In the hypercompetitive world of commercial lending, Union State Bank in Florence, Texas, has found an edge in technology.

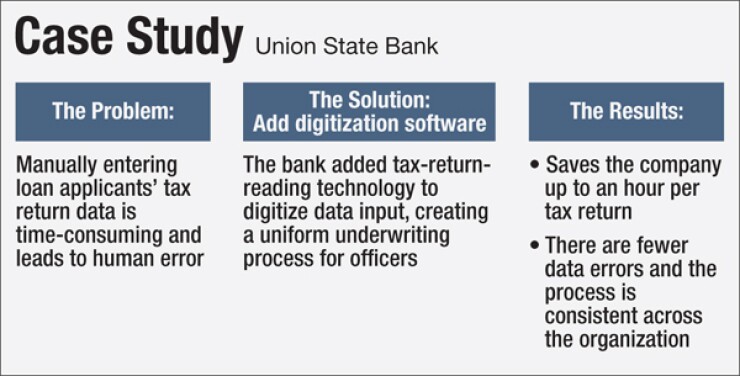

The $480 million-asset company turned to software from Sageworks last June to automate and digitize the process of inputting tax returns and other information from prospective commercial borrowers, a task that is time-consuming, prone to error and often done inconsistently. Bankers at Union State say the software addition is a game changer.

"I can [process] three returns in the time it takes someone else to do one, which is a huge difference," said Lisa Kerschner, a vice president at the bank. "The quicker these numbers can be delivered to the officer, the quicker [the bank] can get answers to customers."

-

Some banks are looking to reenter small-dollar consumer lending now that a recent CFPB proposal has given them greater regulatory clarity. But they may need help from technology companies to make a very labor-intensive business more profitable.

July 18 -

Say what you will about these companies' longevity, were it not for the likes of Lending Club you wouldn't see banks like Wells Fargo introducing expedited loan products.

May 11 -

The impressive loan growth in the second quarter is surprising in an economy that grew by 1.2% in the second quarter and by only 0.8% in the first quarter.

August 4

The company's balance sheet shows that something is working in its favor. Net loans were $193.5 million at the end of the first quarter, up 12.6% from a year earlier, according to data from the Federal Deposit Insurance Corp. Nearly all of the loan growth was in commercial lines of business. By comparison, loans grew 8.11% between 2014 and 2015.

The market for commercial loans, and specifically small business loans, has become fierce for the last few years as banks duke it out in a low-rate environment. Any investment to make the process more speedy and digitized to get decisions back to customers quicker is a benefit to banks, said Bob Meara, a senior analyst at Celent.

"It's a pain point not only because of the time and effort and cost of doing the underwriting (manually), but also the extra time that causes in getting back to a new prospective lending customer," he said. "It's a competitive market, and one that is becoming increasingly more digital; and small businesses especially are digitally driven and time-starved."

Commercial lending has been described as the

"We would hear very consistently [from banks] about the mountains of tax returns, and manually printing out PDFs and keying information into credit analysis system," said Scott Ogle, Sageworks' chief executive. "Sometimes tax returns that businesses have are 100-plus pages."

According to Kerschner, having the ability to automate this information into a credit-decisioning system has saved anywhere from 10 to 60 minutes per return for new loans and reviews as well as reduce data errors that were the result of human error during manual entry.

"It really gives us that step ahead of our competitors," Kerschner said. "It frees up time that loan officers would be spending on underwriting and allows them to get out there and meet with customers and build the portfolio."

The addition of Sageworks' Electronic Tax Return Reader product was part of an overall initiative to transform its commercial lending operations. The technology, which Sageworks received a U.S. patent for this month, allows users to import digital tax returns produced from a tax package, and the data is extracted using X-Y coordinates, according to the company.

Kerschner said evaluating commercial loans typically involves poring over a high volume of tax returns of many different types. "It's not like a retail customer, who may just have some W-2s," she added.

The software has also brought consistency to how the bank reviews tax returns. Before, each of its nine branches used a different Excel spreadsheet for underwriting loans. The disparity created irregularity in the credit files presented to examiners, and examiners would have to determine which system was used to approve a loan.

Union State Bank also purchased a credit analysis product from Sageworks, which can take the tax information uploaded and offer business customers or potential customers a "scorecard" that shows them how they compare against other businesses in their industry.

"We had someone come in who wasn't a customer, but wanted to speak to a loan officer," Kerschner said. "We were able to show him a detailed analysis of his ratios compared to industry standards for similar businesses. He said, 'Why can't my current bank do this for me?' and we eventually gained him as a customer."