Dan Dyer has experience building a business from scratch.

Marlin Business Services, which Dyer founded, expanded from an upstart in 1997 to a specialty lender that earned $16 million and made nearly $400 million in loans in 2015 when he retired.

Beneficial Bancorp in Philadelphia coaxed Dyer out of retirement in hopes he can work the same kind of magic with Neumann Finance, a new national equipment leasing unit. The push is notable for the $5.8 billion-asset Beneficial, which admittedly has little experience launching large-scale businesses.

“We love the leasing business,” said Gerard Cuddy, Beneficial’s CEO. “We think it is additive to the balance sheet. It broadens our platform [and it] gives us access to a higher-margin business. We think there is enormous potential here.”

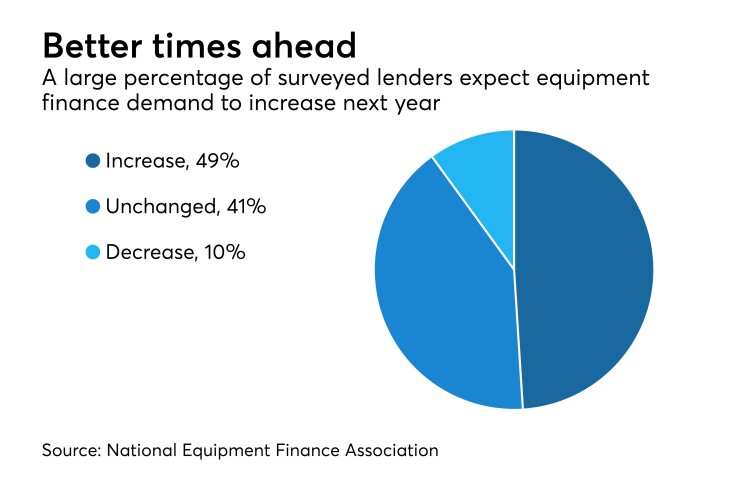

Beneficial is jumping into the business at a time where participants are becoming more optimistic about equipment finance.

In a July

Beneficial, a former mutual that

Neumann, named after the bank’s founder, should fit nicely into Beneficial’s strategy of focusing on commercial loan growth and improving its balance-sheet mix, Cuddy said. At Sept. 30, small-business leases made up just 3% of total loans.

The new unit will take a wider approach, financing “everything from furniture to computers to software,” Dyer said.

“We’ll be in the small-ticket equipment vendor market,” Dyer added. “It’s a $25 billion market with hundreds and hundreds of competitors. … There are those in our industry that focus on verticals. We’ll be more broad-based. You need to be broad-based when it comes to building the scale and size we’re looking to build.”

Dyer, Neumann’s CEO, will have help from George Pelrose, a longtime Marlin associate who was named the unit’s president. The pair will spent the next few months hiring a staff in hopes of making loans by mid-2018.

“We’re assembling all the pieces as we speak,” Dyer said. “The path forward is to grow as fast and as prudently as we can.”

Equipment leasing, to be sure, is hardly an unusual business line for banks. Hundreds are in the business.

While not wildly accretive, equipment finance can become a solid performer for companies that do it right, said Ted Peters, a former CEO at Bryn Mawr Bancorp who is chairman and CEO of Bluestone Financial Institutions Fund. Bryn Mawr followed a similar path, hiring an experienced team to get into the business.

“We started this exact business, which actually worked very well for us,” Peters said.

Equipment leasing, in practice, is similar to indirect automobile lending. Lenders create relationships with loan brokers and vendors, who then refer borrowers who need to lease equipment.

“What you want to try to [do is finance] mission-critical equipment,” Peters said. “If you finance a dental chair, that’s mission-critical. A dentist can’t work without the chair. You want to do phone systems, computer systems and other things that are critical to the business.”

Underwriting still seems relatively rational, according to participants in the National Equipment Finance Association survey. About 40% of the lenders surveyed reported tighter standards from a year earlier.

Beneficial is no slouch when it comes to credit quality, either. Third-quarter net chargeoffs totaled $2.1 million, or 0.07% of annualized average loans.

Dyer said he considered several career options after stepping down as Marlin’s CEO. He chose Beneficial because he had longstanding ties to Cuddy and other company executives, including Chief Financial Officer Thomas Cestare, and because he liked the challenge.

“Marlin was a startup,” Dyer said. “The idea of creating something from scratch and putting your own handprint on the business … was quite appealing. This is the right choice. It’s a perfect fit.”