IndyMac Bancorp Inc.'s prospects look increasingly grim, with some analysts talking openly Tuesday about the possibility of a regulatory takeover.

The $32.3 billion-asset Pasadena, Calif., thrift company may seek to shore up its capital position by selling remaining businesses, and it held out hope that once "this housing and mortgage crisis abates and we return to health" it could resume lending. But observers said IndyMac may not have enough time to ride out the storm.

Jason Arnold, an analyst at Royal Bank of Canada's RBC Capital Markets, lowered his price target for the company to zero, from $1.50 a share, in a note to clients Tuesday that was titled, "Next Stop, Receivership."

IndyMac "will not survive without a material capital injection, which is now even more unlikely than before," Mr. Arnold wrote. "We think the company is backed into a corner with little hope for escape."

Paul Miller, an analyst at Friedman, Billings, Ramsey Group Inc.'s FBR Capital Markets Corp., also lowered his price target for IndyMac to zero, from $1.00 a share.

"We are not predicting" IndyMac's "failure, but we expect that the value of the common equity left after today's announced actions will be immaterial," he wrote in a research note issued Tuesday.

Bert Ely, an independent analyst in Alexandria, Va., who has built his career on accurately predicting failures, said the odds are stacked against IndyMac.

"IndyMac is facing a real struggle," he said. "It quite possibly will fail."

If the company is seized by regulators, the Federal Deposit Insurance Corp. would likely establish a bridge bank, because of IndyMac's size, small number of interested bidders, and doubts about the quality of its portfolio.

The FDIC "would be looking at a bridge bank," said L. William Seidman, the agency's chairman during the savings and loan crisis. "It depends on whether they believe they can take it over to sell or whether taking it over will be useful, and helpful for the overall economy, rather than selling it piecemeal and closing it down."

IndyMac would not make executives available Tuesday. But the company did agree to sell most of its retail mortgage branches to Prospect Mortgage. Financial terms were not disclosed but the deal includes more than 60 branch offices and about 750 employees.

The company, which last year abandoned its core alternative-A mortgage business, said Monday it would cease most mortgage production. Doing so was its only option to shrink its balance sheet and address its increasingly dire capital position after failing to raise funds from investors, IndyMac said.

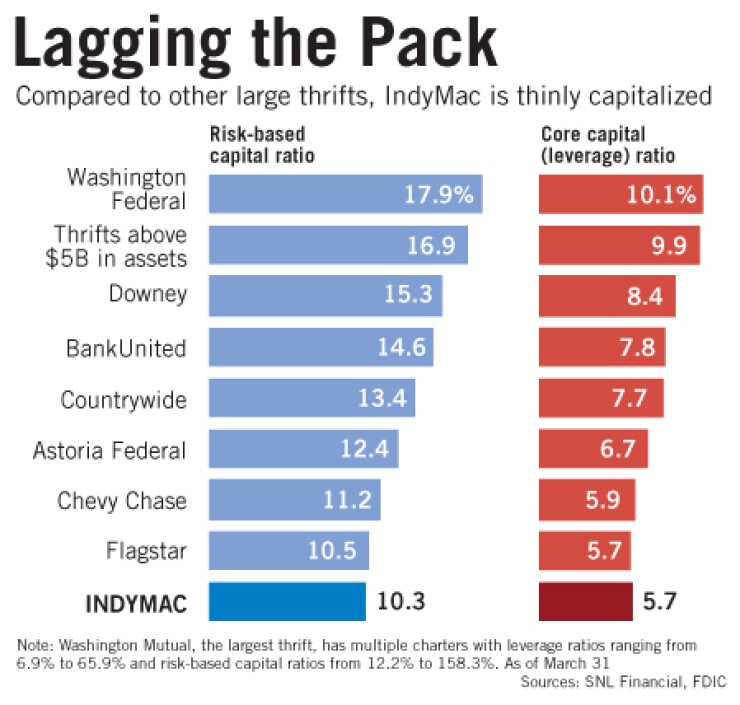

Regulators have told the thrift company it is "no longer 'well capitalized,' " chairman and chief executive Michael Perry wrote in an open letter posted on a company Web site Monday. In a Securities and Exchange Commission filing Tuesday, IndyMac said the Office of Thrift Supervision had subjected it to a range of constraints, including on dividends and compensation, and that the company expects "the OTS will want to formalize the" various limitations "as well as potentially other matters in a public document as part of their normal supervisory process." An OTS spokesman said Tuesday, "We're aware of the situation and we are working closely with the institution."

IndyMac would be the second-largest banking company to fail; Continental Illinois in 1984 was the largest.

According to Mr. Perry's letter, because regulators no longer consider IndyMac to be "well-capitalized," it can no longer accept brokered deposits without a waiver. For that reason, Mr. Arnold said, the company could face a "liquidity meltdown."

In his note, Mr. Arnold wrote that "if brokered deposits run-off more swiftly or if the depositor base pulls money out on concerns over" IndyMac's "ability to survive," the company could be forced into "a spiral of forced asset fire sales and more material losses as funding disappears, which could lead to a rapid unwinding of the business."

Fitch Inc. cut a slew of ratings on the company, saying that its new " 'E' Individual rating reflects a bank with very serious problems, which either requires or is likely to require external support."

Christopher Wolfe, a managing director with Fitch, said "it may not be enough" for IndyMac to shrink the balance sheet.

"It's going to be a function of how long regulators give them to get back to 'well-capitalized,'" among other factors, he said. "Further impairments" and "other reserving actions" are also possible.

In a January letter to employees, Mr. Perry wrote that IndyMac "took advantage of the mortgage market disruption to build a retail lending platform from almost nothing a year ago to a group of almost 2,200 professionals today."

But on Monday he said IndyMac was closing both its retail and wholesale production businesses because they "are not currently profitable due to the continuing erosion of the housing and mortgage markets."

Mr. Wolfe said Fitch had regarded the conversion to the conforming mortgage business with doubts from the outset, because "the margins are so slim and you really need to have the scale to make it work."

"They've traditionally been a rather specialist" alt-A "mortgage entity" — a business "that has severely dried up," he said.

After cutting its work force in half, to "roughly 3,400 or so over the next couple of months," Mr. Perry wrote Monday, IndyMac will have about 1,450 employees in servicing, 800 at its reverse mortgage business, 400 at its retail and Web bank, 500 "in portfolio management and administration," and 250 involved in the discontinued businesses. "We have had to retrench and then rebuild several times over the past 15 years, but clearly these are the largest and most difficult staff reductions we have ever had to make," he wrote.

Mr. Arnold ascribed little value to IndyMac's remaining businesses.

"The option that was out there in the past was to raise capital. I think that if they would have done that maybe a year ago, they could've gotten someone to bite," he said in an interview. "At this point in time, you look at the rapid rise" in nonperforming assets, "it's something that will probably scare anyone that's even potentially considering an investment. From an acquisition perspective, we don't think there's much franchise value left." He cited IndyMac's reliance on wholesale deposits.

Mr. Wolfe said: "There probably is some value in the retail bank. I'm not sure how much. I'm not sure if they would get much of a premium for it."

Ralph F. MacDonald 3rd, a partner in the law firm Jones Day, noted that there is a market for servicing assets and said: "There's some room there. But it's going to be tight, because you know what happens when you're publicly naked on capital, is anybody who is going to look to buy assets from you knows you have to sell and they're going to squeeze you."