-

The narrowing gap between what large and small lenders pay in guarantee fees to Fannie Mae and Freddie Mac has helped the industry's smallest originators grow their share of mortgages sold to the government-sponsored enterprises.

July 1 -

WASHINGTON The House passed a bill Tuesday that could ease the regulatory burden on community and regional banks with mortgage servicing businesses.

July 14 -

Nonbank servicers selling and buying Fannie and Freddie MSRs must meet new capital and liquidity requirement to transfer servicing.

May 20

When costs go up across any industry, large companies that can leverage economies of scale often prevail over their smaller, less efficient competitors. But in mortgage servicing, where the foreclosure crisis and subsequent deluge of new regulations have caused expenses to soar, that maxim hasn't quite played out.

That's because the complexity of servicing regulations has made it difficult for large servicers to scale their compliance processes enough to meaningfully affect their bottom lines. At the same time,

The resulting cost equilibrium reflects a market where there are not only downsides to being too small, but hurdles to being too large. And it raises the question of whether there's a middle ground where servicers are not too big, not too small, but just right.

"Servicers who are very small in size are not able to manage the cost of servicing these loans and remain profitable, so this has been a challenge," said Arjun Raman, associate vice president of Business Process Services at Wipro Ltd. "On the larger side, I think it's more about being able to manage the work."

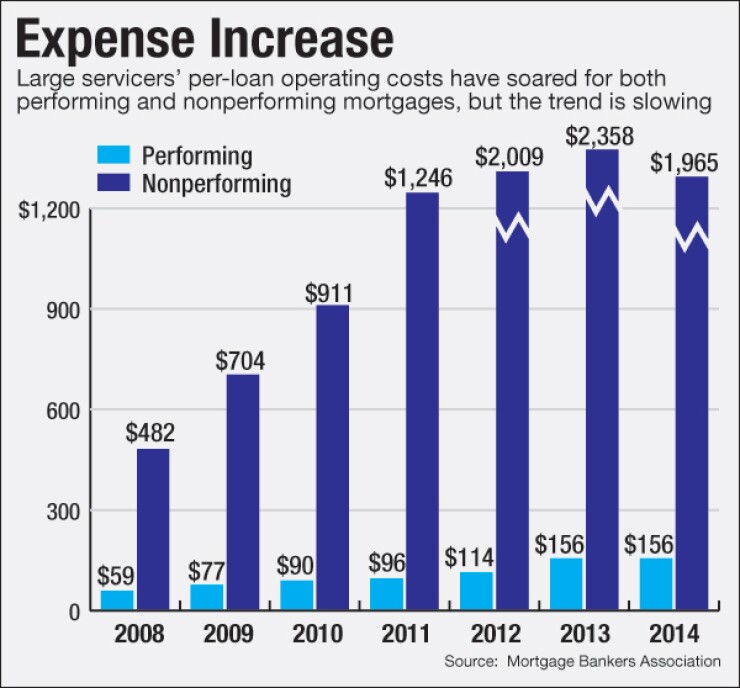

Even for the easiest-to-handle prime credit — performing loans handled by large servicers — per-loan operating costs have surged to $156 in 2014, from $59 in 2008, an increase of 164%, according to data from the Mortgage Bankers Association.

"There is a difference between small and large servicers' [costs], but the difference is less now," said Marina Walsh, the association's vice president of industry analysis.

Servicers of all sizes must comply with increasingly detailed rules in a

The minimum size for a servicer is somewhat easier to quantify than how large a servicer can get before the wheels start to fall off.

"Growth need not necessarily mean that the borrower has a good servicing experience. Things could fall through the cracks," said Raman.

Fannie Mae and Freddie Mac's recently finalized capital and liquidity

Also, for most servicers handling loans with a delinquency rate in the 2% to 3% range, a portfolio of at least 175,000-200,000 loans is necessary to be profitable, said Raman.

But it's difficult to say what would be an ideal large-size servicer, said Pramod Karachur, a business development executive at the default servicing technology vendor IndiSoft.

Big servicers "want to balance growth with profitability, and I think being able to manage the infrastructure to be able to provide a good customer experience would be important," he said.

Outsourcers may help servicers adjust for size as they can help control costs and workloads by providing automation and tapping a lower-paid workforce. But the extent that a servicer is willing to outsource certain functions like technology might determine how big it needs to be.

"When you use software-as-a-service, you're at the mercy of the software vendor for upgrades," said Karachur. "Large servicers have deeper pockets. They can build their own applications."

Reducing call center operations and expanding online chat functions can cut costs in half, but if a servicer is unhappy with the effect on its customer service it has to be big enough to afford not to do it.

"There can be a tradeoff between outsourcing that and also keeping the customer experience where it's supposed to be," said Raman.

In particular, mortgage companies that both originate and service loans may want to consider whether they need to maintain a particular scale in order to keep servicing in-house.

"You may be able to service your own loans better if you originated them," said Richard Cimino, a senior vice president at the appraisal and real estate owned asset management firm LRES.

Less sizable players may not be able to afford to do this, especially when it comes to expensive but necessary tasks related

"These are the types of activities that we see that servicers are looking at vendors to perform at a much lower cost, and I'm talking about 40%-50% savings," Raman said.

One challenge in budgeting and scaling operations for any servicer, but especially smaller firms, is whether the slowing pace of servicing cost increases will continue, or perhaps even entirely reverse course.

"If I have to make a prediction I would say the costs are probably at their highest point right now," said Raman. "As servicers increase partnerships and bring in more technical innovations, you'll probably see some of these costs are tapering off. That's where I'm hoping costs will head, but it's difficult to say."