Amid rising competition and revenue challenges, foreign banks are looking hard at their U.S. operations and asking: Should we stay or should we go?

Since November, three have decided to go, at least partially, pulling the plug on their U.S. retail banking businesses while leaving intact other parts of their stateside operations.

On Tuesday, Japanese banking giant Mitsubishi UFJ Financial Group joined Spain’s Banco Bilbao Vizcaya Argentaria and London’s HSBC Holdings in exiting U.S. retail banking. U.S. Bancorp in Minneapolis

Foreign-owned banks have retreated from the U.S. before — Royal Bank of Canada sold off its American retail operations in 2011, though it

If the competition is too stiff and technology investments are too expensive, foreign-owned banks may look for ways to exit certain businesses," said Scott Siefers, an analyst at Piper Sandler.

“The cost of investment pressure is real,” he said. “To invest in and achieve scale is very difficult, so for some of these foreign-domiciled banks, it can be very pricey to try to generate the types of returns they want to get.

“So they either get significantly larger,” Siefers added, “ or they try to bring some of the capital home.”

BBVA, HSBC and now MUFG have all chosen the latter route. The Spanish bank sold most of its U.S.-based businesses to PNC Financial Services Group in an

HSBC is selling branches to both Providence, Rhode Island-based Citizens Financial Group and Los Angeles-based Cathay Bank, and turning another 20 to 25 branches into international wealth centers

On Tuesday, MUFG said that the decision to sell its U.S. retail bank came amid an increasing need to spend money on technology upgrades in order to achieve the scale that is necessary “to maintain and strengthen competitiveness.”

The two companies said they expect the deal to close during the first half of 2022.

Other foreign banks may follow suit. Indeed, early Thursday, Valley National Bancorp

“I think a lot of these foreign-owned banks are thinking they need to acquire or they need to exit,” said John Mackerey, an analyst at DBRS Morningstar. “And I think they’re doing a lot of soul searching about why they’re in the U.S. and what it does for their global franchise.”

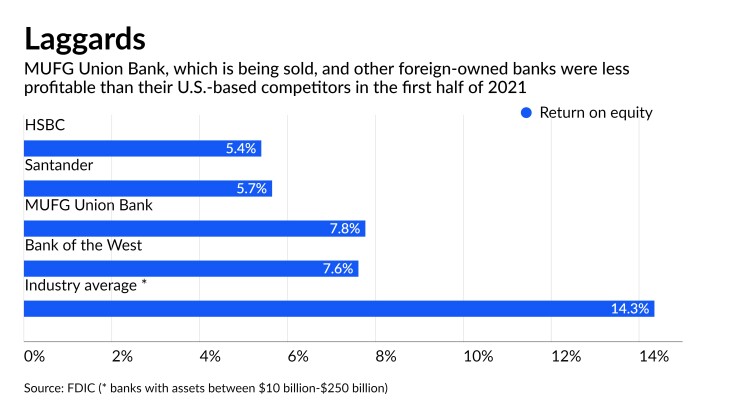

Foreign bank-owned entities have chronically underperformed in comparison with similarly sized U.S. banks, according to an analysis of the performance metrics at banks with between $10 billion and $250 billion of assets. During the first six months of 2021, HSBC, MUFG Union Bank, Santander Holdings USA and Bank of the West all fell short of industry averages for net interest margin, efficiency ratio, return on assets and return on equity, the analysis found.

While the industry average for net interest margin was 3.04% during the first half of the year, it was 1.21% at HSBC, 2.19% at MUFG Union Bank, 2.46% at Santander Holdings and 2.67% at Bank of the West, Federal Deposit Insurance Corp. data shows.

During the same six-month period, the industry average for return on equity was 14.3%, according to the FDIC data. It was 7.8% at MUFG Union Bank, 7.6% at Bank of the West, 5.7% at Santander Holdings and 5.4% at HSBC.

The performance gap is the result of different factors, according to Fitch Ratings analyst Christopher Wolfe. For starters, deposit costs at foreign-owned banks are generally higher than at U.S. banks because the overseas companies tend to pay higher interest rates to attract and retain customers, he said.

Rising expenses also play a role, especially since foreign-owned banks have been subject to higher capital requirements since the financial crisis, as does the “very competitive banking market” in which there are “a lot of banks fighting over good business,” Wolfe added.

Despite the challenges, not all foreign-owned banks with U.S. operations are exiting. Santander Holdings, the U.S. subsidiary of Spain’s Banco Santander, announced this summer that it will buy Amherst Pierpont Securities, a broker-dealer, to boost its corporate and investment banking capabilities.

Santander is also

“The U.S. market is the best risk/return market probably in the world, aside from being large and a source of talent and innovation [and] institutional stability,” Ana Botín, Santander Group executive chairman, told investors in February during the company’s fourth quarter earnings call.

“There are no plans to sell the business,” she added. “We are very focused on growing in a profitable way and building on the foundations over the last few years.”

Bank of the West, the San Francisco-based subsidiary of BNP Paribas in France, declined to comment for this story. The company employs 14,000 people across the United States, which is its largest market after France.

After BNP Paribas

It is hard to predict which other banks might follow the lead of BBVA, HSBC and MUFG, Wolfe said.

“Whenever you see these types of deals … it does force others to look at deal economics and tradeoffs and whether it would make sense to take similar action and what they would do with the proceeds,” Wolfe said. “These kinds of things don’t go unnoticed by other parent companies.”