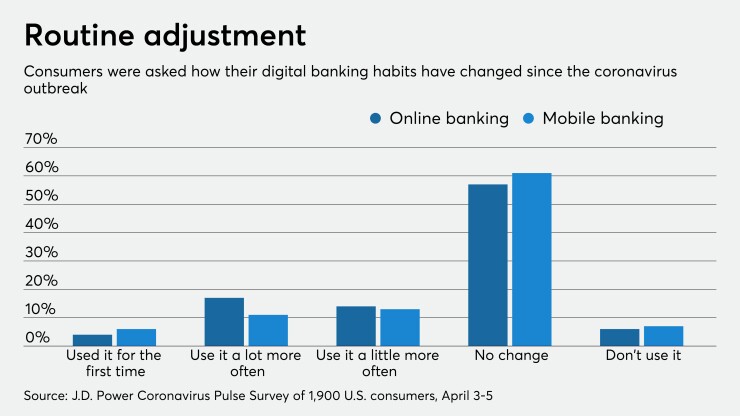

As of April 5, 30% of consumers surveyed by J.D. Power were using their mobile banking app more, and 35% were using online banking more, than they were pre-coronavirus.

The trend was expected, but those numbers still are eye-catching. They also raise two questions: Is the trend uniform across all asset classes? (No.) And will this behavior continue after the health emergency is over? (Maybe.)

Bankers in the trenches confirm the big increases in digital banking use.

BBVA said its mobile banking logins have hit record highs at its U.S. unit.

“In the first three weeks of April, we had 16% more logins than March for the same time period,” said Jose Luis Elechiguerra, head of business development for BBVA USA. The average number of customer logins grew from eight to nine in the three-week period. Online banking logins in the first three weeks of April grew 40% compared with the same period in March, and average logins per user rose from 7 to 8.6.

“Online has been an instrumental channel to support our small-business customers — and in particular the process we put into place for the online Paycheck Protection Program portal, which we set up in record time,” Elechiguerra said.

J.D. Power has been conducting a weekly pulse survey of 1,900 people across America to see how the coronavirus is changing people's behaviors in banking.

Among the four largest banks (Bank of America, JPMorgan Chase, Citigroup and Wells Fargo), use of mobile banking has increased from 63% of customers on average in 2019 to 72% so far in 2020, the research firm said.

“We are seeing a lot of engagement in our digital channels,” said Ben Soccorsy, head of digital payments in Wells Fargo's virtual channels unit.

Its use was on the rise even before most Americans began sheltering in place. Wells Fargo had 30.9 million active digital customers at Feb. 29, the latest available figure. That was up 2% from three months earlier and 3% from a year earlier. The number of active mobile banking users grew 1% from the end of November and 6% from the end of February 2019.

Mobile check deposits have soared. In March, the dollar volume for mobile check deposit was up 50% over the month before. The number of checks deposited through a smartphone rose 40%.

“That shows significant behavioral shift,” Soccorsy said. “Behaviors are in a state of flux as the world is shifting under people's feet. But I think we are seeing a mix of increasing engagement with existing customers, and customers who have historically not used something like mobile check deposit trying it in response to the changing availability of their branch options.”

Like other banks, Wells Fargo has made some branches open by appointment only and others drive-through only, depending on local shelter-in-place restrictions.

Some of the increase in digital banking adoption is people using mobile banking for the first time, according to J.D. Power’s research. Six percent of people surveyed said that since the coronavirus pandemic started, they were using mobile banking for the first time; 4% said the same of online banking.

“Out of necessity, folks are having to change their behavior around their financial lives,” Soccorsy said. “And, it's not just financial services. Everyone's having to try things in new and different ways across everything they do.”

Big-bank advantage widens

The pandemic is also accelerating the trend of large banks gaining digital customers at a faster rate than smaller and midsize banks.

“The big banks are setting the pace,” said Bob Neuhaus, vice president of global financial services at J.D. Power.

BofA, Capital One Financial, Citi, BBVA, JPMorgan and Wells rank highest in digital engagement in J.D. Power’s recent studies. The firm considers consumers using four or more digital tools, such as alerts, person-to-person payments and bill pay, to be highly digitally engaged.

“I liken this to a marathon where they put the fastest runners at the front of the race at the start, so this is where they were positioned going into this marathon, and that enables them to have their customers be more self-service and put less pressure on the contact centers,” Neuhaus said.

More highly digitally engaged customers are also more satisfied than their branch-using counterparts, the research showed.

Before the pandemic, about 10% of U.S. retail banking customers were branch-only, according to J.D. Power’s latest retail banking satisfaction study.

But this varied by bank size. Among the largest banks, 8% of customers said they were branch-only; at midsize banks, 15% of customers said this. Among those who identify as branch-only users, 68% are baby boomers or “pre-boomers” (people born before 1946).

The midsize banks have fallen behind due to the fact that they tend to have an older customer population and lack the large budgets of the top-tier banks, Neuhaus said. Midsize banks also tend to rely on outside technology vendors and have less control over their technology.

“They're definitely transforming,” Neuhaus said. “They've been transforming at a slower pace than the big banks.”

Neuhaus said one thing big banks excel at is helping consumers understand mobile apps and what they do.

“If you're trying to get people to use more features and really get the full benefit of the app, there's a level of communication and engagement that needs to occur that goes beyond the pure self-service model,” he said.

Help with setting up alerts properly or using financial planning tools are two examples.

“When customers were engaging both with the branch and digital channels, that gave banks an opportunity to coach their customers on the use of the app in the branch,” Neuhaus said. “When you take the branch out of the equation, consumers are more left on their own.”

J.D. Power has been tracking other impacts of the coronavirus pandemic. About 20% of consumers are reporting long wait times on the phone, and 9% are reporting that ATMs are out of cash.

“That’s high if you're out and you're stressed and trying to run your errands fast and get home,” Neuhaus observed. “You have a one in 10 chance of not getting cash when you want it. That's a stress point.”

Downed websites have risen from 9% to 15% during the pandemic.

Because of website outages, long hold times and lack of knowledge about how to use digital banking tools, 14% of consumers are very concerned and 42% are somewhat concerned about being able to continue to conduct their banking activities during the coronavirus crisis.

“A majority of consumers are concerned about conducting their banking business,” Neuhaus said.

What will the new normal look like?

J.D. Power has also asked customers how they expect to behave when the crisis subsides.

Some people are saying they plan to go back to their usual habits. Eleven percent plan to visit the branch again, and less than 20% plan to use mobile banking more than they did pre-crisis.

“Forty-six percent said they'd go back to how they behaved before, which means that more than half are changing the way they interact with their banks,” Neuhaus said.

Elechiguerra agreed.

“Typically when our customers learn and adapt to the convenience of checking balances and conduct transactions by swiping on their smartphones, they become less intensive on nondigital channels and see the advantage of not commuting to a branch or not to wait on the phone,” he said. “We believe that the future of banking is to transform into a more convenient and frictionless bank to help our customers reach their goals and, while branches will always be an important channel to have available for our customers, digital channels will play a fundamental role in this transformation.”

Soccorsy concurred. “My own view is that this is going to be an accelerant to the digital banking trend,” he said. “I think customers will be delighted with the convenience of doing many of the things that they were doing in other channels through digital banking, as a result of this crisis. You may see customers unwilling to go back to the way things were. This is the kind of disruptive event that changes behaviors in many ways. But we haven't seen anything like this in our lifetimes, so it's going to play out in front of our eyes.”