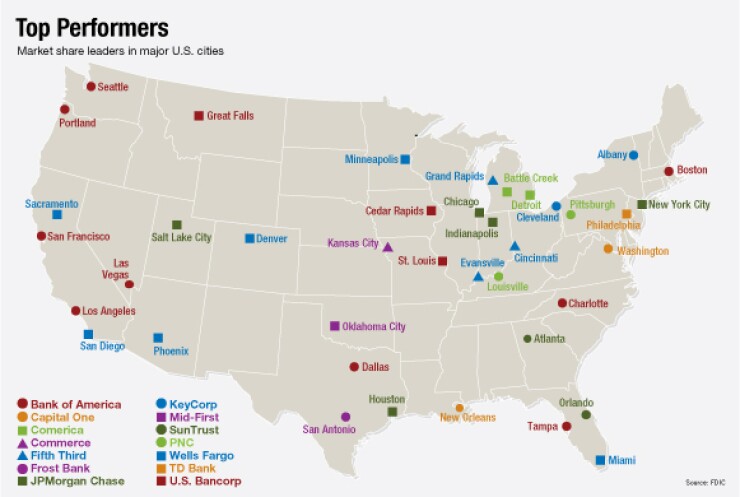

Commerce Bancshares Inc. and Cullen/Frost Bankers Inc. are in rare company as small banks with top shares in major cities.

Among the 30 largest U.S. metropolitan markets, Kansas City, Mo., and San Antonio, Texas, are the only places where the leading bank has less than $20 billion in assets, according to data from the Federal Deposit Insurance Corp.

In both cities, Commerce and Frost compete against the likes of Bank of America Corp. and Wells Fargo & Co. for deposits. Given that some bankers view this as akin to David battling Goliath, the companies' success could be considered quite an achievement. Bigger banking companies "tend to be very aggressive on pricing on our kinds of deals," says David Kemper, the chairman, president and chief executive at Commerce, which has 11.6% market share in its hometown of Kansas City.

He adds that big banks can use their balance sheets to take on larger exposures, an approach that's far riskier for a company like Commerce, with $18.9 billion in assets.

To outsiders, there is an even greater lesson to glean from the smaller banking companies' success: Clear competitive advantage can come not just from maintaining close ties to a community, but also from avoiding the ever-present temptation to pursue growth out of a geographic comfort range.

"They don't chase the latest fads and they don't run out to hot markets in Florida, Arizona and Las Vegas like others," says Robert Patten, an analyst at Regions Financial Corp.'s Morgan Keegan & Co. Inc., explaining the success at both Cullen/Frost and Commerce.

Market share, to a certain extent, is about bragging rights, bankers at Commerce and Cullen/Frost admit. Still, having the largest share creates some real benefits, says Kevin Barth, a Commerce Bank president and chief operating officer who is in charge of the Kansas City market. Commerce Bank uses its 55 area branches to forge relationships with more than 80 of the city's largest employers.

"We're the most convenient bank," Barth says.

Without a doubt, bank executives make mental notes of which bank is winning the battle for market share.

"I'm certainly aware [that we are number one in San Antonio] and I want to protect it," says Dick Evans, the chairman, president and chief executive officer of the $18 billion-asset Cullen/Frost. The company has 9.5% market share in San Antonio, where it is also based.

Evans says that his staff used to believe it would be difficult for to the company grow its market share in San Antonio because it was already dominant. "We've only got 10% of the market," he would reply, emphasizing that there indeed was room for growth.

"Obviously if Texas we compete with most of the 'too-big-to-fail banks," Evans adds. "It is not a new phenomenon for us. We're right in the middle of the pack for pricing deposits and we're able to compete and be profitable. We've been able to not only hold our own but have good organic growth."

Many banks across the U.S. have made it a high priority to grow share, and there are a number of community banks that would love to take over their core markets.

"Size does matter," says John Koelmel, the president and chief executive at First Niagara Financial Group Inc. "We want to ensure we create a prominent position that enables us to execute effectively in creating density and taking more share."

Specifically, the $30.9 billion-asset First Niagara wants to grow in markets where it is already strong, including Buffalo, N.Y., and Pittsburgh. "Our history shows that we have and will grow our market share," says Gregory Norwood, the company's chief financial officer.

Market share could factor into future merger decisions. HSBC Holdings Plc, the market-share leader in Buffalo, plans to sell about 175 branches in upstate New York, including Buffalo. Should First Niagara or M&T Bank Corp. buy the branches, either would vault to No. 1 in deposits in Buffalo. Both Koelmel and an M&T executive have said they have the ability to complete a big deal such as the HSBC branch sale.

The Kansas City and San Antonio metropolitan areas each have about 2 million residents, but otherwise the markets are quite different. USAA Federal Savings Bank is credited as the market leader in San Antonio, at 62.4%, but most of its customers are affiliated with the military and live elsewhere.

As such, Ken Thomas, an economist and retail-banking consultant says Cullen/Frost should be recognized as Kansas City's market leader. (Wells Fargo, which is based in San Francisco is second with 5.9%, followed by Bank of America of Charlotte, N.C., at 5.4%.)

In contrast, Kansas City is highly fragmented, with 147 banks, compared to 62 banks in San Antonio, according to FDIC data. After Commerce, UMB Financial Corp. has 11.1% share and Bank of America has 10.1%. The ranking has changed frequently over the years. Bank of America was the leader in 2008, while Commerce held the most deposit year earlier.

Bank of America and Wells Fargo could not be reached for comment.

A reason for the huge number of banks in Kansas City is that smaller banks from central and western Kansas open branches there to build deposit bases, Thomas says. An example is the $105.6 million-asset First State Bank & Trust Co. of Larned, Kan., which has $3.5 million in deposits in Kansas City.

With a huge number of players, Commerce must constantly expand to maintain its leverage, Kemper says. But Commerce does not seem to have an itchy finger to pull the trigger on a blockbuster acquisition.

"We're going to keep paddling our own canoe on organic growth," Kemper says. "We don't like bank premiums." Still, he would not rule out the purchase of smaller banks.

To be sure, Cullen/Frost and Commerce have expanded beyond their home turf, but most of that expansion has been in cities that are similar to where they are based. Some of Commerce's growth has come from markets such as Tulsa, Okla., where it made a an acquisition.

Even with the top spot in Kansas City and experience winning accounts outside its home town, Commerce still has a competitive disadvantage of being smaller than many rivals.

"I think that aspect is not only unfair competition," said Jonathan Kemper, who chairs Commerce's Kansas City region, "It is also bad public policy and it's a threat to midsize banks like ours that stick to what they do."

Patten also observed that Cullen/Frost and Commerce have longstanding familial ties to their cities. The Kempers are well-known in Kansas City while Patrick B. Frost is president of Frost National Bank.

"They both have built a very strong bond and trust with local businesses and the community," Patten said.