Rebounding demand for cars — sparked by Americans’ reluctance to fly or take public transportation in the midst of the coronavirus pandemic — has driven auto loan originations at Ally Financial to a five-year high.

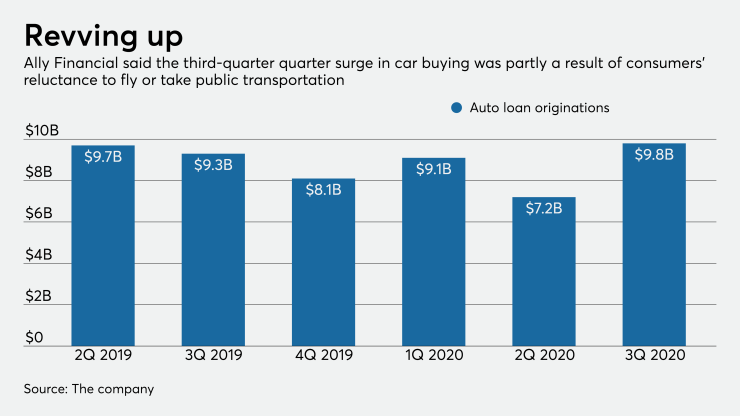

Ally, one of the nation’s three largest auto lenders, originated $9.8 billion of car loans in the third quarter, its highest total since the same period in 2015. Its consumer auto loan originations totaled just $7.2 billion in the second quarter, as stay-at-home orders depressed car sales.

Ally executives said Friday that they believe the surge of activity between July and September was less about pent-up demand and more a result of changes in consumer behavior that have taken hold during the COVID-19 crisis. They noted, for example, that the use of both public transit and apps like Uber and Lyft has declined sharply amid consumers’ fears about catching or spreading the virus.

That trend “affords us a lot of opportunity,” Ally CEO Jeffrey Brown said Friday during the company’s third-quarter earnings call. “I don't think that's necessarily short-lived. Maybe it's an alteration in the environment for the next couple of years.”

Ally also said that reductions in consumer spending on travel and entertainment have made Americans more likely to spend money on car purchases. And with the public flying less frequently, road trips are becoming more attractive options.

“People start looking to drive to a new place, or go to a campground, and you need a vehicle to do that,” Chief Financial Officer Jennifer LaClair said in an interview. “So it’s become a new opportunity for consumers to have some freedom and flexibility in their lives that doesn’t involve being around a lot of people and exposing themselves to COVID.”

The robust demand for car loans fueled strong gains in both revenue and profits during te quarter. Revenue climbed 5.2% from the same quarter last year to nearly $1.7 billion, while earnings increased 25% year over year, to $476 million.

“Overall, it was a very strong quarter for Ally,” Kevin Barker, an analyst at Piper Sandler, wrote in a research note Friday. The company’s shares were up 3.4% in late trading Friday, to $28.82

At other banks that have reported third-quarter results, auto lending trends have so far been mixed. JPMorgan Chase reported a 25% increase in auto loan and lease originations compared with the same period a year earlier, but Wells Fargo saw a 22% decline in originations.

Despite the low interest rate environment, Ally’s yield on retail auto loans increased slightly from the second quarter to 6.56%.

LaClair said that the $185 billion-asset Ally has been able to avoid yield compression in part because of its strong position in the used-car market, where interest rates tend to be higher than they are for new vehicles.

“We’ve been able to be very picky about what we put on the balance sheet,” she said.

Credit quality is also holding up well, though company executives acknowledged that loan defaults figure to rise substantially at some point.

During the third quarter, 2.25% of Ally’s auto loans were at least 30 days delinquent, which was up slightly from the second quarter, but still down sharply from the 3.32% in the third quarter of 2019. Credit performance has been buoyed by government stimulus payments, forbearance offers and reduced consumer spending in other realms, the company said.

LaClair said Ally is anticipating a steep rise in losses, given the nation’s 7.9% unemployment rate, though not before next year. The company set aside $147 million in provisions for loan losses after stashing a total of nearly $1.2 billion in the first half of the year.

“Our reserves suggest that we are expecting credit to deteriorate pretty precipitously,” LaClair said. “I think it’s to be determined the actual severity of losses, as well as the timing around those losses.”