-

CIT Group's deal for OneWest is further proof that buyers are increasingly eyeing deposits, not assets, as they prepare for an increase in loan demand and look to position themselves for rising interest rates.

July 29 -

Southside Bancshares (SBSI) in Tyler, Texas, has agreed to buy OmniAmerican Bancorp (OABC) in Fort Worth, Texas.

April 29

Strong loan growth last quarter means small and midsize banks can coast the rest of the year, right?

Hardly. Competition has intensified and the economy is as difficult to peg as ever, so bankers are trying to manage interest rate risk, ensure loan terms are prudent, adjust their asset mixes, buck up margins and promote organic growth.

These strategies were widely discussed at the Keefe, Bruyette & Woods community banking conference this week in New York, where dozens of banks previewed their plans for the rest of the year and beyond.

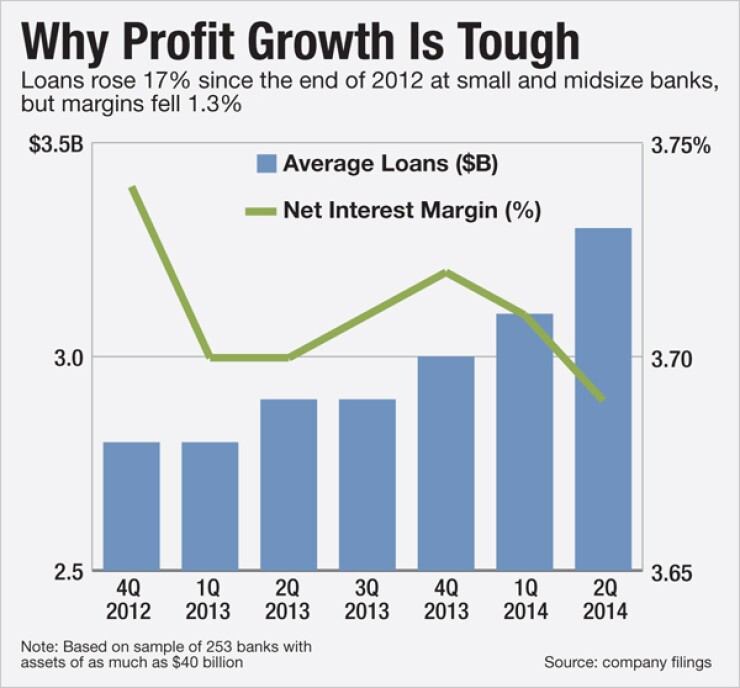

Bank after bank said it wanted to build on last quarter's loan growth, which came in higher than forecast and drove up quarterly earnings and valuations across the industry. Lending rose about 10% year over year at roughly 250 small- and mid-cap banks tracked by American Banker, and KBW analysts raised their earnings-per-share estimates for the regional-banking sector to 8% on the year.

Banks have been forced to adjust to the consequences of this growth. Margins have tightened, ticking down 2 basis points from the first quarter, to 3.69%, according to American Banker's data on banks with assets of $40 billion or less. This has spurred demand for cheap deposits, as banks seek low-cost funding to protect their net interest margins.

These trends have also been fueled by expectations of a rise in interest rates. On Tuesday, Elizabeth Duke tossed cold some water on hopes that a rise could be coming soon, telling conference attendees that she doesn't expect a rate increase before the end of 2015. Duke, a former Federal Reserve Board governor, noted that the Fed has consistently overestimated the economic recovery and says that agency officials will probably spend about six months signaling a hike before making a move.

[Inflation and employment figures

Regardless of the rate debate, commercial lending has been so hot that even banks that favored balance sheets laden with securities investments are shifting to a more traditional asset mix.

"Obviously there are challenges out there with interest rates and regulatory environment that's just a constant in this business," said Sam Dawson, the chief executive of Southside Bancshares (SBSI) in Tyler, Texas. "We know interest rates will rise, we just don't know when."

The $3.5 billion-asset bank plans to shift to commercial loans from securities as rates rise, and hopes its pending deal for OmniAmerican in Fort Worth will help remake its balance sheet, Dawson said. Bonds now comprise about half of Southside's earning assets, but could dip as low as 30% over the next five years as rates rise.

OFG Bancorp (OFG) in San Juan, Puerto Rico, has already shifted its balance sheet to loans from securities, largely to reduce its exposure to Puerto Rican public debt. Loans are now more than 70% of the $7.7 billion-asset bank's earning assets, up from 20% six years ago.

"We've transformed ourselves to a more traditional model, with an emphasis on net interest income," CEO Jose Rafael Fernandez said. Nonetheless, Fernandez is somewhat apprehensive about the lending environment and expects its earning assets to slightly decline over the next year. "We're not going out there looking for volume without [calculating] risk-reward," he said.

Fernandez was far from the only banker to discuss worries about overextending on loans, but the attitude toward growth was, unsurprisingly for an investor-focused conference, very upbeat.

As always, M&A was a major focus. But several banks said they're re-emphasizing organic growth rather than dealmaking, since it's getting easier to add assets without having to pay for someone else's infrastructure or worry about integration.

Community Financial Corp. (TCFC), a $1 billion-asset lender in Waldorf, Md., has never made an acquisition and aims for "measured growth" in attractive markets and on its own terms, Executive Chairman Mike Middleton said.

Like other community banks, Community Financial aims to grow by starting loan-production offices in nearby high-growth markets Annapolis, in Community's case. The bank has a compound annual growth rate of more than 12% over the past decade. It is looking at merger partners but is "very selective" and doesn't feel pressure to deal, Middleton said.

Others are pushing forward on M&A and organic growth simultaneously. Bryn Mawr Bancorp (BMTC) in Pennsylvania, for instance, expects about 10% organic growth this year and would like to buy "at least" one bank a year, along with wealth and insurance businesses, Chairman Ted Peters said.

Cascade Bancorp (CACB) in Bend, Ore., increased its loans about 16% in 2013 and recently finished integrating Home Federal Bancorp, but CEO Terry Zink isn't finished. He said the $2.3 billion-asset bank has the infrastructure to be bigger and that $5 billion to $10 billion is the sweet spot. He expects 8% to 12% loan growth this year and is "looking to do additional deals to get to that $5 billion space," he said.

However, shrinking margins remain a problem. Bryn Mawr has taken several measures to keep its net interest margin strong, including prepaying trust-preferred debt and Federal Home Loan bank advances, Chief Loan Officer Joe Keefer said. "While we do see downward pressure, we don't see a lot, and we're going to fight to keep it above 4%," he said. Bryn Mawr's NIM was 4.03% at June 30.

Other banks have seen loan terms deteriorate and decided to hold back until they find loan deals they're comfortable with. The New Jersey multifamily lender Oritani Financial (ORIT) has seen rates dipping on longer-term loans and prefers to mostly sit on the sidelines because of concerns that "rising rates could bite us if we invested more heavily in those types of deals," Chief Financial Officer Jack Fields said.

"Those deals obviously bring a slightly higher interest rate... and I think that's the attraction for other banks," he said. "We've just chosen to play it safe."