KeyCorp executives are convinced the $186.3 billion-asset company’s asset quality will weaken from the current exceptionally strong levels.

They just don’t know when.

According to Cleveland-based Key, which reported fourth-quarter results Thursday, nonperforming loans totaled $454 million on Dec. 31, down 42% year over year. Meanwhile, net charge-offs of $19 million amounted to 0.08% of average loans.

Chief Financial Officer Don Kimble said those levels are unsustainable over the long term, but neither he nor CEO Chris Gorman could point to any signs indicating an uptick in problem loans.

“Every single indicator we have points to improved credit quality,” Gorman said in an interview. “We gave guidance that we thought charge-offs to average loans would be 20 to 30 basis points [in 2022]. But even there we said that it would be back-end-loaded because we frankly don’t yet have the visibility on 20 to 30.”

Key maintains a business servicing commercial real estate loans, which is “another outside lens, and that book looks like it’s performing extremely well,” Gorman said. “There’s actually fewer dollars in active special servicing today than there was in the middle of 2021.”

Pristine credit helped drive what Kimble, in a conference call with analysts, described as “a good finish to the year.” Key reported net income of $601 million for the three months ending Dec. 31, up 10% from the same period in 2020. Reflected in that result was a $4 million provision for credit losses, compared with $20 million a year earlier.

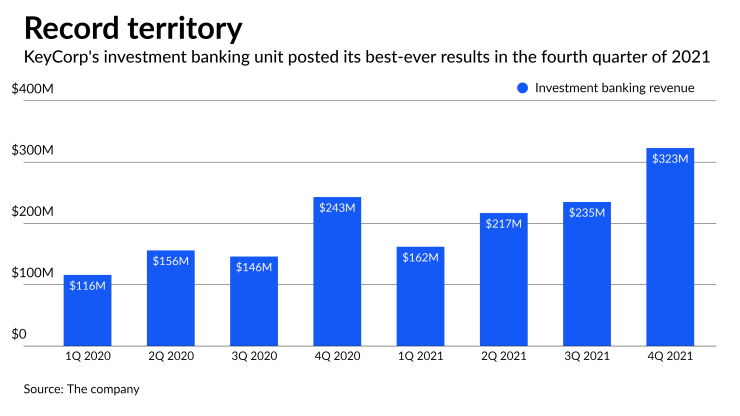

Key’s bottom line also reflected an outsize contribution from investment banking. Over the course of 2021, Key’s investment bankers helped raise more than $100 billion for clients, generating $937 million in fee income — including a record $323 million in the fourth quarter.

Key’s 2021 numbers followed a then-record outcome in 2020, when the company reported investment banking fee income totaling $661 million. Though Key did not provide a specific target, it is projecting continued growth in 2022. Indeed, the future business pipelines “are stronger today than they were a year ago,” Gorman said on the call.

Wells Fargo Securities analyst Mike Mayo, expressed skepticism at Key’s stance, noting most banks active in the investment banking space are forecasting some degree of contraction after a busy 2021.

“You're the only capital markets player that I've heard so far to guide for higher 2022 results,” Mayo said during the call. “People have said, 'CEOs have said impossible comps, normalizing lower,' yet you're saying it should still go higher.”

For his part, Gorman said Key's investment banking unit focuses on fast-growing, cash-hungry business lines such as health care, technology and renewable energy. Key has also been active adding bankers and will continue to do so in 2022.

“We have built the business on this notion of targeted scale around certain sectors of the economy that are growing and that need capital,” Gorman told analysts. “We continue to add to our platform. … Obviously, there's no guarantees in the deal business, but I feel really good about our team, and I feel good about the momentum of the business.”

Key has acquired a number of fintech companies in recent years,

“We’re a big part of the ecosystem and as a result we see a lot of these fintechs,” Gorman said in the interview. “It’s really helpful for us as we think about how we can better serve our clients. …The fact we’ve successfully acquired fintechs and retained their leadership, I think that bodes well for our ability to continue to attract really niche, unique fintechs onto our platform.”