As bigger lenders tighten credit, small and midsize businesses are warming conceptually to striking relationships with community banks — and the banks appear receptive.

"We now have the opportunity to go in and potentially write business with a company that has been with a National City-type for 20-plus years," said Clay Stinnett, chief strategic officer of the $1.65 billion-asset S.Y. Bancorp Inc. in Louisville. "A lot of them want a more stable relationship; pricing has changed, terms have changed, but to them, their business hasn't fundamentally changed, and it scares them."

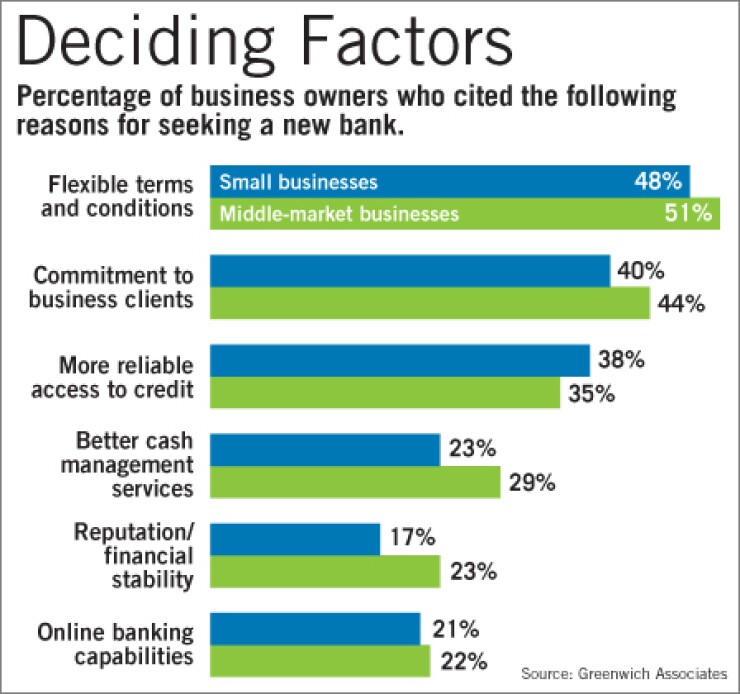

Nearly half the small and middle-market businesses in the country are either seeking a new bank or would entertain the notion of switching if they were given a compelling enough offer, according to a study of 670 companies Greenwich Associates LLC of Stamford, Conn., released today. That is a dramatic increase from a year earlier, when less than a third of those surveyed said they would at least consider switching.

Steve Busby, managing director of Greenwich, said that the credit crisis is at the core of the sentiment change, and that longtime business customers are taking it personally.

"Banks are tightening standards across the board, yet some businesses believe they are still creditworthy and feel a little victimized," Mr. Busby said. "The net flows are going to the smaller institutions, which are more hungry for credit. This is a once-in-a-lifetime opportunity."

In some cases, the desire to switch is motivated not by a lack of credit, but by a lack of attention, he said.

"Banks are preoccupied. … Too many bankers are worrying about their own jobs, and the customers are taking a back seat," Mr. Busby said. "You have to tell them you'll be there for them and then demonstrate that commitment."

Robert E. Kafafian, the president and chief executive of Kafafian Group Inc., a Parsippany, N.J., community bank consulting firm, said bankers "need to be out there and calling," so they can "nip service problems in the bud."

Given the current economy, Mr. Busby said, bankers also need to do a better job of communicating their financial health to customers. The Greenwich survey found that nearly a quarter of the small businesses that switched banks last year said they would have stayed if their former bank had better communication or was more appreciative of the business and treated them better.

Robert Hulsey, the president and CEO of the $2 billion-asset American National Bank of Texas in Terrell, said many small-business owners will not change banks because of the work involved in moving accounts.

"There is a stickiness with a checking account," he said. "The thought of changing an account is like 'Oh, my gosh, I hate my bank, but I don't want to mess with it.' It's easy for people to say they want to move, but people moving is a lot less frequent."