Berkshire Hills Bancorp in Boston is taking a breather from acquisitions.

The $12 billion-asset company will focus internally after it buys SI Financial Group in Willimantic, Conn., a deal set to

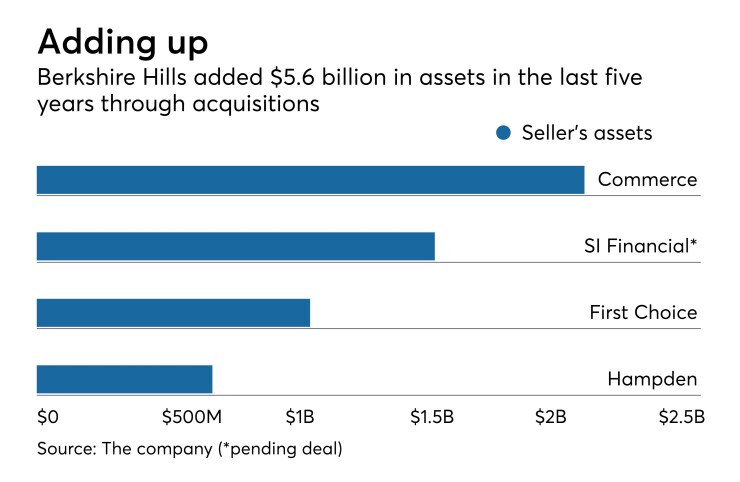

Berkshire, which has bought several banks since the financial crisis, disclosed during its last quarterly earnings call that it had begun a strategic review to examine operational and financial structuring options, which could include capital management and possible stock buybacks to improve returns.

Marotta, who had been president of Berkshire Bank, said he expects the review to end soon. He plans to share the findings when Berkshire reports its first-quarter results in April.

As part of an effort to improve its corporate culture, Berkshire hired a consultant to help create a more inclusive environment, Marotta said during a recent interview.

Here is an edited transcript of the conversation.

How has your time as CEO gone so far?

RICHARD MAROTTA: I’ve had strong support from the board and the rest of the executive team and all the employees. As I look forward, I am enthusiastic about the opportunities we have around the footprint, including right here in Boston. Even though I became CEO recently, I’ve been here almost nine and a half years, so it’s just sliding into a different chair.

What have you been spending most of your time on? What are your priorities?

We're concentrating on closing the [SI Financial] transaction ... and then looking at balance sheet structure, looking at lines of business profitability, expense management and the utilization of capital. [We want to] really drive profitability and liquidity throughout the company.

The other thing I’m very excited about is creating a culture of diversity, mutual respect and belonging. One of the things that's very near and dear to me is the ability to have a culture ... that is good and right for all people so everybody feels that they belong here. We hired a consultant about four or five months ago and they specialize in diversity in the communities that we operate in around the footprint. We're a community bank and we want to be able to look and act like the communities we serve.

Did an issue with diversity and inclusion initiatives have to do with the CEO transition?

No, not really. This started because we have grown from a [western Massachusetts] bank and moved into areas of Connecticut, New Jersey, into Philadelphia with an SBA office. Finally, with the move of the headquarters to Boston, you look around and the communities are different and diverse. In order to serve those communities, you have to look at things like that. It’s just a natural progression as we have gotten bigger and have expanded our footprint.

What does that look like internally? What kind of culture are you trying to create at Berkshire Hills Bancorp?

Just one of inclusiveness and belonging. So any person who works here no matter their race, their sexual orientation, or their gender, are very comfortable. I’m a strong believer that if you can increase [the diversity in] your talent pool you just have a better, stronger and ultimately more profitable company because you're able to draw on different experiences and different backgrounds. ... If you just step back, it’s being driven from the board level all the way down through the organization. The goal is to make [Berkshire] look like the communities we serve and therefore the communities will be comfortable with us. That's really the definition of a community bank.

What can you tell me about the strategic review mentioned on the earnings call?

As you grow through acquisitions and M&A as we have done over the past so many years, every so often you have to step back and look internally. I'm a strong proponent of return on capital. There are two things that are sacred and very dear in banking: capital and liquidity. You have to use both of those things wisely. So my philosophy has been, and continues to be, that you need to take both of those things and put them in place. Where are you going to get the most profitability? [The goal is] to make the bank as profitable as it could possibly be in the markets and communities we serve to drive shareholder value.

What prompted the abrupt change in leadership that happened last fall?

That's a good question. I think everything that we’ve said about it is already in the public domain, so I really don’t have anything to add.

How would you describe your M&A strategy moving forward?

We have expanded over the last eight or nine years into eastern Massachusetts, into New Jersey, into Philadelphia and we have a pending deal in eastern Connecticut. Our focus now is really just the integration of the [SI Financial] deal and to drive synergies. We always have and will monitor M&A conditions in the market, but right now that's not our primary focus at all. Our primary focus is to drive the profitability of the company.

Berkshire Hills Bancorp has closed a few branches, most recently in upstate New York. Do you expect more changes to the branch network?

That’s an ongoing thought, and I don’t have the numbers in front of me, but over the last several years we have closed or reconfigured different branches. That's just an ongoing thing. There's no blue print that says we're going to do this or that. It’s just as things change and we change with the times and tangible markets.

We hear a lot about the competition for talent right now, and reports after the CEO change alluded to employee discontentment. Is that something you're worried about or focused on?

Anybody who runs any business in the service industry always has to worry about that. Your lifeblood is your people. I can safely look you in the eye and tell you that there has been no one leaving and no discontent. I think the change was well received and I think people understand all the things we're doing and that we're forward-thinking and trying to be a progressive company. That's where we're going, so I have not felt any of that.

What do you see as the most exciting exciting opportunities?

I think it’s just taking the bank and understanding the profitability and the use of capital and liquidity. That’s the financial piece of it. The second piece of it, which I'm very passionate about, is driving a culture that is all inclusive and that everyone who works here wants to work here and wants to stay working here because that drives the first thing I’m trying to do, which is to increase profitability. If you can do that you have unlocked a door to growth, productivity and profitability. It’s just a wonderful thing. If I’m passionate about anything, it’s driving that culture, which in turn will drive profitability.

What’s your outlook for the mortgage business?

Mortgage is a tough business. ... It's just a difficult business. We have very a strong group that manages expenses very well in good and bad times. Those are things we constantly look at [to decide] what's the optimum use of capital and liquidity.

What will Berkshire’ Hills Bancorp's biggest challenges be in coming years?

The macro, which you can’t control, is what the economy is going to bring in the next 12 to 24 months and the presidential election coming up. That's always an iffy thing [where] we don’t really understand what all that means until it happens. From a more micro or internal level, it’s getting where we want to be from a person and culture perspective and profitability. If you just shut out the outside world, we have a nice strong game plan. The world throws things at you and then you have this plan, but you have to build it with enough flexibility so if and when market conditions change and political conditions change, it doesn’t just knock you way off course.

Where do you see the bank five years down the line?

Five years down the line I hope it’s the most efficient, profitable bank that it can be and that every person, no matter their race, sexual orientation or gender, feels that Berkshire is the place to work in our markets and [we are able to] draw talent from inside and outside our markets.