They would seem to be small, incremental changes to a 20-year-old law. But updates to the Americans with Disabilities Act could force many banks and private operators of automated teller machines to make wholesale changes to their ATM fleets by next year.

Complying with the new accessibilities rules, introduced last December by the U.S. Department of Justice, might partly be a matter of simple changes like remote software upgrades. But it also might require the costly retro-fitting of older hardware, the deployment of new models or a decision to outsource ATM operations altogether.

The expense impact is "significant when you’re talking about some of the big banks having thousands of thousands of ATMs," says Joseph Cody, senior manager of Deloitte Consulting's banking practice. He has been following the rush by banks to meet the new standards by the March 2012 deadline.

According to research outfit Phoenix Marketing International, more than half of the 225,000 bank-based machines—and close to a quarter of the 215,000 ATMs operated by independent sales organizations (ISOs) on behalf of retailers and the like—don't meet the updated standards for ATMs, falling short of new privacy or access standards or speech-enabled technology requirements.

It may be surprising to some that accessibility could still be an issue in 2011, given that most ATMs have included text-to-speech functions for vision-impaired customers for more than a decade, and have been subject to space and screen-height requirements for wheelchair-bound users since the original ADA was signed into law in 1990.

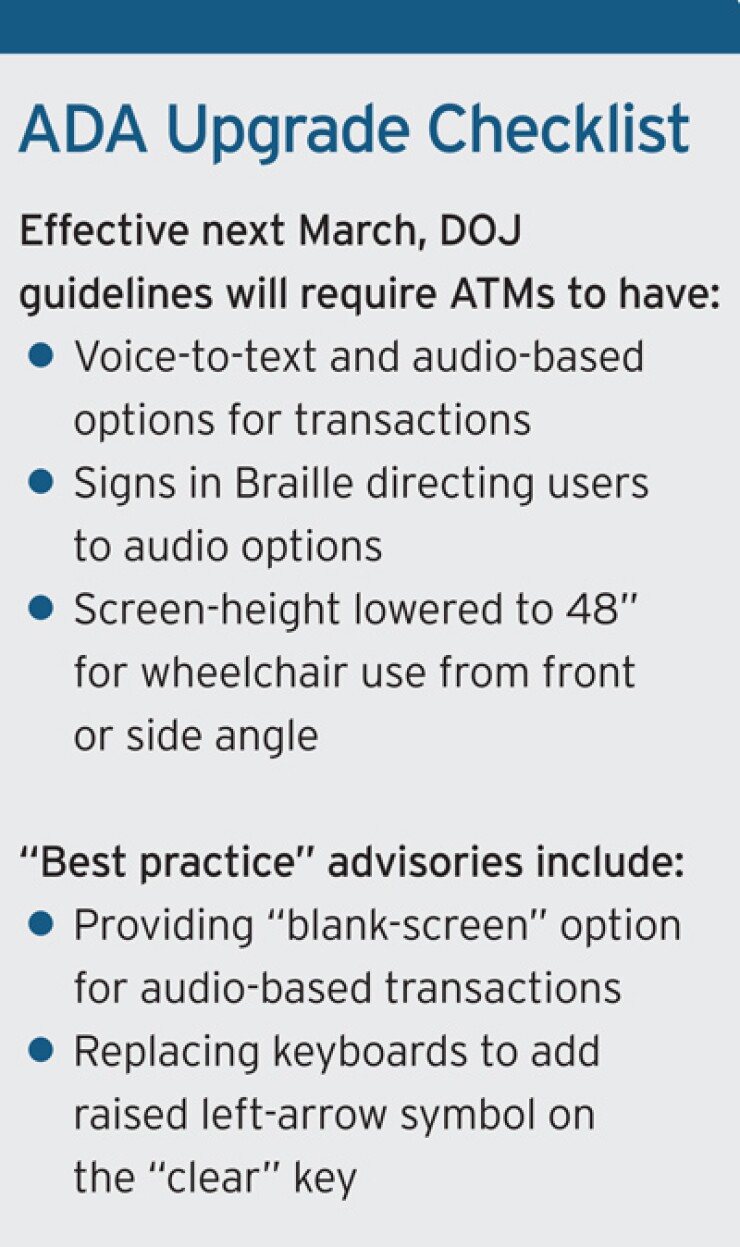

But the updated rules, which have been worked on for at least seven years, add regulations or advisory guidelines that few banks—other than the national institutions—meet for advanced instructional and security features for blind or physically disabled customers (see checklist following the story).

Among the more dramatic changes, ATMs will have to include audio-based capabilities for all features on the machine (if standard users can get transaction histories or mini-statements, for example, so must blind customers using the text-to-speech mode). Signage also must be on the machine directing customers to the functions for disabled users.

Some of new guidelines are not required, but are considered crucial for disabled customers' privacy and security–namely blanking out the ATM screen when using audio. Wells Fargo, among the most progressive banks in meeting ADA standards—all of its machines are audio-enabled—is among those working to introduce a screen-blanking feature to its machines in November, according to Alicia Moore, head of ATM banking for the San Francisco-based bank.

While Wells and other national banks are ahead of the pack, the timing of the ADA rules may have caught some regional and community banks flat-footed. Announced last December, the edict came after most banks had finished budget planning, leaving many institutions to "get it executed as early as possible in late 2011 or early 2012" with little IT investment capital on hand, says Dean Stewart, a senior director of product management for ATM manufacturer Diebold.

Banks, retailers, merchants and ISOs all have to assess whether non-compliant machines will be worth upgrading or replacing. Machines running on older IBM OS/2 software, for example, most likely would have to be scrapped, since they aren't capable of text-to-speech functionality.

The ADA rules (along with new data security standards from the card industry) already are pushing many banks to consider outsourcing their ATMs, rather than shelling out $20,000 or more for a machine that could require a replacement or upgrade within five years.

For $1.7-billion asset Community Trust Bank in Choudrant, La., ADA compliance needs were "the deciding factor" in its choice to shift to an ATM outsourcing agreement with Diebold to replace or take over management of its 53 bank machines in Louisiana, Texas and Mississippi, according to Lonnie Scarborough, executive vice president and chief retail officer at Community Trust.

"A lot of our machines were 10 to 12 to 15 years old, and could not be upgraded," Scarborough says.

Despite the work ahead for banks, Aite Group senior retail banking analyst David Albertazzi figures none will end up tripping on ADA compliance.

The ADA guidelines "already have ATM executives' attention," says Albertazzi. "They are already focused on compliance and risk management, so I think they’ll be successful at meeting the deadline."

Even if they aren't, institutions may very well manage to escape bank examiner scrutiny of the issue, given the other concerns weighing on the industry at the moment. But the risk of civil suits is an exposure that must be managed in any economic environment.