-

The Federal Reserve Board released an overdraft rule Thursday that would force banks to get customers' permission before enrolling them in such programs — but it did little to satisfy lawmakers who want to go even further.

November 12 -

DALLAS — Green Dot Corp., one of the oldest and biggest players in the prepaid card market, is about to change its fee structure drastically, and by doing so, it could accelerate the maturation of the young prepaid industry.

June 4 -

By slashing the fees of its popular prepaid debit card, Wal-Mart Stores Inc. is making a bid for a wide swath of banks' checking and credit card customers.

February 19 -

Banks could lose up to $20 billion of annual revenue if a large group of checking account holders shift their money to prepaid debit cards, a report published Wednesday said.

February 12

If the checking account's loss has been the prepaid card's gain, new overdraft regulations could kick that trend into overdrive.

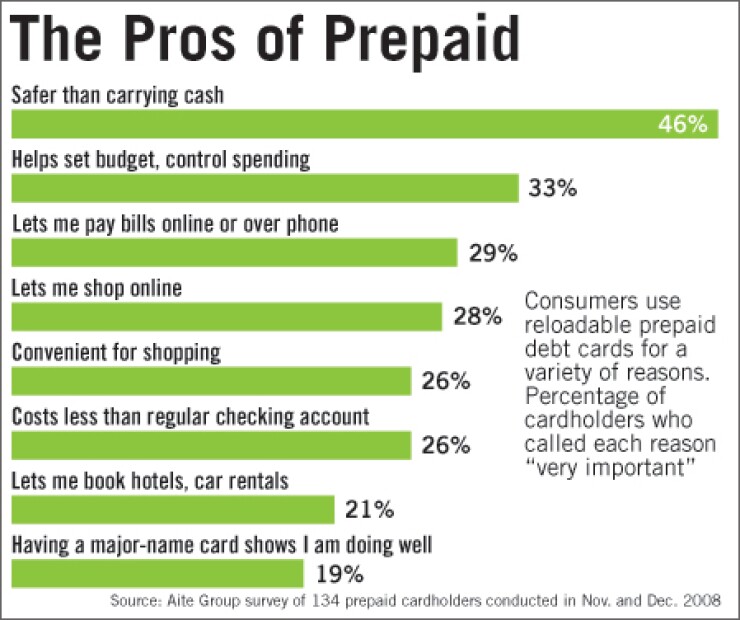

The reloadable prepaid card business has had a banner year, helped by the economy — and the industry's claim that, for a large swath of lower-income consumers, such cards can be cheaper than traditional bank accounts with overdraft protection.

But the costs that are said to make checking accounts the more expensive option for these consumers are not obvious to many of them. The federal rules on overdraft fees that go into effect July 1 could prompt banks to replace those costs with more visible ones — laying bare the cost differential with prepaid.

"It could put the checking account on par with the prepaid card. It's going to be more about competition from a marketing standpoint and a pricing standpoint: the two products will be more closely aligned in terms of how the pricing works," said Gwenn Bezard, a research director at Aite Group LLC. "I suspect that the checking account is going to become more expensive right off the bat" than it is now, as banks institute monthly fees or fees for bill payments and other types of transactions that are currently free.

The Federal Reserve Board's overdraft rules, released last month, will require banks to get customers' permission before enrolling them in such programs. The banking industry stands to lose at least part of the $25 billion to $38 billion Fed officials have estimated it makes annually from overdraft fees.

In the short term, the overdraft-regulation changes might have a downside for prepaid providers. In a much-cited February report, Bezard found that 9 million households pay more in overdraft and other checking-account fees than they would for prepaid cards, despite the high — and frequently assessed — fees those cards carry.

In this sense, overdraft fee regulation "may have a negative impact" on the prepaid industry by taking away some of the price advantage, Bezard said last week. But if banks move to compensate for the loss of overdraft fees, he said, "the checking account may be more expensive up front, instead of after the fact."

And though some companies still charge significant up-front, monthly and reload fees, the costs of prepaid cards have decreased significantly this year.

In February, Wal-Mart Stores Inc. cut the up-front, monthly, and reloading fees on its popular MoneyCard, in what was seen as a major step for the industry. Other large prepaid players, including Green Dot Corp. and nFinanSe Inc., followed suit over the summer.

Prepaid executives also professed themselves more excited than concerned about the impact of overdraft regulation on their industry.

"I have confidence that the retail banking industry will continue to not favor consumers in our demographic, people who make less than $50,000 a year," said Steve Streit, the founder and chief executive of Green Dot, which is one of the oldest and biggest prepaid marketers.

"Within that demographic, just because the law has changed doesn't mean that those consumers will be any more popular with banks. So the banks will need to find ways where they can structure their programs so they still can get similar fees, otherwise they can't be profitable — so I don't see that having a significant impact."

Even observers with slightly less of a stake in the prepaid industry's survival said that the fight to retain consumers in traditional accounts is one for banks to win or lose.

"It really primarily depends on what banks do with their new environment, and how effective they are in turning the overdraft regulations into a new opportunity. And so far they're mostly concerned with lost revenue," said Rachel Schneider, the innovation director for the Center for Financial Services Innovation, a nonprofit arm of Chicago's ShoreBank Corp.

"In that sense, prepaid has a real advantage: they're not operating in a land of uncertainty, a land where the basic pricing structure of their product is going to change dramatically by fiat. It could be an opportunity for prepaid to capitalize on some uncertainty around the checking account fee model."

Prepaid has long been the province of alternative financial services providers: the big names are well-known merchants like Wal-Mart and H&R Block Inc., along with marketers like Green Dot, NetSpend Corp. and AccountNow Inc. Such nontraditional players use banking companies as their behind-the-scenes issuers, but the largest traditional card issuers do little in prepaid, especially in terms of the general-purpose reloadable cards that could be a long-term alternative to a checking account.

Some observers expect that balance to shift as a result of the new overdraft rules.

"Financial institutions who have historically pushed DDAs to that population will now push prepaid cards, because there may be additional fee opportunities," said Duncan Douglass, a partner who specializes in payments at the law firm Alston & Bird LLP. "The fee opportunities on DDA were higher before than on prepaid, but now they may fall below even though prepaid has remained the same, so you may see more financial institutions pushing prepaid."

But the chief executive of at least one traditional financial institution sounded a little skeptical of that argument. "I guess I have trouble seeing debit card business move to prepaid because of overdraft changes," David Nelms, the CEO of Discover Financial Services, said in an interview last week as his company reported quarterly results. "I actually think that the bigger piece may be that people that can't qualify for credit cards anymore may have to use prepaid … since you can't charge as easily for risk anymore in the credit space."

Other industry members agreed that the overdraft-protection changes — as well as the effects of the economy and the other regulatory changes of the past year — are likely to cool many traditional financial institutions' interest in developing products that would primarily serve lower-income, underbanked consumers.

"If it was a long-term strategy before, it's a longer-term strategy now," said Brian Shniderman, a director of the banking team at Deloitte Consulting LLP. "They're really more focused now on their prime customers than they are on trying to get the un- and underbanked served. The big issuers for many years wanted to get into the un- and underbanked space — now they're much more willing to let the second- and third-tier institutions serve those groups, the community banks and credit unions. I think they won't return to that emphasis as a group, generally speaking, before things stabilize."

And even if the banking industry does ramp up its efforts to reach underbanked consumers, that audience might not be receptive. Schneider said that a government-mandated pullback in overdraft policies will have little impact on the reputation of traditional checking accounts — or their providers — in the eyes of consumers who have previously had bad experiences with overdrafts. "It remains to be seen how effective banks will be at selling and marketing the changes that they're making to their overdraft policies," she said. "The negative consumer sentiment that's resulted from overdraft is unlikely to be magically erased by a regulatory change, or even by changes in the product structure. The customers who are using prepaid because they've had really negative experiences with banks are going to continue to act out of that emotion."