-

Fifth Third Bancorp and U.S. Bancorp say they will delicately approach expenses in 2015 or at least until rates rise. They are investing where they must, but pinching where they can, and trying to manage expectations on loan growth.

January 21 -

After a surprising fall swoon, demand for commercial loans bounced back in December. Lenders, meanwhile, are paying much more attention to how falling energy prices could impact loan portfolios.

January 29

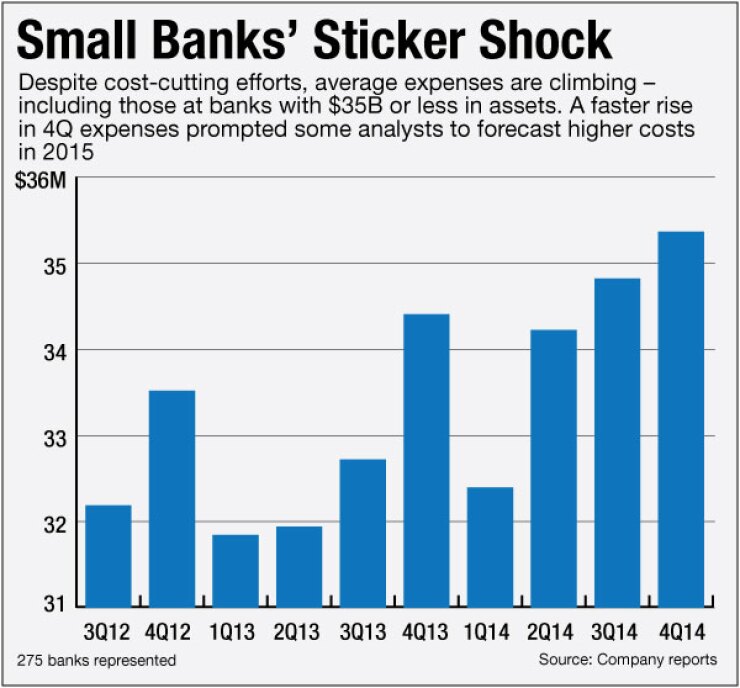

Higher-than-expected expenses in the fourth quarter could be a signal that banks cost-cutting initiatives are losing steam.

Banks have benefited from

The results disappointed analysts. More than 85% of banks reported higher expenses than consensus estimates, according to a

Rising expenses show that cost-cutting has been getting harder each year, said Terry McEvoy, an analyst at Sterne Agee. McEvoy said he plans to update his firms earnings model to increase expense estimates for this year and 2016.

Banks have focused on cutting costs for the past several years, and generally they have been successful, McEvoy said. Unfortunately, now there are new areas that need investment.

The good news is that revenue has outpaced rising costs. Average revenue at the banks analyzed by American Banker rose nearly 11% from a year earlier, to $54.5 million, because of an 11% rise in net interest income and a

Despite stronger revenue, higher costs caused the average efficiency ratio to decline by 1 basis point from a year earlier, at 64.8%. The ratio had been declining since the fourth quarter of 2013.

It is easy to make too much of the quarters increase in costs, and hard to determine the causes. There is a seasonal component to the high fourth-quarter expenses, as banks tend to book one-off costs at the end of the year.

Still, analysts and some bankers pointed to systematically higher compliance and technology costs that are likely to continue at least throughout this year.

I think were going to have heavy lifting for many years to come in terms of expenses, Joseph DePaolo, president and chief executive of Signature Bank, said during the New York companys Jan. 22 conference call. He told analysts to expect year-over-year expense growth in the mid-teens in 2015, compared to typical increases of 10% to 12%.

Were anticipating a fair level of regulatory spend for the foreseeable future, DePaolo warned.

Much of the investment is in areas like compliance and risk-management that dont provide offsetting revenue, McEvoy said.

During the financial crisis, upgrading accounting systems and operating platforms wasnt a top priority, McEvoy said. Were seeing some catch-up institutions that are in a more stable position and are thinking about internal investing.

Incremental expense pressure will make increasing revenue more crucial this year, analysts said. Expecting earnings growth through expenses cuts, rather than higher revenue, may no longer be a viable strategy.

For 2015, its going to be tough to show positive operating leverage without better revenue growth, said Peter Winter, an analyst at BMO Capital Markets.

Based on fourth-quarter results, BMO raised its expense estimates for the banks it covers from flat to 2% growth over 2015.

The regulatory environment has really changed, and this is the new paradigm that were in for banks, Winter said. The bottom line is that its getting more challenging to cut expenses, and thats combined with increased regulatory compliance and the need to invest for future growth in a challenging environment.

Not all industry observers see this as the end of cost-cutting leverage. Frank Schiraldi, a Sandler ONeill analyst who covers super-community banks in the mid-Atlantic, said noninterest expenses came in about 1% higher than his group expected, mostly due to regulatory costs. But he sees it more as a blip than a trend, and his firm did not raise expense forecasts for 2015.

Banks continue to talk a good game in terms of their cost-save initiatives for 2015, centered around technology updates and thinning of branch costs, Schiraldi said. These efforts should help banks at least run in place while drumming up new revenue.

Schiraldi cited Fulton Financial as a bank that impressed on expenses in spite of regulatory pressures. Despite dealing with Bank Secrecy Act issues, the $17 billion-asset companys noninterest expenses rose less than 1% from a year earlier, to $117.7 million, which was lower Schiraldi had forecast. He called Fultons forecast of low-single-digit expense growth in 2015 a big positive.

For most banks, however, the cost guidance for the rest of the year suggests that the expense bump is not a one-quarter anomaly, McEvoy said. Banks will have to dig deep with expense cuts to balance rising baseline costs, he said.

There will continue to be the need to add to regulatory and compliance and improve systems and technology, McEvoy said. Banks will be challenged to offset that.

Paul Davis contributed to this report.