Family-owned banks appear to be at a crossroads.

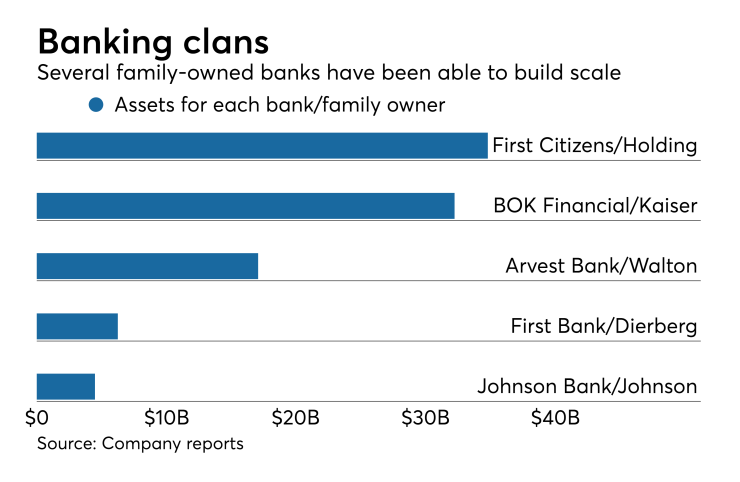

Many face the same hurdles as other banks, including regulatory costs, heightened competition and revenue challenges. A large number of family owned banks are small and closely held, creating concerns about scale and raising capital.

Other wrinkles include family succession and tax and estate planning. Many members of the current generation were responsible for navigating their banks through the financial crisis and its aftermath.

To be sure, there are advantages to being family owned. Owners have more skin in the game than many other institutions. And being closely held often allows management to be nimble and make long-term decisions without having to sell their strategy to a large investor base.

Often, family-owned banks have deep-rooted ties to their communities, especially in rural markets where banking options might be limited. They also tend to do a good job retaining employees, industry observers said.

Family-owned banks “will often be the long-established leaders in the communities, socially prominent, financially powerful, politically influential and the major sources of philanthropic contributions,” said Rod Taylor, president of Taylor Mead, an executive and management consulting firm.

All of these factors weigh on family-owned banks, particularly when one generation is looking to step aside. In that moment, the family is left with three options: promote a new leader from within, hire an outsider or hire an investment bank to sell the bank.

Here is a look at how several families approached that difficult decision.

Keeping it in the family

Rajan Patel has worked with his father, Chan, at

Titles don’t matter at State Bank, said Rajan Patel, the $960 million-asset institution’s chief lending officer. Egos are scarce and the family is focused on running the bank.

“Everybody knows their role, nobody gets their feelings hurt — ever,” Patel said. “We’re friends at work, we’re friends at home. We just happen to be family.”

The Patel family, after buying out many original investors, owns about three-fourths of the bank. Sushil had been at the bank since 2003; Rajan joined two years later.

There were no doubts about maintaining family ownership and oversight when the elder Patel, 74, decided to scale back.

“We have no intention of getting rid of any of it or, it’s all going to stay in the family,” Rajan Patel said. “There’s no plan to change anything.”

While raised in the business, neither of the younger Patels felt pressured to join the bank. With that in mind, Rajan Patel is unsure if his small children will want to take over and extend family management into a third generation.

“We’d love to keep this as a generational asset and hope that one day our kids take over but I’m not here to tell my kids what to do,” he said.

In comparison, Grand Rapids State Bank in Minnesota has been managed by four generations of the Wilcox family, beginning when Claude Wilcox bought a predecessor bank in 1920. The $218 million-asset bank is now run by Noah Wilcox, who recalls sweeping floors and mowing the lawn as a kid.

Noah Wilcox, who majored in art at the University of St. Thomas, didn’t always want to go into banking even though the family business “was the topic around the lunch table, and definitely the dinner table and holidays,” he said.

Wilcox ended up joining Grand Rapids State to handle technology projects. He succeeded his father as president and CEO in 2007. His wife is vice president of marketing and there is optimism that his youngest brother, Nicholas, may eventually become president.

Nicholas Wilcox, like Noah, has worked at other community banks.

“I wanted Nick to go work somewhere else before he came back so he can hopefully appreciate our business model in a similar way that I do,” Noah Wilcox said.

There are challenges sharing an office with family members. Noah Wilcox recalled a recent family fishing trip where they all had to agree in advance to avoid discussing the bank.

“That was an unusual barrier … but we didn’t talk about business for 10 days, which was pretty refreshing,” Noah Wilcox said. “You have to have some balance because you live and breathe it.”

The goal is to keep expanding — Grand Rapids State bought a bank three years ago — and to remain family owned and operated.

“I’ll do my best to make room for family that wants to work for the bank,” Noah Wilcox said.

Turn to an outsider

The family that owns Broadway Bank in San Antonio chose a different path in May 2016 when it hired David Bohne, a former CEO of USAA Federal Savings Bank, as its next leader.

“For the family … it was very important to bring someone in who could take the bank to the next level,” said Jim Goudge, the bank’s chairman. The goal was to hire “somebody who would have the desire to keep the bank independent and family owned.”

Broadway was founded in 1941 by Charles and Elizabeth Cheever to serve military families moving into San Antonio. Goudge, who married the Cheevers’ daughter, spent about a decade as the bank’s president and CEO after other family members balked at working there.

Bohne was selected after the family spent 18 months working with Korn Ferry, an executive search firm, to find Goudge’s successor.

Then again, it wasn’t the first time Broadway had looked outside the family for leadership. Greg Crane was the bank’s CEO for 15 years before handing the reins to Goudge in 1998.

While he would like to see another family member eventually run Broadway, Goudge said it is more important to maintain ownership for the foreseeable future.

“We have really built an institution where [the next generation] can go back and say that their grandparents would be very proud of” the bank, Goudge said.

Sell the business

A number of family owned banks have decided in recent months to sell, including Scottdale Bank & Trust in Pennsylvania;

The reasons for selling vary.

Home State, which boldly declared in 2010 that it would "

In the case of Avon State, the family that ran the $105 million-asset bank “wanted to retire,” Jay Johnston, president and CEO of American Heritage National Bank in St. Cloud, Minn., told the St. Cloud Times.

American Heritage, which is also family owned, bought Avon State in November.

The owners of the $865 million-asset Peoples Bank decided to sell to National Bank Holdings because of a belief that its lenders and customers would benefit from being part of a larger institution, said Wint Winter Jr., Peoples’ CEO. At the same time, the Winter family will still have some sway as National Bank’s second-biggest shareholder.

“We were facing two choices,” Winter said. “Choice A was to reject offers to merge and continue to grow organically and run our own company indefinitely." Choice B was to "enjoy the ride and … say yes to a very good offer from a company that we felt fit with ours.”

Winter, whose father bought a Peoples Bank predecessor in 1972, said no one in the family’s third generation had an interest in running the bank. The family, which owned about 92% of Peoples, also gained a more liquid stock from the publicly traded National Bank.

Other families considering a sale should be patient and conduct thorough due diligence on any interest buyers. And be prepared to go through an emotional roller coaster, Winter said.

“Looking back there’s a hell of a lot of pride and history," he said. "The Winter family has been at this for five decades … and we won’t have that now. We won’t be calling the shots anymore.”