When Fifth Third Bank in Cincinnati began a maternity concierge program last year, the intent was to help new mothers better navigate their transition back to the workforce. But the personal assistant service soon clued in Fifth Third’s leadership to another need its employees had: financial planning.

Employees were not coming to company leadership directly and demanding it. The topic came up naturally — and often — in conversation when new and expecting mothers approached the maternity concierge for help with things like grocery shopping and finding day care. Those employees expressed uncertainty about how to plan financially for their newest family member.

The maternity concierge relayed that message to company leadership, and that was enough to motivate the bank to partner up with a company owned by Goldman Sachs to offer personalized financial planning to all of its employees. Now, Fifth Third says the vast majority of its employees have taken advantage of the program, completing a personalized financial assessment and later following that up with some form of coaching.

“What we started hearing a lot was the desire by pregnant women in the company, and women who had just returned to work after having children, to get more financial education,” said Bob Shaffer, Fifth Third’s chief human resources officer. “There’s a change in perspective in life in terms of wanting to figure out how to save for college, life insurance benefits, and how to budget for new expenses such as day care.”

Wellness programs of all stripes are an increasingly popular workplace perk, as banks try to dream up new ways to hold on to talented employees. Bhushan Sethi, a partner in PricewaterhouseCoopers’ financial services advisory practice, said that wellness is increasingly part of the narrative when he talks to HR executives at client firms.

“I’ve seen more of an uptick around health wellness and mental or spiritual wellness, but these things are all interrelated,” he said. “Your lack of financial wellness and getting into debt can also stimulate mental and physical wellness issues as well.”

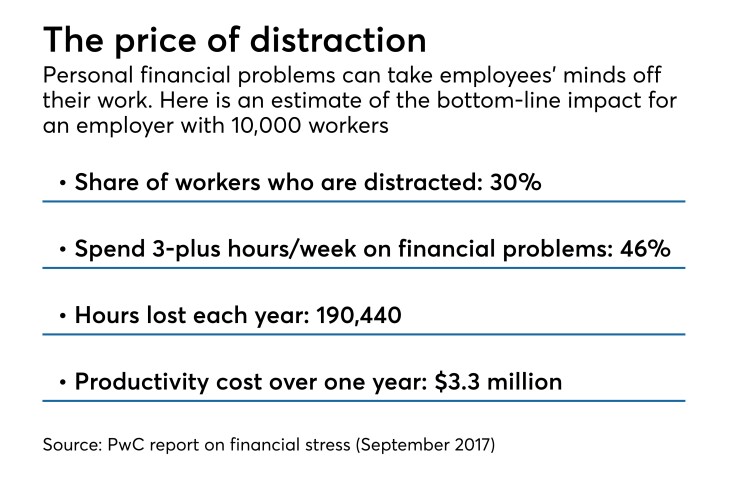

In fact,

In the year and a half since Fifth Third launched that program, more than 400 women have used the free service. The bank found that 86% of the women who used the program remained with the company six months after taking parental leave, compared with 62% among those who did not use the program.

Though they are still less popular than other types of wellness benefits, financial wellness programs have also been picking up steam.

SunTrust Banks in Atlanta, for example,

SunTrust’s program can be tailored to the needs of a particular client. Momentum onUp can be completed online, at an employee’s own pace, or taught in a classroom-like setting, but it revolves around eight core concepts, including building an emergency fund and improving credit. The whole curriculum can be completed in two or three hours, but SunTrust encourages users to think of the program as a resource they can use over a number of years.

Sethi said the most successful wellness programs, whether they are geared toward financial or physical wellness, are those that can be tailored to an individual’s needs and situation. Employees who are just out of college and paying down student loans are going to have different needs than those who may be approaching retirement, and a successful financial wellness program should be able to serve both.

Furthermore, those programs also need to be accessible across a variety of different channels, he said.

“The challenge for employers is having the right menu, the right channels available and making sure they’re overtly communicating to their employees that this is out there,” he said. “It’s not multiple policy manuals anymore. It needs to be easy to access, on the internet or through mobile channels.”

The $142 billion-asset Fifth Third ultimately chose the workplace financial planning company Ayco, which is owned by Goldman Sachs, to offer a personalized financial coaching service to its employees.

The program starts with a financial assessment intended to gauge an employee’s personal financial situation. That assessment results in a personalized checklist of financial goals for that employee. The program participants also have access to an online tool where they can link all of their accounts and view an overall picture of their financial situation. Finally, they get access to their own financial coach at Ayco, either by phone or online.

To sweeten the deal, Fifth Third offered employees an incentive of up to $600 for completing the assessment and following that up later with some coaching.

Fifth Third officially launched the program in July 2017, and now a little over 13,000 of Fifth Third’s 18,000 or so employees have taken advantage of the Ayco program in some way or another. Most choose to connect with their financial coaches exclusively online.

Shaffer said that feedback has been mostly positive so far, and Fifth Third has learned from Ayco that its employees’ two biggest areas of concern are planning for retirement and basic household budgeting.

Sethi predicted the interest in wellness programs would only rise in the years ahead, as employers continue to make the connection between their employees’ wellness outside of the workplace and their performance at work.

“Obviously there’s a link between wellness and workplace productivity. People will be more focused, more productive and there’s going to be less absenteeism in the workplace because people are physically, financially and spiritually as well as they can be,” he said. “Beyond just the workforce metrics, it is just the right thing to do.”