The overall level of current and performing mortgages improved in the first quarter to 88.6%, up from 87.6% in the previous quarter and 87.3% a year earlier, according to the latest mortgage metrics report issued by the Office of Comptroller of the Currency and the Office of Thrift Supervision Wednesday.

According to the report, which covers the performance of 32.7 million first-lien loans, or approximately 63% of outstanding mortgages, the improvement was driven by a decline in delinquencies.

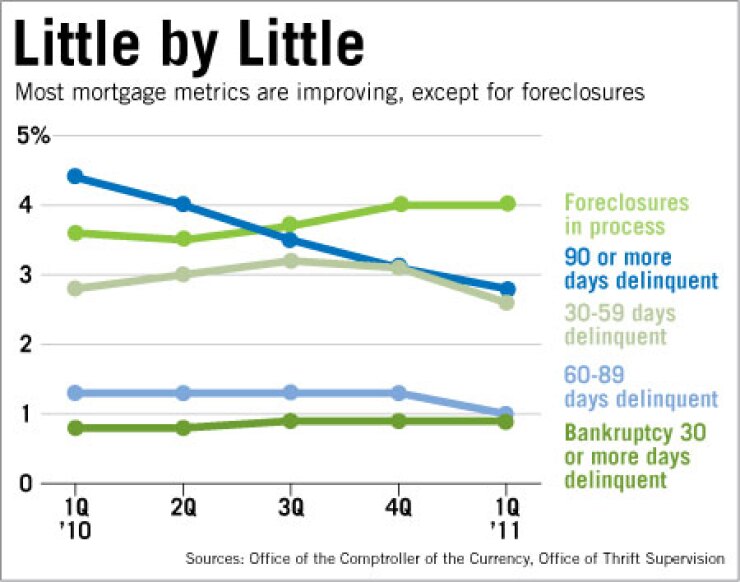

Mortgages that were 30-59 days overdue fell to 2.6% of the portfolio, the lowest level in three years, while mortgages more than 60 days past due dropped for the fifth straight quarter to 4.8%, the lowest level since the first quarter of 2009. The number of mortgages entering the foreclosure process fell 11.3% from the previous quarter, but the overall portion of mortgages in the foreclosure process remained unchanged at 4%.

The performance of loans on banks' balance sheets isn't as cheery. This is first quarter that the agencies broke out the performance of bank portfolio loans, which constitute 14.5% of the mortgages surveyed in the report.

Of the mortgages held by reporting banks and thrifts, 80.3% were current and performing at the end of the first quarter, compared with 93.2% of government-guaranteed loans and 88.6% of all reported mortgages.

The agencies noted that loans on bank balance sheets tend to be nonconforming loans with increased risk characteristics and geographic concentration in weaker real estate markets.

However, the data also indicate that banks are servicing their own mortgages differently from those they service on behalf of others. For example, the percentage of early-stage delinquencies among government-guaranteed loans is consistently higher than the percentage in bank portfolios.

"Servicers, since these loans are owned by the banks themselves, will have more options in terms of trying to work through the loans and not processing them through the foreclosure process," said Bruce Krueger, the OCC's lead mortgage examiner. "Whereas the government-guaranteed mortgages or GSE mortgages, once they reach the late stages of delinquency, they are on a very prescribed methodology in terms of offering a modification or if that doesn't work, then processing through a foreclosure."

Altogether, servicers initiated more than three times as many new home retention actions — loan modifications, trial-period plans, and payment plans — as completed foreclosures, short sales, and deed-in-lieu-of-foreclosure transactions. But overall, new home retention actions were down 10.5% from a year earlier, as fewer distressed borrowers qualified for the government's Home Affordable Modification Program. "As we continue through this whole process over the last two years you are reaching a stage where lesser numbers of people who qualify for the programs are out there," Krueger said.