The banking giant has unveiled an online platform that links eligible small-business owners and entrepreneurs to

More than 150 CDFIs around the country are available on the platform, which aims to reduce some of the barriers that small-business owners face when they don't qualify for traditional bank loans. The CDFIs have been vetted by

"We believe this will really fill a gap" between self-funding and traditional bank-loan readiness, said Pam Seagle, senior vice president of inclusive entrepreneurship at

Interested in creating something more interactive,

CRF Connect is an aggregator that collects information from potential borrowers and feeds it into an algorithm that pre-qualifies borrowers for loans and matches them with certain CDFIs based on factors such as geography, industry, size and the length of time in business.

The Access to Capital Connector works the same way, offering streamlined, direct help to small-business owners in need of capital or other assistance in growing their companies. CDFIs that are on the platform typically lend between $10,000 and $1 million, and they tend to offer interest rates between 7% and 15%, according to the platform's frequently asked questions section.

If owners don't get pre-qualified for financing, they will be offered other resources that can help with developing business plans and improving their credit, Seagle said.

In many cases, the tool will introduce CDFIs to business owners who may not know about them.

"This is creating visibility for small businesses that don't know these opportunities are out there," said Patrick Davis, senior vice president of platform and technology services at CRF. "The best way to do that is through centers of influences, and banks are one of the best avenues for that."

CRF, as a CDFI, may get some referrals through

Awareness of CDFIs as potential capital conduits for small businesses is rising, in part because of the pandemic,

CDFIs are "critical to closing the small-business financing gap and ensuring all small businesses, regardless of their size or ZIP code, have the capital and coaching they need to thrive," Carolina Martinez, CEO of CAMEO, California's statewide microbusiness network, said in an email Wednesday. "Programs that expand awareness of and access to CDFIs are welcome news for entrepreneurs and the economy," she added.

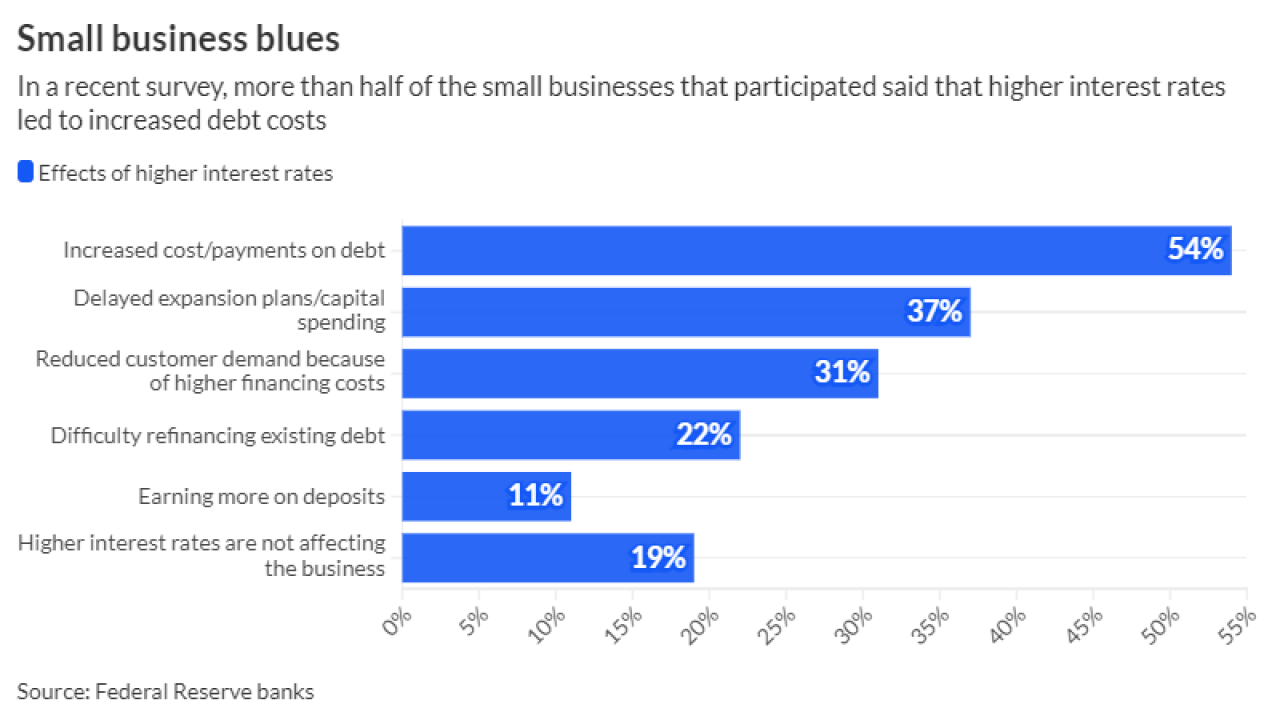

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

This isn't the first time that CRF has partnered with a bank to provide such services. It

However, activity has slowed in recent years, and it is not currently being marketed, Davis said.

U.S. Bancorp remains committed to working with CDFIs, a spokesperson said Wednesday. In 2023, the company committed $555 million to CDFIs and other organizations, according to its latest annual report. That figure includes debt commitments, grants and corporate contributions.

In addition to the grant,

CRF is talking to other big banks about launching similar platforms, David added.

"For us strategically, the point is to open the channel to work with the largest banks and create more symbiotic relationships with CDFIs," he said.