-

A Seattle-based company is trying to make it easier for individual investors in peer-to-peer loans to cash out early.

June 17 -

The warehouse retail chain's partnerships with LendingClub and SmartBiz illustrate how bank branches are becoming less relevant in the lives of small-business owners.

June 9 -

Prosper is already offering loans at doctor's offices while Lending Club is testing a device that would allow it to make loans on the spot at car dealerships and other retailers. The efforts highlight the need for marketplace lenders to keep innovating as competition for customers intensifies.

May 8

Lending Club, the expansion-hungry marketplace lender, has its eye on an often-overlooked niche in the U.S. auto lending market the sale of used cars by individuals.

"Twenty percent of all car sales in the U.S. are done person-to-person. And that represents less than 5% of all financing being made available," Lending Club Chief Executive Renaud Laplanche said in an interview last week. "And so there's no good solution for you to get credit to buy a car from a neighbor."

Laplanche stopped short of saying that Lending Club intends to introduce financing for so-called private-party car sales. But his comments provided new context about the company's previously announced plans to enter the auto lending business.

Lending Club, which has more than doubled its loan volume in each of the last four years, is scheduled to release its second-quarter results late Tuesday.

Last year, the San Francisco-based firm originated more than $3.5 billion in loans. Lending Club is on track to surpass $6 billion in originations this year - mainly personal loans to consumers and small business loans.

[Coming this November:

The company, which went public in December, operates an online platform that performs automated underwriting and then makes approved loans available to investors.

Laplanche has spoken previously about his intention to start originating auto loans and mortgages. But his remarks to American Banker suggested that Lending Club's strategy in those two consumer lending markets will be quite different.

In the mortgage market, Laplanche said his team is not focusing on any particular niche, but looking more broadly to improve the customer experience for home buyers and those looking to refinance.

"I don't think there's been much innovation in the mortgage experience over the last 20 years," Laplanche said. "Everyone's complaining about the time it takes, and the amount of paperwork it takes, to get a mortgage or refinance a house. So I think that's where technology can make the process a lot faster and a lot easier."

In the auto lending market, Laplanche indicated that Lending Club is more interested in finding particular segments where it's relatively hard for consumers to get financing.

He said that auto sales between individuals have been less likely to rely on financing, partly because of fraud risks lenders need to protect against phony transactions.

"So there are a lot of problems that are hard to solve for banks and traditional auto lenders, but that can be solved with good technology," Laplanche said.

In recent years, auto sales between private parties have accounted for about 28% of total used car sales, according to data from the National Independent Automobile Dealers Association. In 2013, the most recent year for which data was available, there were around 12 million such sales.

Many of these transactions are cash purchases because they involve comparatively small sums of money, said Mike Wall, director of automotive analysis at IHS Automotive.

Still, he said he expects the used-car market to continue to grow, since today's automobiles stay on the road for longer than their predecessors did. When auto shoppers finance a purchase from another individual, they typically go to a bank or credit union for a loan, he said.

That's a more cumbersome process than arranging financing through a dealership.

"I could definitely see where there would be an opportunity," Wall said.

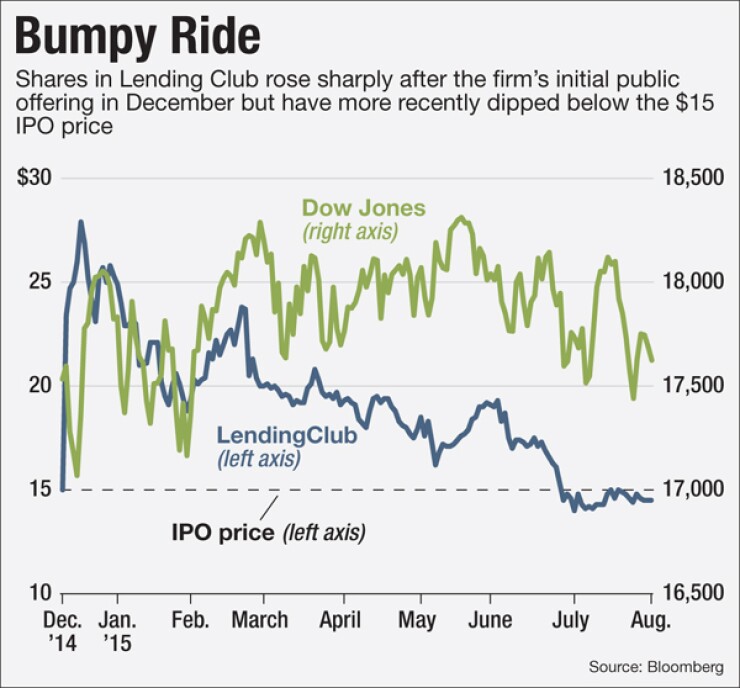

Also during the interview, Laplanche addressed the recent decline in Lending Club's stock price. Shares debuted at $15 in December and climbed as high as $29, but have since fallen. In midday trading Monday, the stock was trading at around $14.25.

Laplanche pointed to two factors that he said may have driven down the share price in the short term. First, stock investors are assigning somewhat lower valuations to high-growth companies. And second, June 9 marked the end of a 180-period following Lending Club's IPO when certain shareholders were barred from selling.

"I think there's been some imbalance between the amount of shares suddenly available for sale and appetite from the market," Laplanche said.

"We're not managing the stock price, we're managing the company. I think over time the stock price and the company performance will converge. They always do."