-

PacWest Bancorp (PACW) in Los Angeles is experiencing life on the other side of the bargaining table after its bank agreed to sell 10 branches to Opus Bank.

July 9 -

PacWest Bancorp (PACW) in Los Angeles is dead serious about expanding its California footprint through acquisitions.

May 9

C. G. Kum may want to send Matthew Wagner a gift basket for

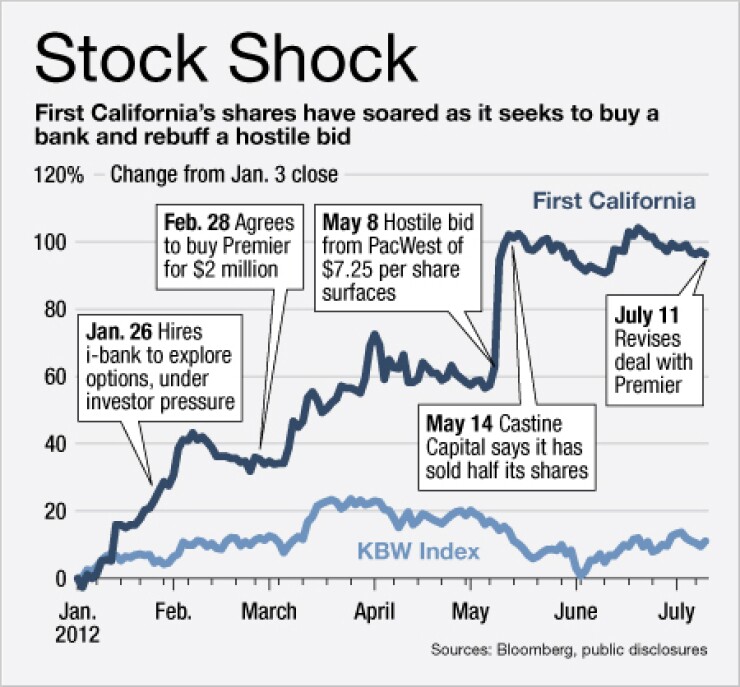

Kum's pending all-stock purchase of a small Los Angeles-area bank could prove more lucrative thanks to the tug-of-war between his First California Financial Group (FCAL) and Wagner's PacWest Bancorp (PACW).

First California in Westlake Village

First California closed at $5.43 on May 7, and its shares have hovered between $6.60 and $7 per share since PacWest's announcement. Two of the $1.9 billion-asset First California's shareholders — Basswood Capital Management and Loeb Capital Management — have urged the board

The dollar value of the deal would stay the same. But First California expects to issue about 38% fewer shares than initially planned to pay for the deal, and it is now expected to close by yearend instead of Aug. 31 as first scheduled.

Premier "continues to have a strong customer base and fits into our desired geographic footprint extremely well," Kum, the president and chief executive of First California, said in a press release. "We look forward to closing the transaction as soon as possible."

The terms of the renegotiated deal would make it less dilutive to holders of First California's roughly 29.24 million outstanding shares. It probably would be more accretive more swiftly on an earnings-per-share basis, too.

First California did not discuss Wednesday how the new terms would affect shareholders, nor did it return a phone call seeking comment. It said in a presentation in March that the deal was to be immediately accretive to profits, and that it would boost earnings per share by at least a nickel next year.

What does all of this mean for its yet-to-be-resolved struggle to keep PacWest and other potential suitors at bay?

That has yet to be determined. Wagner, PacWest's CEO, still has the currency and incentive to buy First California. The 10 branches PacWest

PacWest officials declined to comment Wednesday.

First California as of late afternoon traded at $6.77 per share, or about 156% of its tangible book. PacWest traded at $24.84, or an exceptionally robust 193% of tangible book.

In other words, PacWest could still afford to pay a healthy premium for First California, having made a public bid of $7.25 per share for the company.

That takeover attempt thus far has been a win for First California shareholders, including Kum, whose reported 1.7% stake in the company was worth about $3.4 million as of Wednesday.

If First California remains independent, the unsolicited bid may have been a blessing for the company by making it a stronger buyer.