-

The long-delayed merger between First California Financial Group (FCAL) and Premier Service Bank (PSBK) has been called off.

January 30 -

Grandpoint Capital's plan to acquire its ninth bank in less than three years has been terminated, or possibly just iced for now.

January 29 -

Unable to seal their deal, C1 Bank and U.S. Century have instead struck a new agreement that would still give C1 a foothold in the Miami area.

December 28 -

U.S. Century Bank, the nation's largest undercapitalized bank, is close to a deal that would give a controlling stake to local investors.

February 1 -

Four out of five banks that closed important deals last week did so in four months or less. First PacTrust, which is new to getting M&A approval from regulators, needed 10 months to close one deal and has another pending after more than a year.

July 12 -

Both sides of a bank deal need to meet with their regulators well ahead of announcing it in today's complicated world.

May 14

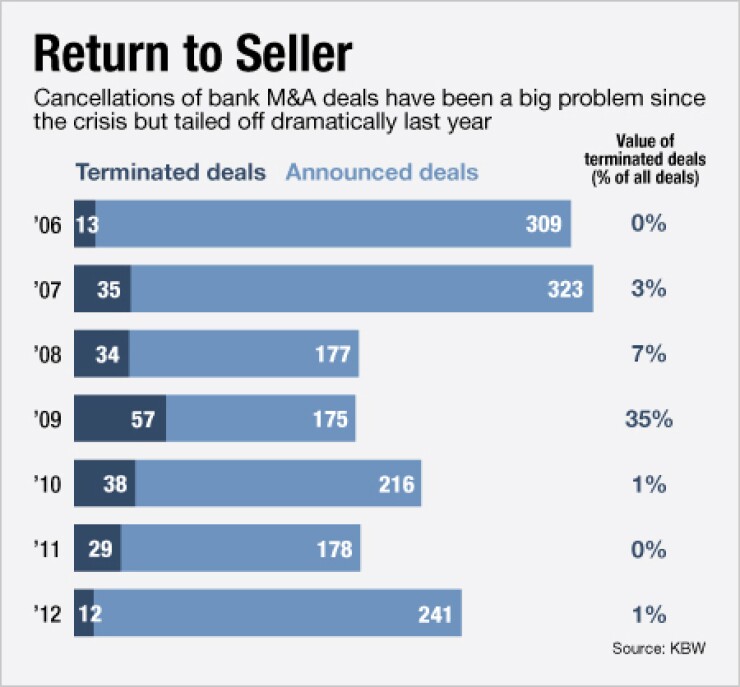

Bank deals in 2012 were stickier than in years passed, but some still came unglued.

A dozen of the 241 deals announced last year have been terminated, according to data from KBW.

That 5% cancellation rate is the lowest since 2006 — so far. Sixty-five of the deals are still pending.

It's a sign of better times that more deals are crossing the finish line, M&A advisors say. Credit quality for buyers and sellers has stabilized, buyers have learned to better navigate the regulatory process and there are fewer last-minute attempts to save undercapitalized banks.

"A lot of the terminations happened because of asset quality deterioration at the seller or the buyer after the deal was announced," says Wesley A. Brown, a managing director at St. Charles Capital, a Denver-based investment bank. "There are very few asset-quality surprises now."

Although the industry is healthier, asset quality remains a driving force in deal terminations, advisors say.

Recent terminations include: First

Each target had elevated credit issues, and the terminations show that the environment remains challenging for some.

C1's deal for U.S. Century was surprising, advisors say. At $1.2 billion of assets, U.S. Century is larger than the $900 million-asset C1. More importantly, U.S. Century is deeply troubled, with roughly 22% of its loans noncurrent at the end of the third quarter. C1 had planned to infuse the bank with $100 million in capital.

Months after First California announced it would acquire Premier Service, it announced it would sell itself to PacWest Bancorp (PACW), which aggressively pursued the deal.

NCAL was Grandpoint's ninth deal announcement since forming in 2010. Their agreement involved some additional consideration to be paid based on future performance.

Grandpoint had no comment beyond its press release, a spokeswoman said. But NCAL executives have said that the deal fell apart because NCAL experienced some additional credit problems and because Grandpoint had wanted to close by yearend.

"We just felt it was fair for both sides to step back just a little bit and see if we can figure it out," Henry P. Homsher, the president of NCAL, said in an interview last week.

Officials at C1, U.S. Century, First California and Premier Service did not return calls for this story.

All three deals had a Dec. 31 deadline for their deals. Acquisition agreements often are tied to the end of the year, but Brown said that was particularly true in 2012 as banks wanted to complete any acquisition before

Terminations of definitive agreements are declining, but behind-the-scenes, early-stage negotiations collapse more often. That serves as a reminder that the market is still trying to find equilibrium.

"There are a lot of deals that are not getting done; we are just seeing the public tip of the iceberg," says Jeff Gerrish, a partner at Gerrish McCreary Smith.

Early-stage deals often collapse because of inexperienced buyers who are skittish and sellers' credit quality, Gerrish says. Increasingly, he says, some sellers have backed away because their credit profile has improved.

Advisors expect most of the 65 pending deals to be completed. After all, they say, agreements are signed with the intention of being completed.

"You spend a lot of time and effort, so if it doesn't close, you've lost all of it," says Chip MacDonald, a partner at Jones Day in Atlanta. "A termination can also hurt your reputation when you try to do the next deal."

To avoid a potential termination, advisors say banks should give themselves more time than they think they need to complete a deal and not be afraid to extend the agreement.

"

Surprisingly, regulators were not mentioned as a cause for deal terminations. The regulatory process has not gotten any easier, advisors say, but buyers have become savvier and

"In the heyday, you may or may not have told them about it before, but now it is a given," said Stephen Klein, a partner at Graham & Dunn. "It is bad form for them to hear about it after it is announced now."