While retailers are already utilizing the mobile, tablet and online channels to great advantage, many financial institutions have yet to fully leverage these digital channels.

Financial institutions that invest in digital channels have an opportunity to increase revenue, boost wallet share and build stronger relationships. Getting digital banking right not only requires delivering and promoting the products customers need today, but also having flexible technology that will adapt in a post-Apple PayTM world.

STARTING WITH THE RIGHT PRODUCTS

Offering the right products will spur incremental adoption of digital banking and help build brand loyalty. By prioritizing in-demand services shown to provide lift in adoption and transactions, financial institutions will attract and retain customers and transactions:

Person-to-person payments provide the convenience and flexibility that is attractive to valuable consumer segments, such as Millennials. Additionally, P2P payments can generate revenue through enhanced services like expedited delivery.

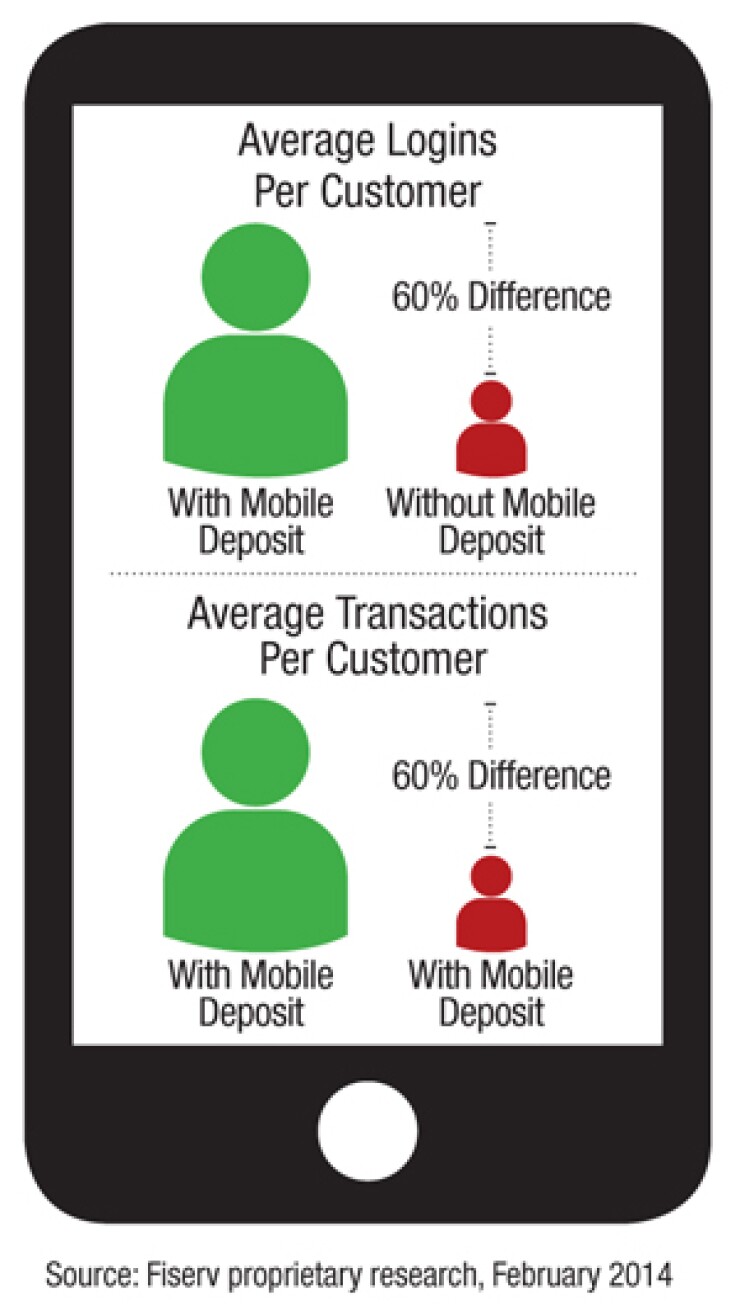

Mobile deposit is a very sticky capability that tends to spur customer engagement. Institutions offering this capability typically generate 60% more logins and transactions than those without mobile deposit, according to a 2014 Fiserv study.

Actionable alerts delivered via SMS or push notification give customers the ability to not only receive information, but take immediate action from their mobile device. Alerts about account activity, balance information and bills coming due provide an enhanced experience when account holders are able to respond.

Instant balances enable customers to check their account balances on their mobile phone or tablet without logging in. This feature can drive mobile banking enrollment and account holder acquisition.

Tablet banking will continue to grow, as tablet ownership among U.S. adults is expected to reach 72% by 2018, according to Javelin Strategy & Research. Customers conduct as much as twice as many transactions per month on a tablet as they do on a mobile phone, according to Fiserv analysis.

MAKING OFFERS PERSONAL

Today's consumers, conditioned by Amazon and Facebook®, expect personalization in their digital experiences, and want financial institutions to deliver the same, according to research from Fiserv.

With actionable insights derived from the use of analytics, financial institutions can customize and target product offers. For example, if an account holder consistently has a high checking account balance, a message could recommend opening a savings account for a better return.

Another way to help formulate personalized offers during digital banking sessions is through automated interviews. In this technology-enabled process, customers, recognized by their log-ins, are served a short interview geared to them. After three questions, or about 10 seconds, they receive an offer based on responses. If the customer accepts the offer, the order is either fulfilled or the lead is transferred for follow-up. Automated interviews can generate 10 times the number of qualified leads compared with typical online advertising.

Digital channels can also be used to generate revenue from partners. Third-party products offer value to mobile customers while generating referral revenueall without incurring additional costs. These offers work best with relevant products such as offering insurance to someone researching car loans.

EFFECTIVE DIGITAL CHANNEL PROMOTION

There are many digital options for delivering promotions. Examples include:

In-session banner ads that deliver a credit card offer to a customer who is transferring funds.

Links to content pages that are optimized with concise product information and designed for display via the channel through which they are accessed.

Secure messaging and live chatoptions that are familiar to today's consumers. Digital banking log-in authenticates each customer so financial institution representatives have the context to provide efficient, effective experiences.

Push notifications can also be targeted and securely actioned. A customer approaching his credit card limit can receive an offer to increase it. Or, if an account holder's car loan is nearing the end of its term, a message can offer details on car loan rates.

READY FOR WHAT'S NEXT

To succeed in a competitive market that is seeing the entry of new banking and payments products from companies such as Walmart and Apple, it is important for financial institutions to establish themselves as customers' primary digital banking and payments providers. Offering the right products at the right time, and promoting them so that customers are aware of what is available to them, is essential. Customers will look first to their financial institutions for new digital banking and payments products, but may go elsewhere if they don't find what they need.

THE RIGHT PRODUCT AND PROMOTION NOW AND INTO THE FUTURE

By accelerating the development and deployment of mobile, tablet and online banking and payments, and working to increase awareness of the services, financial institutions will attract customers and retain their transactions in the face of nonbank providers.By working today to build digital product suites, brand loyalty and customer trust, financial institutions will establish a strong foundation to compete in digital commerce now and be prepared for the future.