Financial stocks have soared since the elections, but boom times for big banks are not here quite yet.

That was the takeaway from the first day of earnings season Friday, when some of the biggest names in the industry — JPMorgan Chase, Bank of America and PNC Financial Services Group — reported fourth-quarter results.

Revenue from investment banking was strong, following the rally in capital markets, but was offset by other pockets of the business –particularly on the consumer side — that were spotty. Lower mortgage banking fees and — in the case of JPMorgan — higher customer-acquisition costs on credit cards weighed on results.

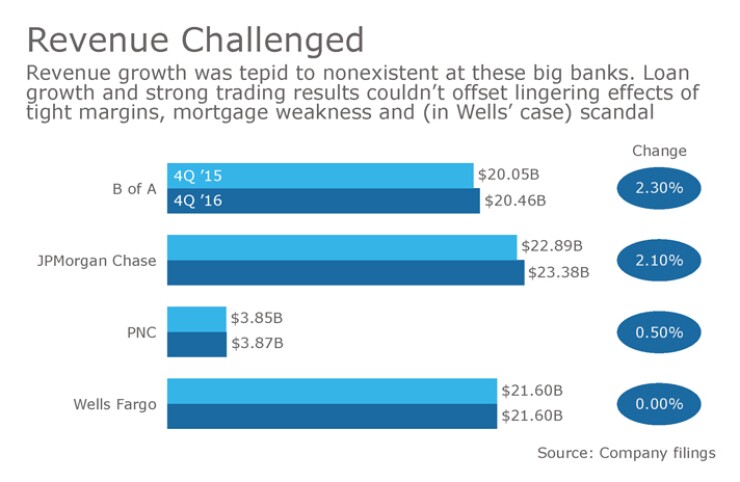

Overall revenue growth was tepid, increasing just 2% at B of A and JPMorgan from a year earlier, and slightly less at PNC.

However, big-bank executives reiterated their optimism for the months ahead — and sought to back it up with comments on interest rates and policy changes likely to come under President-elect Donald Trump.

Jamie Dimon, chairman and CEO of JPMorgan Chase, said improvements in business confidence and consumer spending, among other measures, point to a more favorable growth environment for banks in the months ahead.

A lighter regulatory and compliance burden under the incoming Trump administration will likely also be a boon.

"I do think, with regulatory relief, you will see banks be more aggressive and growing, opening branches in new cities, adding to loan portfolios, and seeking out clients they don't have," Dimon said.

At Bank of America, executives expressed optimism about the prospect for additional rate hikes in the months ahead.

While the rate hike came too late in the year to affect fourth-quarter results, executives said they expect it will provide a "significant" boost to the bottom line this quarter and throughout 2017.

Here's a closer look at the results.

Retail

Consumer banking results offered a reality check of sorts amid some of the far-ranging expectations for earnings growth in the industry.

At JPMorgan — the largest bank by assets — profits in the consumer and community banking division slipped 2%, to $2.3 billion, despite strong growth in mortgages, cards and auto loans.

Increased spending on the company's credit card division weighed on profits. Over the past year the company has paid a hefty price to win branded card deals. It has also ramped up marketing on its new Sapphire Reserve card, generating hoopla among high-spending millennials who closely track points.

"In both cases, that it has had an impact on our revenues," said Marianne Lake, chief financial officer at JPMorgan, though she described the card business as "very attractive."

Such investments led to a 38% decline in card-related income from the prior year. Still, sales volume on card products increased by double digits, and the company said that revenue growth will pick up in the months ahead.

Profits in JPMorgan's consumer and community bank may be squeezed in the first quarter, as well, as the company expects overall costs in the division to increase.

PNC also faced challenges on the consumer side of the business, as loans dipped 1% during the quarter, to $73 billion. The Pittsburgh company — best known as a commercial lender — has recently embarked on an effort to expand its retail operations.

But there were encouraging pockets of the business, particularly in mortgages. Originations grew by 29% at JPMorgan, to $29.1 billion, and by 28% at Bank of America, to $21.9 billion.

Brian Moynihan, Bank of America's CEO, told analysts that the bank is keeping more than 75% of its loans — most of them jumbos — on balance sheet rather than selling to Fannie Mae or Freddie Mac and paying a guarantee fee. The reason, he said, is "that credit quality [on the loans] is so strong that it's not worth getting the guarantee."

Still, pace of growth is unlikely to continue now that the Fed seems committed to raising rates. B of A said that its mortgage production pipeline was down 43% at Dec. 31 from just three months earlier.

Commercial

Commercial banking bolstered profits across the board, and companies described signs that lending will increase steadily in the months ahead.

Like many other bank CEOs, Moynihan said that corporate clients are feeling more confident about the direction of the economy. Loan demand from middle-market customers, in particular, picked up late in the fourth quarter, and Moynihan said that many business executives he has met with in recent weeks are planning to increase their borrowing.

"They think policies will be supportive of growth in their business," Moynihan said.

Moynihan added that the bank will also benefit from a rise in interest rates.

While the December rate hike came too late in the year to affect fourth-quarter results, Moynihan said he expects net interest income to increase by $600 million this quarter, or 5.8%, when compared with the fourth quarter. Assuming another rate hike later in the year, the bank is projecting that net interest income will increase $3.4 billion, or 8.1%, this calendar year.

Big banks posted solid commercial loan growth, with JPMorgan leading the pack at 13%. Bank of America and PNC grew commercial loans by 6% and 3%, respectively, compared to a year earlier.

JPMorgan, in particular, has also invested heavily in growing its commercial operations, adding more than 130 net new bankers overall and opening 8 new offices.

Still, during conference calls with analysts, a discussion about signs of trouble in commercial real estate market put some executives on the defensive.

JPMorgan, for instance, has rapidly grown its lending for apartment buildings in several major markets. During the fourth quarter, commercial real estate lending grew 31% to $14.7 billion.

The company said that it is closely keeping tabs on "frothy" markets that have seen a boom in multifamily units, particularly in Dallas, Houston and parts of Brooklyn.

"We don't sit in meetings here and say, 'Could you grow at 10% or 12%?'" Dimon said. "We would have no problem not growing at all" if conditions in the market deteriorated.

Meanwhile, JPMorgan is still working through issues on a "name-specific" basis in its energy book, Lake said.

Within its commercial bank, the provision for credit losses edged up 6% as the company continues to deal with troubled loans in the oil, gas and mining industries.

"Ultimately, if energy stays stable or improved … God willing, then we will see more [loan-loss] reserve releases," she said.

Capital Markets

Trading revenue drove profits higher across the board.

Boosted by the market rally, following the Republican sweep in the elections, big banks saw a surge in fees from their investment banking divisions.

At JPMorgan, profits in the corporate an investment bank rose 96% on higher markets revenue and greater appetite among clients for risk in credit and securitized products.

"It was a strong performance in the quarter, and we expect that to continue," Lake said.

Bank of America also posted gains in fixed-income and equity trading.

Over the past year, JPMorgan has increased its market share in its investment banking division, and Lake noted that it will be "challenging" to replicate the same pace that in the year ahead.

"We will try our hardest," Lake said.