Baked into JPMorgan Chase’s

But executives at the nation’s biggest bank cautioned that the situation remains in flux. While the $3.2 trillion-asset JPMorgan is prepared for a “relatively adverse” scenario, there could be billions of dollars in new credit costs if the economy is dealt another setback.

“There are a lot of people who are under a lot of stress and strain who won't be able to survive another year of complete closedown,” Jamie Dimon, JPMorgan’s chairman and CEO, said during a Tuesday conference call to discuss quarterly results.

Projections are hard to make at JPMorgan, or any other bank.

The company could have up to $10 billion in excess loan-loss reserves in a best-case scenario, Dimon said. But it could be forced to set aside another $20 billion over several quarters if the economy slips into another recession and unemployment returned to 12%.

The unemployment rate was 7.9% in September, according to the U.S. Bureau of Labor Statistics.

“Even though recent economic data has been more constructive than we would have expected earlier this year, there remains a significant amount of uncertainty,” Dimon said. “So we continue to prepare for a broad range of outcomes.”

JPMorgan has a $33.6 billion loan-loss allowance and “remains heavily weighted to the downside scenarios, thus they are reserved for an outcome that is worse than the base case,” Brian Kleinhanzl, an analyst at Keefe, Bruyette & Woods, wrote in a client note.

While “thoughtful” planning by government officials to fully reopen the economy can “maximize the chance of a good outcome,” Dimon said there are no guarantees such preparation would stave off another wave of COVID-19 cases.

The U.S. is reporting nearly 50,000 new coronavirus cases daily, the highest number of increases since August, according to the COVID Tracking Project.

JPMorgan’s net income more than doubled in the third quarter from a quarter earlier, to $9.4 billion. Revenue fell by 11% to $29.9 billion, including a 4.4% decrease in net interest income and a 16% drop in fee income.

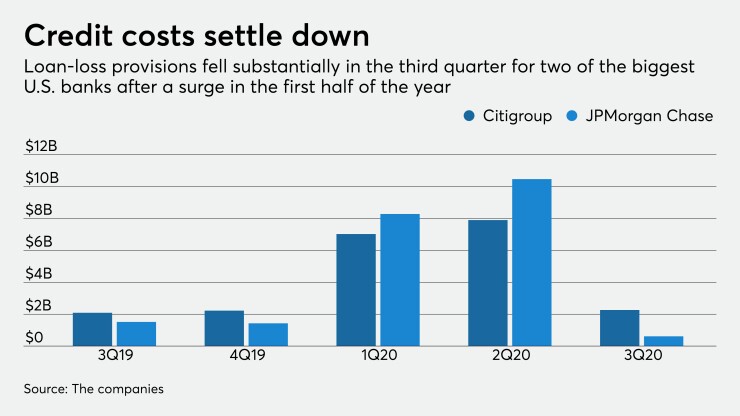

The company’s loan-loss provision decreased by 94% to $611 million.

Citigroup also reported a lower provision, which fell by 71% from a quarter earlier, to roughly $2.3 billion.

Though the provision fell, credit quality remained a mixed bag at JPMorgan.

The company recorded a $794 million loan-loss provision tied to its consumer and community banking operations, indicating continued struggles for Main Street borrowers and overshadowing reserve releases in its commercial lending and corporate banking segments.

Nonaccrual loans rose by 18% from the second quarter to $5.1 billion.

About a tenth of mortgage borrowers who have come out of forbearance periods are still unable to make payments, Chief Financial Officer Jennifer Piepszak said during Monday’s call.

At the same time, about 80% of retailers are again on schedule to make rent payments, she said.

Absent additional stimulus this year, Piepszak said JPMorgan expects delinquencies to “tick up” in early 2021 with charge-offs building into the second half of the year, largely because of issues with credit card accounts.

Talks on a second round of economic stimulus have stalled in recent months.

“Future stimulus would give us more confidence in the economy delivering on the base case,” Piepszak said.