Student loan debt isn’t just a financial problem for consumers. It’s an emotional problem, too.

When Mike Crawford and his team at Fifth Third Bank in Cincinnati were exploring new ways to meet the needs of millennial customers several years ago, they came to this realization at a focus group, where discussions of student loan debt brought a 30-year-old borrower to tears.

“The best innovations typically aren’t focused on new functional needs but how do you fill in the gaps in emotional needs?” said Crawford, vice president and senior manager of digital-first product development at the $185 billion-asset Fifth Third. “One struggle in this generation is the feeling that student loan debt is different from a mortgage or car loan, that they can’t get out of it and have no control over it.”

In 2017, the bank launched Fifth Third Momentum, an app that automatically rounds up customers’ debit card purchases to the nearest dollar and directs these amounts to their student loan balances. There have been nearly 100,000 downloads of the app to date; about two-thirds of the users are millennials, and a third belong to older generations.

“The notion of how do you create this accountability partner, but not in a shameful way, was at the root of what we were trying to do,” said Crawford.

Momentum is not the only tool designed to help consumers manage their debt load, but it is one of the few offered directly by a bank. Some banks, including Citizens Financial Group, Discover and Wells Fargo,

A number of fintechs, including FutureFuel.io, Savi and Summer, are stepping in to fill that gap: helping students figure out which federal and state loan forgiveness or repayment programs they are eligible for, as well as how to enroll in the one that is best suited for their situation. These services may also help students strategize refinancing private loans and provide other pieces of advice.

They see themselves as complementary to banks and are slowly making inroads with bank partnerships.

Their argument: Banks can benefit from helping their customers lower their student loan payments, because borrowers who free up potentially hundreds of dollars a month can stay on top of bills, take the plunge on homeownership or other large purchases, and ultimately feel more loyalty toward their financial institution.

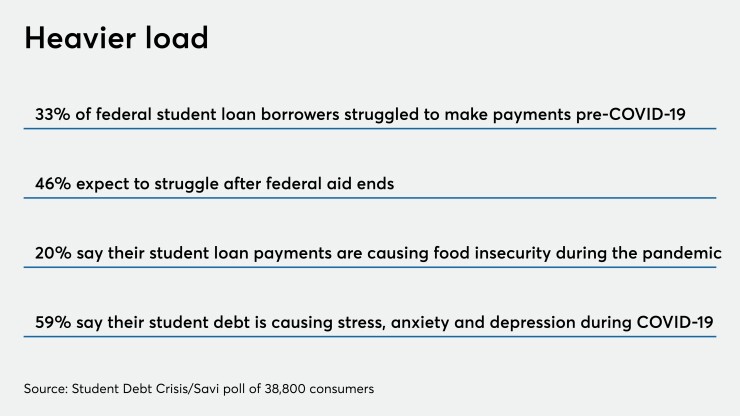

Some of these startups also say the matter is urgent. Direct federal loan payments are paused through September under the coronavirus relief bill, but borrowers will need to resume payments in October. At the same time, some older federal loans as well as private loans were not covered under this relief measure.

John Thompson, chief program officer at the Financial Health Network, acknowledged that student loan payments are one of several challenges people are facing right now and are not the top priority for everyone.

But, “for many people, dealing with student debt is in the early part of their financial lives,” Thompson said. “If actionable advice on how to manage student debt comes from a bank, that’s a critical part of establishing loyalty and trust.”

Solving the student loan problem

In its latest Report on the Economic Well-Being of U.S. Households, the Federal Reserve found that as of late 2019, 43% of those who went to college, representing 31% of all adults, had incurred some debt (largely student loans, but the debt comes in the form of credit cards, home equity lines of credit and other loans as well) for their education.

Currently, borrowers owe a total of $1.6 trillion in student loan debt, according to the Federal Reserve Bank of St. Louis.

The impact of student loan debt can also be measured in terms of financial health. The Financial Health Network’s U.S. Financial Health Pulse survey from May found that only 18% of those with student debt are financially healthy, compared with 36% of those without student debt. The Financial Health Network takes several factors into account, such as the ability to pay bills on time and have sufficient liquid savings.

Savi is one startup that addresses this problem by combing through national and state repayment and forgiveness programs for its users and matching them with the best option — say, a forgiveness program based on the borrower’s profession. Users can manually enter their loan information or sync it using Plaid, and Savi will pre-fill application forms to enroll them in the appropriate program.

Savi is available to customers or members of partner organizations. Financial services provider TIAA, which owns TIAA Bank,

Savi is offering a lightweight version of the software free for the next few months to those hurt financially by the pandemic.

Tobin Van Ostern, co-founder of Savi, sees his tool as a fit for banks in two ways: freeing up their customers' cash flow and supporting those who face financial hardship.

“If we’re able to improve the financial wellness of their end users, that has a broad, positive ripple effect,” he said. “If we’re saving $150 per month, that is immediate cash flow that folks might set aside for retirement or use to buy a house or purchase a car.”

On the flipside, customers who have lost a job or are experiencing financial distress will face more difficulties keeping up with their other debts. If they can get a temporary reprieve on their student loan payments with an income-driven repayment plan, they increase their chances of staying current on other bills.

Consumers can use the basic version of Summer, a similar service, for free. They can organize their loans in one dashboard, check eligibility across 100 assistance and repayment programs, compare options, submit their applications and more. A premium version includes financial advice and other perks.

Will Sealy, co-founder and CEO of Summer, said the startup is in talks with 40 banks and credit unions to integrate into their servicing and collections unit.

He echoes Van Ostern in casting Summer’s benefits to financial institutions as twofold: a way to increase value and to prevent defaults and mitigate delinquencies. The latter is especially relevant during the pandemic.

“Financial institutions see value in improving the cash flow of existing customers who might be at risk of defaulting on loans they already owe the institution,” Sealy said. “With the CARES Act unemployment benefit of $600 per week expiring in July and state assistance running out for most customers this fall, they recognize there is a reckoning coming with potentially millions of people defaulting on mortgages and car loans and missing credit card payments.”

Institutions can also use this tool to be proactive. For example, if a customer’s checking account balance drops significantly, the bank could potentially target that customer for an income-driven repayment plan. Customers who are unemployed may be eligible for a $0 monthly payment.

A third service for student loan borrowers is FutureFuel.io. Besides guiding users through repayment plan options and helping them apply for loan forgiveness, this tool has features that put spare change toward loan balances and lets users earn back cash for shopping at certain merchants.

FutureFuel.io's service is available to customers of the challenger banks Chime and MoneyLion. The company has also partnered with credit unions, which largely offer its service as an employee benefit, but rollouts to credit union members are planned.

“This gives banks the opportunity to not only realize what is effectively an increase in deposits, but an opportunity to help that consumer put that money to work on wealth creation and a nest egg,” said Laurel Taylor, founder and CEO of FutureFuel.io.

Depending on the company, these tools can integrate with banks via application programming interface, a hybrid approach of API and embedded framed-in widgets that would launch from the institution's own website, a web link to a co-branded version or as a white-label product.

“The path to building more profitable customers," Thompson said, "is investing in their financial health.”