The small-business lending fintech Kabbage has struck its first deal with an online banking platform, Azlo, which has launched a new program to provide its customers with loans of up to $250,000.

Azlo provides banking services for business customers and has no physical branches. It offers deposits, debit cards, bill pay and ACH and debit push and pull. In addition, Azlo has also

“Azlo works with people in rural locations, gig economy workers and small-business owners that don’t have millions of dollars in revenue to help build their credit file,” said Laura Goldberg, Kabbage's chief revenue officer.

The Mission Street Capital program will use Kabbage's data platform to analyze customers' banking information, bookkeeping software, payment processor data and website analytics to provide an automated funding decision. (There are no fees to apply or maintain access to funding, and small businesses are not obligated to withdraw funds once qualified.)

The Kabbage loan application process will be made easier for Azlo customers as the banking platform provides Kabbage with the bank data it needs to underwrite.

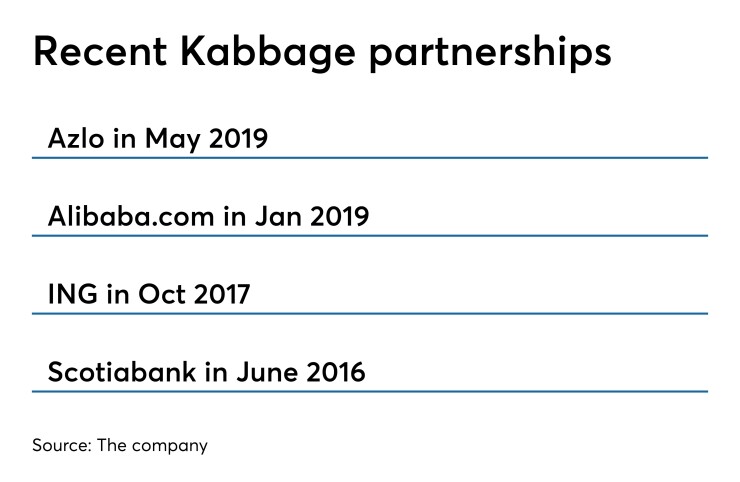

“Our partnerships run the gamut of financial institutions, to online sellers, etc.,” Goldberg said. In January, Kabbage announced a partnership with Alibaba.com.

“Azlo is the first online bank that we’ve partnered with and we think that’s an exciting proposition,” she added.

Azlo’s customers will receive the same 10-minute approval time as Kabbage’s customers do now.

“Our mission is enabling small businesses to succeed in their mission and partnering with Kabbage is a huge step forward in being able to accomplish that,” Azlo's chief operating officer, Bryan Crumpler, said in a press release.