For several years, the online lending industry faced doubt about its ability to endure a stretch of high unemployment. But during the pandemic-induced downturn, credit quality has held up better than expected.

The latest evidence: data showing that the percentage of borrowers who made their regularly scheduled loan payments continued to rise in August, even after the expanded unemployment benefits from the federal government expired.

“The unemployment benefit did subside, and there was no material drop-off in loan performance at all,” said Vadim Verkhoglyad, an analyst at the data firm dv01, which issued a report last week on the performance of more than 2.3 million loans from across the U.S. online lending industry.

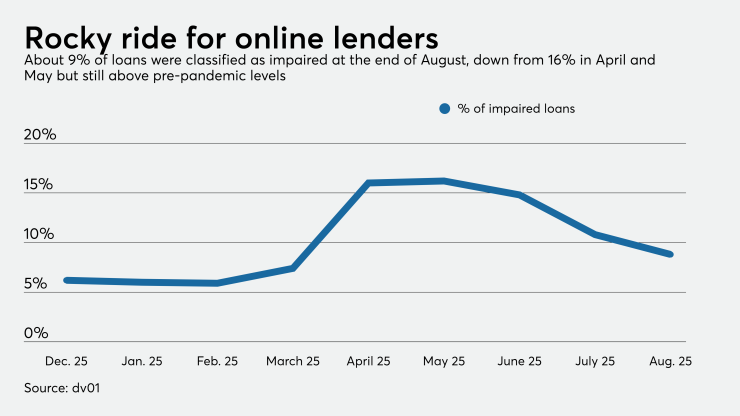

Before the COVID-19 crisis, around 5% to 6% of borrowers with online loans were typically failing to make their regularly scheduled payments, either with or without the blessing of the lender, according to the report. That percentage spiked to 16.5% in early May as many borrowers requested forbearance. By last month, it had declined back to 8.9%.

Credit performance in the online lending sector could still deteriorate, particularly if high unemployment persists and Congress fails to reach an agreement to renew government stimulus payments.

But so far, U.S. consumers are acting differently than expected, and are deleveraging rather than borrowing to sustain consumption, said Todd Baker, a senior fellow at Columbia University’s Richman Center for Business, Law and Public Policy. The data to date suggests a better outcome than the worst-case scenarios, he added.

During the online lending sector’s years of rapid growth, some observers were skeptical about its ability to weather a downturn because online installment loans do not provide ongoing utility to borrowers, who receive the loan proceeds upfront.

That’s in contrast with credit cards, which continue to be useful as a spending tool as long as borrowers are making their minimum monthly payments. Historically, credit performance in the card industry has been closely linked to the unemployment rate.

But during the pandemic, consumer spending has declined substantially, which has likely helped many borrowers to keep making payments on their online loans. Since April, the U.S. personal savings rate has been above 15% — the first time that has happened since the 1970s.

Verkhoglyad suggested that fear has led American households to be more frugal, which has led many to pay down existing debt. The dv01 report shows that the percentage of online loan balances that get paid off early has risen since before the pandemic. Borrowers typically take out these installment loans to refinance existing credit card debt at a lower interest rate.

There is also some reason to wonder whether

Today, the residue of the 2008 financial crisis may also be influencing the behavior of U.S. consumers. “In some cases their income never recovered,” Verkhoglyad said. “In some cities their house price never recovered.”

“This isn’t 2008,” said Anuj Nayar, financial health officer at LendingClub. He noted that U.S. consumers entered the current recession with stronger balance sheets than they had at the outset of the last crisis. After peaking at 12% in May, the percentage of LendingClub loans on hardship plans fell to less than 5% at the end of July.

“It’s weathering kind of in line with, or better than, our expectations,” Nayar said.

Still, the surprising resilience of the online lending sector since March has not been enough to persuade some investors who previously provided funding to return. LendingClub, like some other online loan platforms, matches prospective borrowers with either individual savers or institutional investors who fund the loans.

The San Francisco company reported $325 million in second-quarter loan originations, which was down 90% from the same period a year earlier. Nayar said while investors have begun to return to the company’s platform, LendingClub will not hit its pre-pandemic pace for loan originations in 2020.

Across the online lending industry, loan issuance rose by 21% between June and July, but it was still down 56% from the same period a year earlier, according to the dv01 report.