First-quarter margins at many banking companies contracted, despite rising core deposits — an anomaly that may have run its course.

The increase in core deposits, a typical driver of higher margins, failed to do its usual trick in the quarter, since it was overwhelmed by the full impact of Federal Reserve Board interest rate cuts and, in many cases, decreased interest as more loans soured.

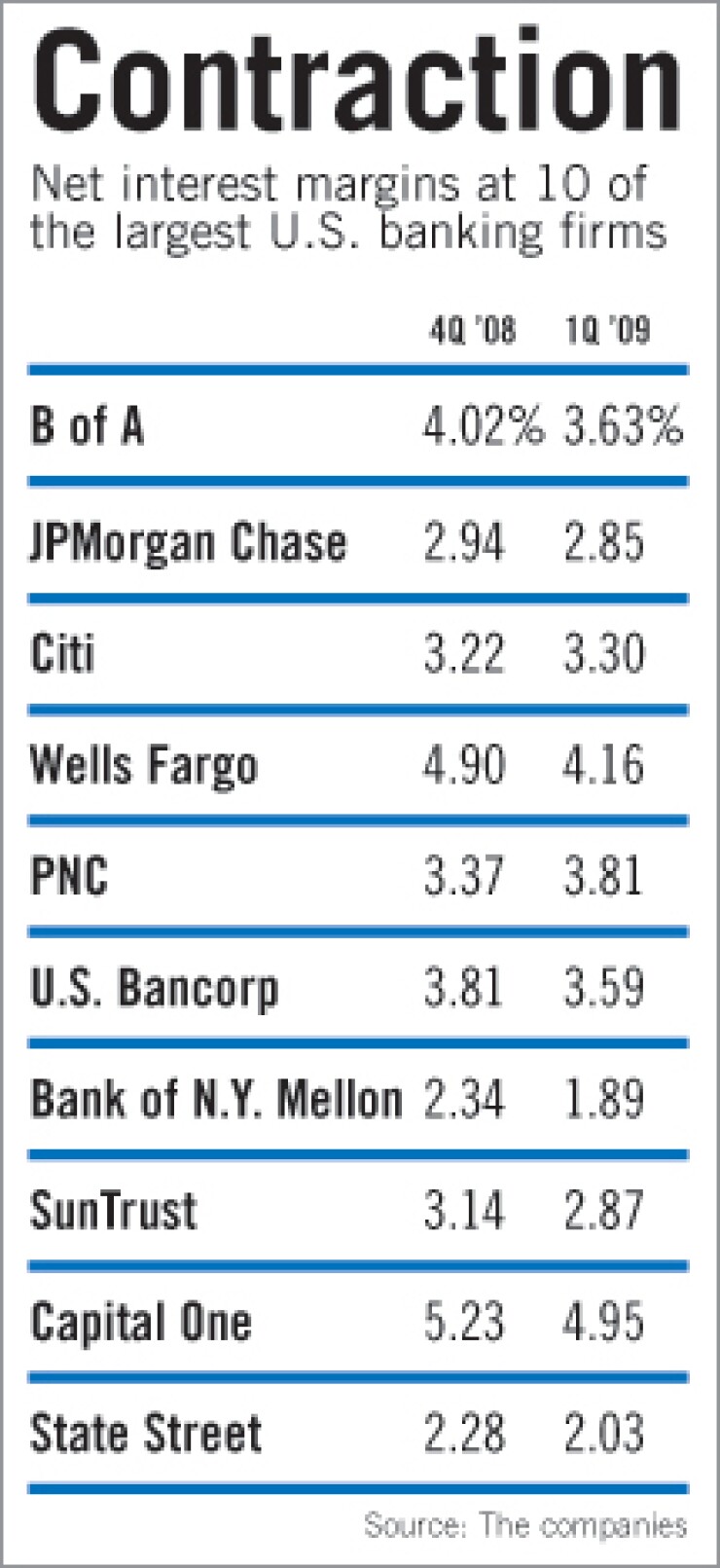

These factors knocked down the core margins at BB&T Corp., for example, by 11 basis points from the fourth quarter, to 3.57%, and at Webster Financial Corp. in Waterbury, Conn., by 21 basis points, to 2.99%. Net interest margins contracted at eight of the nation's top 10 banking companies (see chart).

At SVB Financial Group, deposits rose a higher-than-expected 39%, to $7.9 billion, reflecting growth in demand deposits. But the $10.9 billion-asset Santa Clara, Calif., company's margin contracted 142 basis points, to 3.97%.

"I don't think we have ever seen so many deposits roll on to our balance sheet in such a short period of time," Ken Wilcox, SVB's chief executive, said in an early earnings call April 8. "And this, of course, is combined with very low yields on these excess cash levels."

However, companies like Comerica Inc. are anticipating margin improvement as deposit prices continue to fall and new borrowers take out loans at higher rates.

"The margin actually bottomed in January, and our expectation is that it will further expand the rest of the year, as loan spreads continue to improve, and multibillion dollars worth of CDs will mature and people will reinvest at lower yields," Beth Acton, the $67.4 billion-asset Dallas company's chief financial officer, said last week.

Comerica's first-quarter margin fell 29 basis points, to 2.53%.

During B of A's earnings call April 20, Joe Price, the Charlotte company's CFO, said the core net interest margin on a managed basis fell 39 basis points, to 3.63%.

Before the fourth quarter "our risk position had been liability-sensitive, where we benefit as rates decline and are exposed as rates rise," Price said. "The risk position has evolved over the last two quarters to become asset-sensitive. Given the low level of rates, short-term funding products are unable to reprice much lower, while our discretionary portfolio is prepaying faster."

Brett Rabatin, an analyst at Sterne, Agee & Leach Inc., said that even though bankers have been able to book new loans at higher rates commensurate with increased economic risk, overall loan portfolios have repriced downward because of Fed rate cuts — and loans have repriced faster than deposits at many banks.

But analysts and bankers say core deposits should maintain strength, as more liquid demand deposit and money market accounts act as a "safe haven" when compared with higher-priced certificates of deposit and the stock market.

The Federal Deposit Insurance Corp.'s coverage increase to $250,000 per account also helped bankers attract core funds, analysts said.

Allan Landon, the chairman and CEO of the $11.5 billion-asset Bank of Hawaii Corp. expects "some people will shift into alternative uses of their money, but we think there's going to be a lingering caution about the equity markets, given the results of the last year."

Kelly King, BB&T president and CEO, said during its April 17 earnings call that first-quarter core deposit growth was "a great story" for the $143.4 billion-asset company. In particular, the company posted its strongest demand deposit growth "in a long, long time." Such deposits rose 8.2% from the fourth quarter, to $14.7 billion.

"We really feel great about our client growth — we're seeing it in personal and business," King said. "We'll continue to do well in organic growth, adding 22,000 net new accounts during the quarter."

On the other hand, its CDs fell 5.1%, to $26.5 billion.

Robert Patten, an analyst at Regions Financial Corp.'s Morgan Keegan & Co. Inc., said customers at many banks are picking money market accounts over CDs, because the rates on the two products are not that far apart. As of April 22 the average yield for a one-year CD had dropped 3 basis points from a week earlier, to 1.29%, according to Bankrate.com. The average yield for money market accounts fell 2 basis points, to 0.41%.

"Customers are going into money markets versus CDs as a way to stay liquid, to use their money to invest when they want to come back into the market," Patten said.

For companies like the $17.2 billion-asset Webster, deposit pricing discipline remained a priority; its money market accounts rose 32% from the fourth quarter, to $1.79 billion, while CDs fell 1%, to $4.6 billion.

"While growing deposits during the quarter, it is important to not achieve this through aggressive pricing," Jerry Plush, Webster's CFO, said in an earnings conference call last week.

Marshall St. Clair, Webster's senior vice president of product management, said in an interview Monday that many customers are choosing not to lock up their money in CDs, which on average are carrying a rate of 2%. Moreover, Webster is attracting money market customers who have withdrawn from money market mutual funds, which are yielding around 0.2% to 0.3%, St. Clair said.

James Bradshaw, an analyst at Bridge City Capital LLC in Portland, Ore., said business customers are playing a part, too, by "hunkering down" and parking their operating cash at banks, at least while the economy remains weak.

"When we start to see the economy churning again, businesses will start to bleed down their balances with banks and start investing in inventory, factories and some M&A activity," he said.