NEW YORK — Jeff Szyperski is taking over as chairman of the American Bankers Association at a time when the banking industry is on a winning streak.

Szyperski, chairman and CEO of the $803 million-asset Chesapeake Financial Shares in Kilmarnock, Va., will officially begin a one-year term at the ABA’s annual convention this week.

Bankers have scored several victories since Donald Trump was elected president in 2016. Trump appointed

The key for Szyperski is to keep that momentum going, regardless of what happens in the looming mid-term elections.

“We do not see banking as a partisan issue,” Szyperski said in an interview.

“We see deploying capital to help communities and customer as about as bread-and-butter as you can get,” he added. “So regardless of who is in power, we’re looking to get more regulatory relief to help our communities, and we think we can do that on both sides of the aisle.”

Among the many items on his to-do list include pushing for an overhaul of the Community Reinvestment Act, advocating for the removal of asset thresholds in bank regulation — and simply getting more bankers involved in politics.

Here is an edited and condensed version of a recent conversation with Szyperski.

What will be at the top of your agenda when you become chairman?

JEFF SZYPERSKI: The real low-hanging fruit for our industry is deepening our political engagement for more bankers across the country. It’s been largely born by the CEOs — and there are about 5,700 banks in the country. But there are 2 million bankers. In my bank I have all of my employees engaged, about 225 of them.

Also, de novo formation — we need to add new blood to our industry. Everyone talks about consolidation, and really the level of consolidation has not accelerated in the past decade. But the big difference is that there have been no new banks formed.

Several

If you go back historically, pre-2007, I think the average was somewhere between 125 and 150 per year. So I think the level of de novo activity we’re starting to see is still very modest compared to historical terms. I think we need more than that.

In terms of getting bankers more engaged, are you referring to the

It’s really more of the latter. When issues come out I would like for more bankers to get engaged. I’m specifically talking about trying to engage those other 2 million bankers across the country. So when Congress hears [from us] it’s not a handful of letters, it’s a substantial amount.

The banking industry scored a big win with rollback

From a legislative perspective, if we could waive a magic wand, we would get rid of the artificial dollar thresholds that go across all spectrums of banking — small, medium and large. We think really tailoring of regulatory supervision based on the complexity of the bank makes a huge amount of sense. I think artificial thresholds are exactly that. They’re artificial, and they don’t help.

We’re also looking at an exam fairness bill that that was floating around last year that would have sort of [created] oversight of exams by a prudential authority over each of the regulators — if a bank thought it was unfair. I would be supportive of that.

And then GSE reform, but that’s just a huge topic in and of itself.

Our emphasis going into 2019 will be a lot more regulatory than legislative.

What are your regulatory priorities?

I think one-third of [the Dodd-Frank rollback] went into effect immediately, but two-thirds of it is being implemented. In the vein of the devil is in the details, we’re spending a lot of effort to make sure that it gets implemented the way it was passed.

The OCC has taken the lead in looking at the Community Reinvestment Act — that’s important. I think the other regulators are looking to see what the OCC does with that first. That’s an outdated regulation in our view.

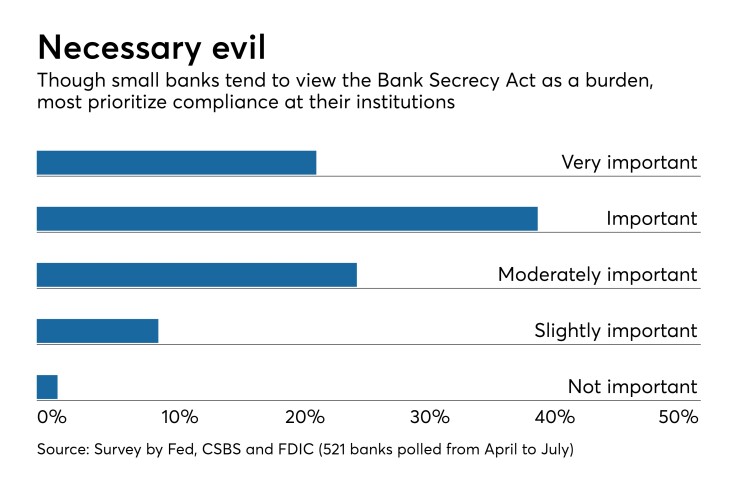

And then there’s some things around the Bank Secrecy Act and anti-money laundering that I think probably could be modified. If you talk to most bankers across the country, really a lot of them immediately go to BSA and AML. The most recent beneficial ownership rules that were enacted this year are probably the most burdensome.

What changes would you like to see to CRA? Are you concerned about the OCC taking

My understanding is that the other

I think the most obvious [thing I’d like to change with] CRA is just the assessment area. The whole concept of redlining and those sorts of things were very valid when [the law] was passed. But people aren’t walking down the street, necessarily, to get their mortgages anymore. They’re doing them online, and the act does not accommodate the way people deal with banks now.

Do you view the

For those that are going for the fintech charter, I personally think the OCC is on the right track in terms of trying to get them in the tent, and not have wild cards or mavericks floating out there.

But, I talk to a lot of bankers across the country, and there are a lot that disagree with me on that. It’s a change from the past, from our perspective. Someone asked me the other day why banks have consolidated so much. Obviously regulation is an impetus … but the low-interest-rate environment and the Fed are [also factors]. But so is just the sheer level of technological spending that you need to do just to stay in the game.

What else should bankers know about you and what you plan to do as ABA chairman?

It will be a busy year for me. I don’t come from a huge bank, so I don’t have scores of people to back me up. So it will be an interesting year, but it will be fun.

We are at inflection point in our industry. The legislation that we had last year was bipartisan. So, we laughingly say that if you said going into 2018 — or, say, 2016 — that [one of the only pieces] of bipartisan legislation that’s going to make it through Congress is banking legislation, you would have laughed.