When people speak of challenger banks, they tend to talk about Chime, Varo and Current. But the neobank Dave, which launched in 2017, has quietly become a force to be reckoned with.

Dave has grown to 10 million users of its financial management and other services, counts "Shark Tank" star and Dallas Mavericks owner Mark Cuban among its investors and

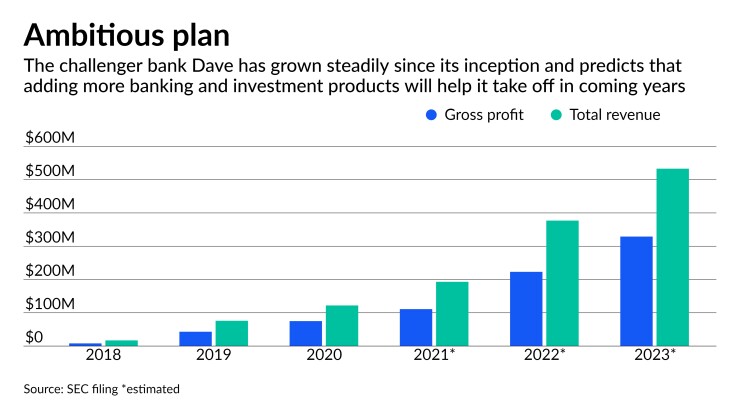

Along the way, Dave's profits have steadily increased. In 2020, it had $122 million in total revenue and $75 million in gross profits, according to

Much of Los Angeles-based Dave’s rise can be chalked up to its mission against overdraft fees, a strategy many challenger banks and even a small number of traditional banks have taken up. Dave has also benefited from the support of high-profile investors like Cuban — who Dave founder and CEO Jason Wilk says taught him the value of making a company profitable quickly — and The Kraft Group. And looking forward, the company plans to broaden out its banking and investment product portfolio, to deepen relationships with its young audience.

Dave was founded on the idea of reinventing overdraft, according to Wilk. Its original tagline was, “Dave: outsmart overdrafts.”

“When we first got the company together, we looked around the industry and saw that ... banks were charging $34 per overdraft, up to a hundred dollars a day in fees,” Wilk said. “But if we looked at the neobanks, their approach to overdraft was to not allow overdraft at all. So if you're stuck at the gas station or grocery store with insufficient funds, you either can't get home or can't feed your family. We saw that people would rather pay the fee if it meant actually being able to pay for everyday essentials in these sort of emergency scenarios. And so we created what we thought the most fair product was, one that I would have loved as a college kid.”

Dave provides just-in-time cash advances of up to $100, even to customers who don't have their paychecks directly deposited in a Dave account. It allows early direct deposit, meaning that people who normally get paid on Friday can access their paychecks on Wednesday. And it analyzes customers’ upcoming bills and warns them when they’re going to overdraft.

In focusing resources and attention on the problem many people face with overdraft fees, Dave tapped into the zeitgeist in a way that banks are starting to.

But much of the industry still leans on the revenue obtained from overdraft fees to achieve profitability.

“What Dave’s success shows us is that there is demand for better features within financial relationships and that there is room for many models to emerge, from Chime to First Boulevard, with different models and different communities in focus,” said Brad Leimer, co-founder of Unconventional Ventures in San Francisco. “While banks have finally woken up to fintech startups eroding portions of their revenue streams, it seems that they have only doubled down on what makes them profitable and efficient, not on what consumers are really looking for — and that’s change that helps them have better financial outcomes.”

Aaron Klein, a senior fellow at the Brookings Institution and outspoken critic of banks’ overdraft policies, agrees.

“Consumers want faster access to their own money than the current banking system provides,” Klein said. “Banks that adapt, providing their customers faster access to their own money, are doing the right thing. It is a shame that the Federal Reserve and other bank regulators continue to operate and support a system that penalizes those living paycheck to paycheck to maximize bank profits.”

Approach to overdraft

Dave's $100 advance, which is called ExtraCash, is a form of nonrecourse overdraft product. The company doesn’t require access to a paycheck-depositing account, so it’s not a form of early wage access. Dave doesn't conduct a credit check and doesn’t require the customer to pay the money back, so it’s not a loan. There are no late fees and no interest charges.

Customers can give a tip if they want to; the average tip is $1. The tip-based model was rolled out in 2017 and was a page out of GoFundMe’s book, Wilk said, “letting people decide what they think is fair for the product. And that can either be zero or any amount of money the customer wants. And that was a really interesting experiment for us to figure out what people were willing to pay.”

At Dave, the tip is never factored into the decision to grant the advance and more than 90% of people that ask for it get it, Wilk said.

Dave doesn’t always get paid back for the cash advances.

“That's been one of the unique challenges to not requiring a direct deposit to access,” Wilk said. "We very much view that product as a way to help people get back on their feet and as a way to build a long-term relationship with the customer. And so we decided to make money on it with completely optional fees.”

Dave charges $1 a month for access to its financial insights, which “a significant amount of customers” use to understand upcoming bills, Wilk said.

If customers want ExtraCash funds instantly, Dave charges a fee for expedited processing. If customers want the money sent via ACH, it charges nothing.

Dave also, like other challenger banks, receives interchange fees when customers use their debit cards. It also gets a small affiliate fee from some job providers when users use its part-time job finder, Side Hustle, to find and accept gigs.

Though Dave offers early direct deposit, Wilk doesn’t see tremendous value in it.

“Customers do like it, but too often, it doesn't do a whole lot to help the customer,” he said. “I don't quite understand how that would really help people except for the one time that resets your schedule the first time. That essentially becomes just your new paycheck date.”

The combination of ExtraCash, early direct deposit and the ability to tell people how much they can spend between paychecks set Dave apart from the beginning, according to Wilk.

Side Hustle is also a differentiator.

“We saw that quite a few customers were driving for Uber or Lyft,” Wilk said. “And so we thought it'd be really cool to offer our own job marketplace for side jobs.”

Dave has 35 part-time employer partners, including Instacart, DoorDash and Postmates, that provide opportunities for people to make money on the side.

“That's another way to avoid a negative balance and not pay overdraft fees,” Wilk said.

Dave’s management saw that the most requested feature from customers was a Dave bank account. So in December, the company — which had previously helped customers manage manage finances in outside accounts — launched its own bank account with no overdraft fee and no minimum balance. More than 1.3 million existing customers have signed up.

Customer profile

One unique characteristic of Dave is that 80% of its customers are under the age of 30. The average age among traditional bank customers is about 53. Most of Dave's customers have come through word of mouth, Wilk said.

“And then we have this very easy to understand brand name of Dave, which is supposed to represent the everyday customer, but also David versus Goliath, given how we're going up against" large banks that charge heavy fees, he said.

Dave has a plan to keep young people in the fold as their financial lives become more complicated.

“We recognize that the last few years of Dave have really been about solving people's short-term pain of dealing with overdrafts,” Wilk said. “And now we are much more focused on becoming the daily financial hub for our customers, with everything related to their financial life.”

That’s part of the reason to go public, he said, and to build out Dave’s banking portfolio.

“Anything related is on the table at this point for what we could offer,” Wilk said. “We think if we can make Dave that trusted brand name for financially inclusive products for our customers now, they can count on us to offer something at an incredibly reasonable price compared to what they're used to paying, then that's something that we want to get into.”

How Mark Cuban got involved

Wilk met Mark Cuban when he was writing a blog about tech companies. He had recently sold a small business and graduated from college and was figuring out his next move.

He attended a tech conference in 2008 where Cuban was the keynote speaker.

“He had only made a few angel investments, but I thought he was just such a smart guy,” Wilk said. “I was blown away by what this guy had done in such a short time span in his career.”

Cuban gave a speech about the 10 ways entrepreneurs could get him to invest in their company. He gave his email address and encouraged people to send him pitches.

Wilk wrote an article about Cuban’s talk and sent it to him. At a reception, he approached Cuban and told him he admired him and hoped he would invest in a future company of Wilk’s whenever he came up with an idea. Wilk emailed Cuban several business ideas over the next few years.

Wilk finally settled on an idea about a platform for sports fans. He applied to the startup accelerator Y Combinator and got in. Cuban happened to lead a funding round for the cohort Wilk’s company was in.

“He's just been an incredible mentor,” Wilk said. “And we've now been working together for almost almost 12 years, through a couple of different companies.” The Kraft Group has also been a longtime investor.

At that first company, Cuban told Wilk to cap his salary at $30,000 a year until he could get the company profitable.

“I was living in Los Angeles, trying to run a company,” Wilk recalled. “You can imagine the financial stress we had, and that also led to a lot of overdrafts in that time period. So in a strange way, that was the seeding of the idea for Dave.”

Wilk and his partners made the company profitable. It was sold in 2015. Both joined the seed round of Dave. Cuban invested $3 million in Dave at the start, according to